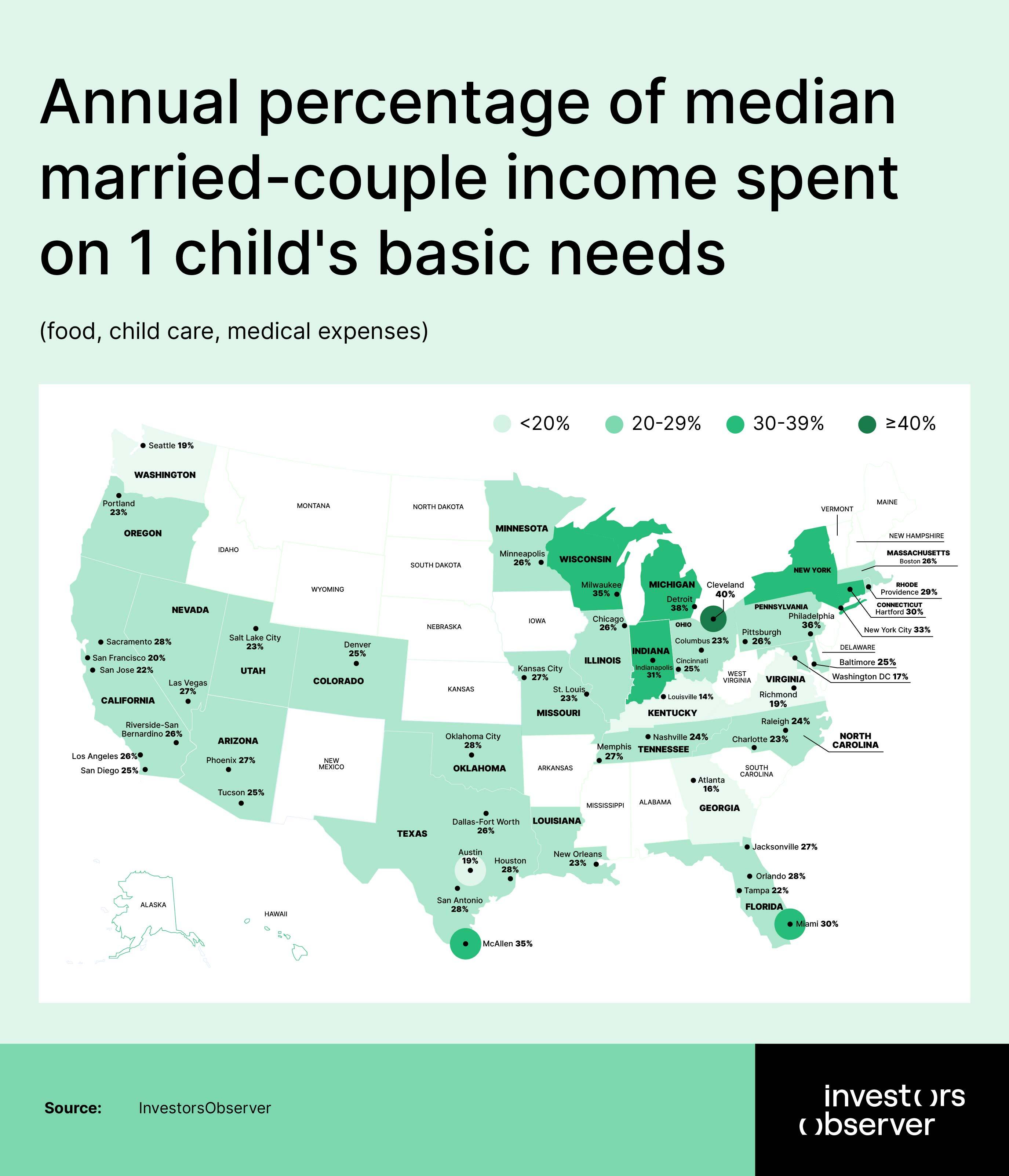

InvestorsObserver’s research team has dived into 50 major metropolitan areas, comparing median married-couple incomes with the required income and basic costs to raise one, two, and three children.

This study reveals income surpluses and deficits along with the real share of income spent on childcare, food, and medical essentials. It also ranks the top and bottom 10 metros based on an affordability index specifically for raising one child.

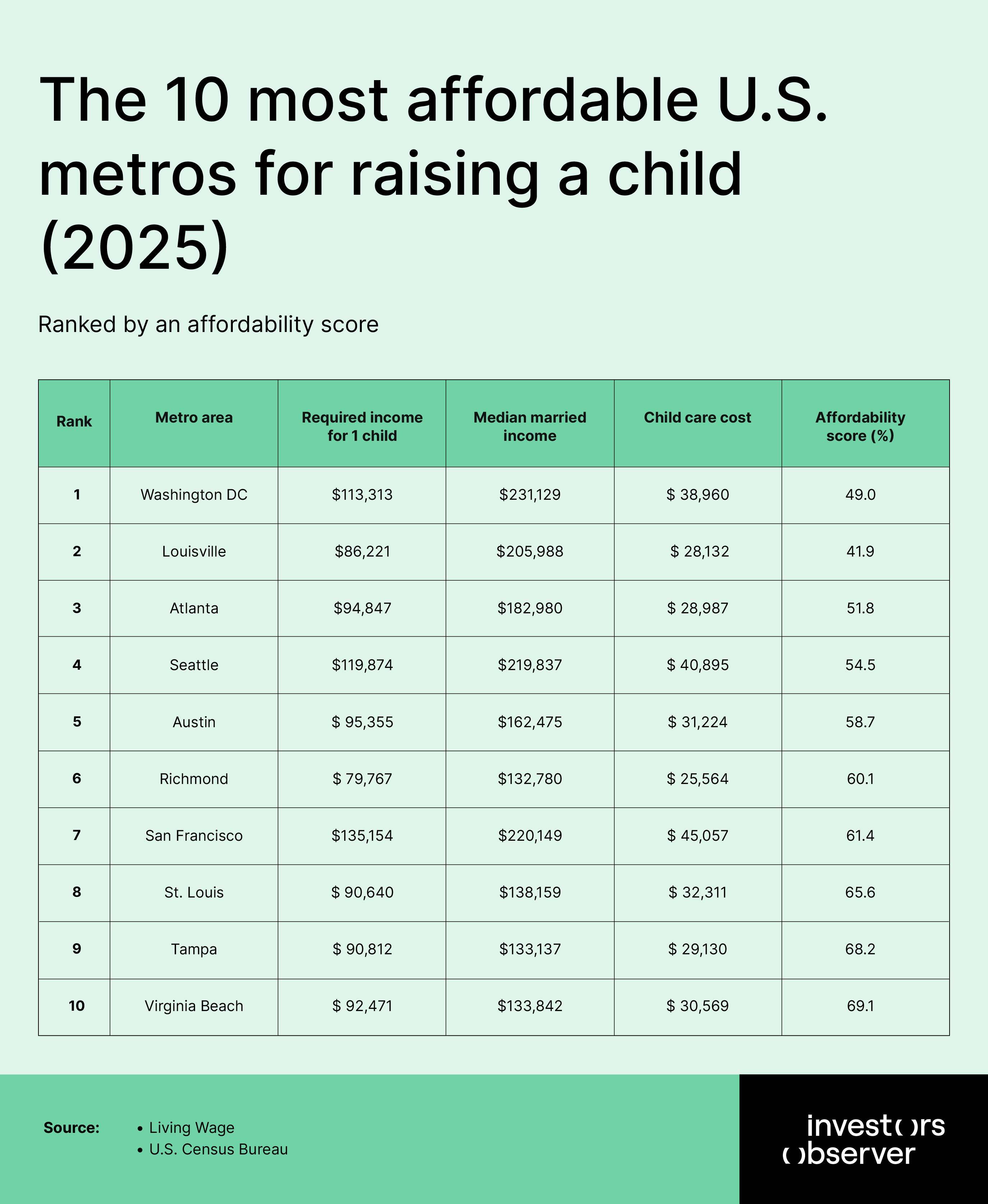

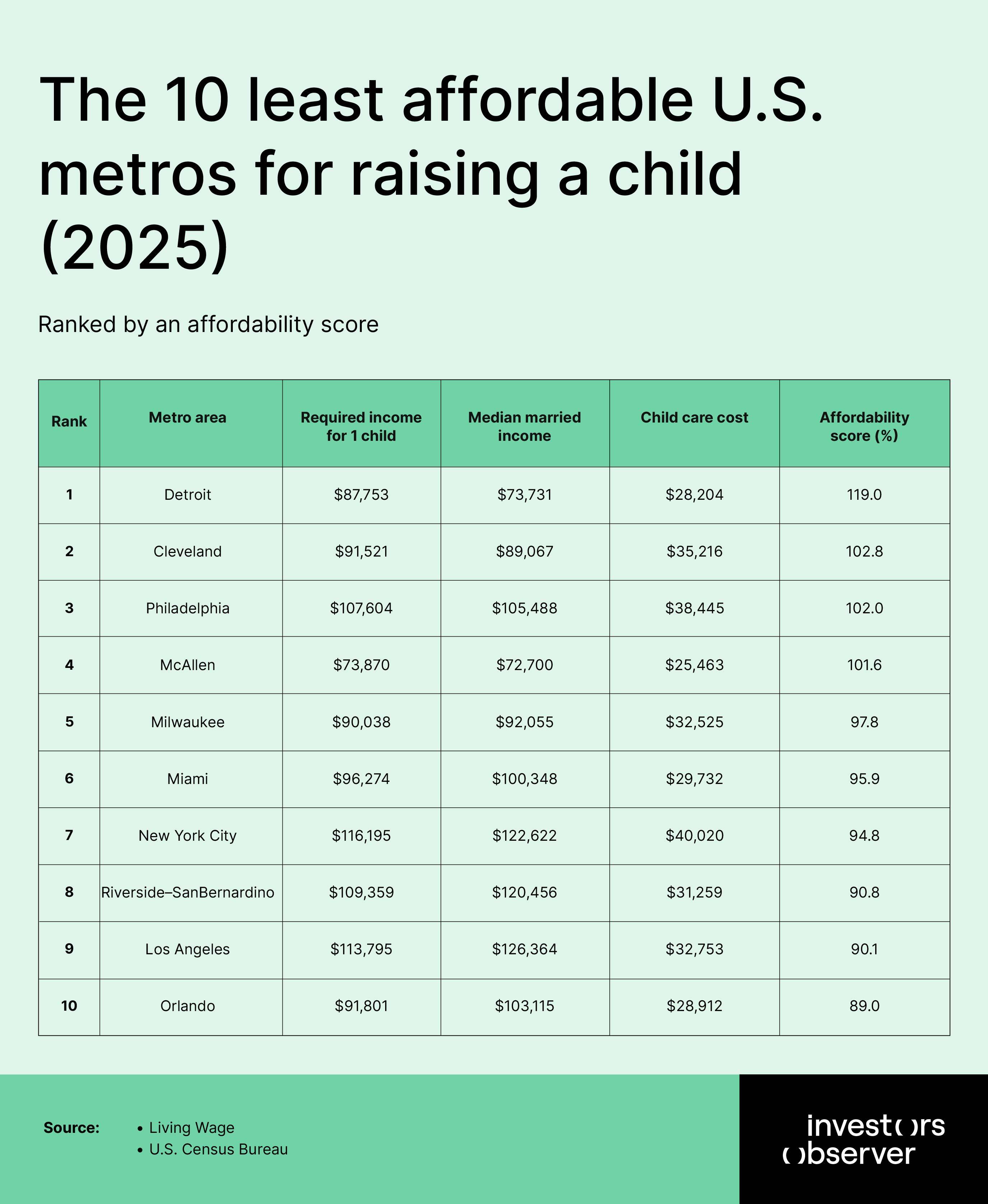

The ten most affordable metros demonstrate that prosperity can make child-rearing attainable, while the least affordable metros expose a crisis where even diligent, dual-income families fall short for one child, let alone multiple children.

Key findings

- There are 4 metros where the median married-couple household cannot afford even one child: Philadelphia, Detroit, Cleveland, and McAllen.

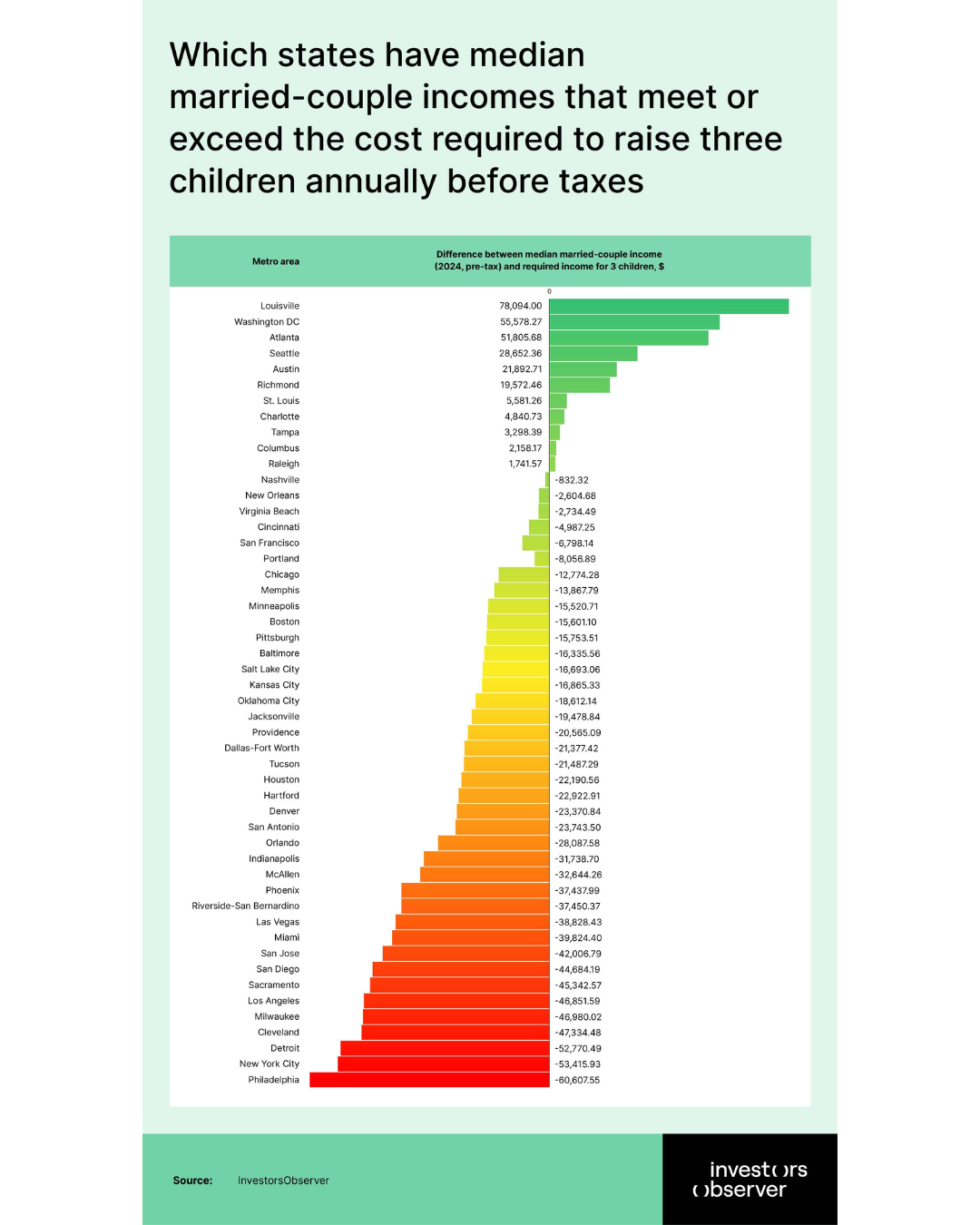

- 39 metros have a negative difference between median married-couple income (2024, pre-tax) and required income for 3 children which make having a larger family utterly unaffordable.

- Detroit is the least affordable, where raising a child demands 119% of the local median married income, producing an average annual deficit over $50,000.

- Washington DC holds the top spot for affordability, requiring only 49% of the median income to cover costs, and leaving a surplus of over $55,000.

- The average affordability score across metros is 78.5% – meaning most families need to spend nearly four-fifths of their income on child-related costs.

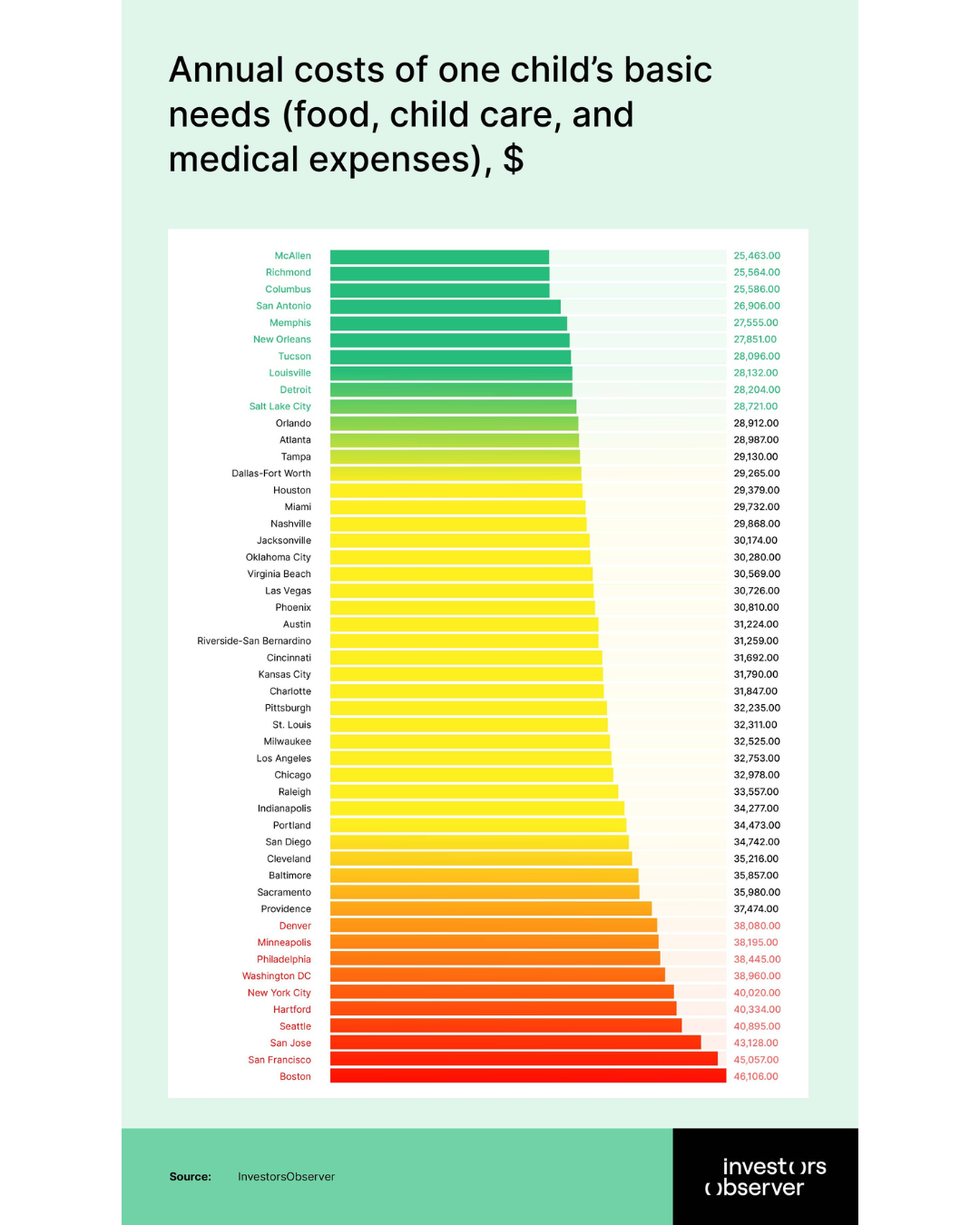

- Child care costs alone vary wildly, from $25,463 (McAllen) to $46,106 (San Francisco), exerting massive influence on overall affordability.

- Only 10 out of 50 metros analyzed have families with incomes exceeding local child-rearing needs.

The 10 most affordable metros for raising a child

1. Washington DC

The nation’s capital emerges as a surprisingly affordable area for child-rearing despite its reputation for high costs. The required annual income before taxes to raise one, two, and three children in Washington D.C. is approximately $113,313, $125,110, and $138,538 respectively.

The median married-couple household income in Washington D.C. for 2024 is about $231,129. This results in an annual surplus of roughly $117,816 after covering the costs for three children, indicating a strong financial capacity for families in the area.

This 49% affordability score reflects the region's robust federal employment base, which provides stable, well-compensated positions across government agencies, contracting firms, and related industries.

The metro's economy remains resilient even amid federal downsizing discussions, with approximately 11% of the workforce directly employed by the federal government and countless others in supporting roles. While child care costs reach $38,960 annually – above the national metro average – the region's high wages more than compensate.

The 5.5 million-person metro benefits from exceptional educational infrastructure, world-class healthcare systems, and reliable public transportation that reduces family transportation costs. Federal employment traditionally offers superior benefits packages, including health insurance and retirement contributions that further enhance real family income beyond raw salary figures.

2. Louisville

Louisville’s affordability score is 41.9%, meaning families need around 41.9% of the median married-couple household income to cover comprehensive child-rearing and household costs. The required annual income before taxes to raise one child is approximately $86,221, for two children $106,185, and for three children $127,894. The median married-couple household income is $205,988.

After covering the costs for raising three children, Louisville families have a comfortable surplus of about $78,094, highlighting the city’s strong financial capacity for larger families and overall affordability relative to income and living costs.

Childcare and essential child costs total $28,132 annually, which is manageable compared to many large U.S. metros. Louisville's population of about 1,394,234 benefits from this affordability, making it a desirable location for families seeking economic balance and quality of life. The city's cost structure allows families to raise children without excessive financial strain, supported by stable incomes and moderate living expenses.

3. Atlanta

Atlanta's position as the economic engine of the Southeast translates into genuine affordability for families. The required annual income before taxes to cover essential costs – including housing, food, childcare, healthcare, transportation, utilities, telephone, and other necessities – is approximately $94,847 for one child, $114,160 for two children, and $131,174 for three children.

This broad measure of family expenses goes beyond just child-rearing and reflects the total budget needed for a typical married-couple household with two working adults in Atlanta. Compared with a median married-couple household income of $182,980, families in Atlanta enjoy a significant surplus after covering these comprehensive living costs, underpinning the city's reputation for family affordability.

The metro's 51.8% affordability score reflects a diversified economy spanning technology, healthcare, logistics, and corporate headquarters that has attracted major companies and sustained wage growth above national averages.

With 6.2 million residents, Atlanta benefits from a young, educated workforce and consistent population growth of 1.5% annually – nearly double the national rate. The metro's relatively modest child care costs of $28,987 significantly enhance affordability compared to peer cities.

Atlanta's appeal extends beyond raw economics: Hartsfield-Jackson International Airport provides unmatched connectivity, while the region's cultural amenities, educational institutions like Georgia Tech, and moderate climate create an attractive family environment.

The metro's healthcare sector, anchored by institutions like Children's Healthcare of Atlanta, has expanded significantly, adding over 7,600 jobs recently and providing stable, well-paying employment for dual-income families.

4. Seattle

Seattle's technology-driven prosperity creates genuine affordability despite the region's reputation for high costs. Families require approximately $119,874 annually to cover the essential costs for one child, $153,319 for two children, and $191,185 for three children.

With a median married-couple household income of $219,837, this translates into surpluses of $99,963, $66,518, and $28,652 respectively. Seattle’s affordability score is 54.5%, reflecting the balance between income and the comprehensive family expenses that go beyond just child-rearing.

The 3.5 million-person metro's economy centers on major employers like Amazon, Microsoft, and a thriving ecosystem of tech startups that have driven median earnings for computer and mathematical workers to $157,200.

While child care costs reach $40,895 annually – among the highest nationally – Seattle's wage premium more than offsets this burden. The region's educated workforce enjoys exceptional benefits packages typical of major tech companies, including comprehensive health coverage, retirement matching, and often stock compensation that enhances total family wealth.

Seattle's appeal for families extends beyond economics: excellent schools, abundant outdoor recreation opportunities, and a culture that values work-life balance. The metro's commitment to public transportation and walkable neighborhoods reduces family transportation costs, while the region's environmental consciousness translates into sustainable living options that can reduce long-term expenses.

5. Austin

Austin's transformation into a major tech and creative hub has created remarkable affordability for families. The required annual income before taxes to cover essential family costs is approximately $95,355 for one child, $115,559 for two children, and $140,582 for three children.

With a median married-couple household income of $162,475, this translates into surpluses of $67,120, $46,916, and $21,893 respectively. Austin’s affordability score stands at 58.7%, reflecting a positive balance between income and comprehensive living costs including housing, childcare, healthcare, and other essentials.

Despite rapid growth that has pushed the metro to 2.3 million residents, Austin maintains relatively manageable child care costs of $31,224, significantly below coastal tech hubs.

The city recently topped national rankings as the #1 large economic boomtown, driven by a 51% GDP surge fueled by tech, manufacturing, and professional services growth. Austin's economy has diversified beyond major employers like Dell and Apple to include thriving creative industries in music and film, providing multiple income streams for families.

The region's educational infrastructure, anchored by the University of Texas, creates a pipeline of skilled workers while offering cultural amenities that enhance quality of life. Austin's relatively young median age and growing international migration help sustain a dynamic economy, though recent cooling in domestic migration reflects affordability pressures that could challenge future growth.

6. Richmond

Richmond stands out for its exceptional value proposition with required annual incomes before taxes of approximately $79,767 for one child, $96,544 for two children, and $113,208 for three children. These costs are the lowest among top metropolitan areas.

The median married-couple household income in Richmond is about $132,780. This results in surpluses of around $52,813 for one child, $36,236 for two children, and $19,572 for three children. Richmond’s affordability score of 60.1% reflects these positive financial prospects for families, highlighting significant room in household income beyond essential family expenses.

The 1.15 million-person metro combines affordable child care costs of $25,564 with a diversified economy spanning government, finance, healthcare, and manufacturing.

Richmond's economy has shown remarkable resilience, with the fastest job recovery rate among Virginia metros post-COVID and consistent population growth driving statewide expansion. The region benefits from its role as Virginia's capital, providing stable government employment, while major employers like CoStar Group and expanding healthcare systems create well-paying private sector opportunities.

Richmond's cost structure remains favorable across housing, transportation, and services, while the metro's educational institutions provide cultural amenities and research opportunities. The region's strategic location provides access to major East Coast markets while maintaining a lower cost base than northern competitors.

7. San Francisco

Despite requiring the highest income among most affordable metros at approximately $135,154 for one child, $178,198 for two children, and $226,947 for three children, San Francisco’s median married-couple household income of about $220,149 creates surpluses for one and two children of approximately $85,000 and $42,000 respectively.

However, raising three children results in a narrow deficit of approximately $6,798. This translates into an affordability score of 61.4%, reflecting the high cost environment and income constraints families face in San Francisco.

The 3.3 million-person metro's tech-driven economy supports some of the nation's highest wages, with major employers offering comprehensive benefits packages that extend beyond base salaries.

Child care costs reach $45,057 annually – the highest nationally – but the region's wage premium historically compensates skilled workers. San Francisco's appeal for families includes world-class educational opportunities, cultural amenities, and access to outdoor recreation.

However, the narrow margin between income and costs leaves little room for economic volatility, and recent tech sector adjustments have created uncertainty for some families. The region's public transportation infrastructure reduces family transportation costs, while the concentration of high-paying jobs continues to attract educated workers despite affordability challenges.

8. St. Louis

St. Louis offers solid affordability with required annual incomes before taxes of approximately $90,640 for one child, $113,446 for two children, and $132,578 for three children. The median married-couple household income is about $138,159.

This produces surpluses of roughly $47,519, $24,713, and a modest $5,581 for one, two, and three children respectively. St. Louis’s affordability score of 65.6% reflects a reasonable balance between household income and essential living expenses for families with children.

The 2.2 million-person metro has experienced its largest population growth since 2010, gaining 6,420 residents in 2024, primarily through international immigration. The region's diversified economy spans healthcare, manufacturing, agriculture, and financial services, with major employers including Anheuser-Busch, Express Scripts, and expanding healthcare systems.

Child care costs of $32,311 remain manageable, while the region's educational infrastructure, anchored by Washington University and St. Louis University, provides research and healthcare opportunities.

St. Louis benefits from central location advantages for logistics and distribution, relatively affordable housing, and cultural amenities including professional sports teams and music venues. The metro's workforce has grown significantly, adding over 94,000 employees over the past decade.

9. Tampa

Tampa represents Florida's economic success story, with required annual incomes before taxes of approximately $90,812 for one child, $108,837 for two children, and $129,839 for three children. The median married-couple household income is about $133,137.

This creates modest surpluses of roughly $42,325, $24,300, and $3,298 for one, two, and three children respectively. Tampa’s affordability score of 68.2% reflects the city’s balance between household earnings and essential family expenses.

The 3 million-person metro has been recognized as having one of the fastest-growing economies in America, with GDP jumping 43% between 2019-2023 while average paychecks grew 38%.

Child care costs of $29,130 remain reasonable, while the region attracts 170 new residents daily, creating sustained demand for goods and services. Tampa's economy has diversified significantly, with major growth in financial services, life sciences, healthcare, and advanced manufacturing.

The region's port facilities, international airport, and business-friendly climate attract major employers and foreign investment. Tampa's appeal includes year-round warm weather, no state income tax, growing cultural scene, and expanding educational opportunities. Recent recognition as the #8 metro nationally for talent attraction reflects the region's ability to draw skilled workers essential for continued economic growth.

10. Virginia Beach

Virginia Beach rounds out the most affordable metros with required annual incomes before taxes of approximately $92,471 for one child, $111,501 for two children, and $136,576 for three children. The median married-couple household income is about $133,842.

This results in surpluses of approximately $41,371, $22,341, and a deficit of $2,734 for one, two, and three children respectively. Virginia Beach's affordability score stands at 69.1%, reflecting strong affordability for families with up to two children and a slight shortfall for larger families.

The 1.5 million-person metro benefits from its large military presence, tourism economy, and growing business services sector.

Child care costs of $30,569 remain manageable, while the region's diverse economy includes significant federal employment, shipbuilding, agriculture, and tourism. Virginia Beach's advantages include oceanfront location, relatively affordable housing compared to other coastal metros, and stable employment in defense-related industries.

The metro's educated workforce – 38% hold bachelor's degrees or higher – and median age of 36.4 years provide a strong foundation for economic growth. However, the narrow surplus leaves families vulnerable to economic fluctuations, and competition from higher-wage metro areas may challenge long-term talent retention.

The 10 least affordable metros for raising a child

1. Detroit

Detroit stands apart as the nation’s least affordable major metro to raise a child in 2025 with an affordability score of 119%. The required annual incomes before taxes are approximately $87,753 for one child, $107,016 for two children, and $126,501 for three children.

However, the median married-couple household income is only about $73,731. This results in significant deficits of $14,022 for one child, $33,285 for two children, and $52,770 for three children, forcing many families to seek alternative income sources, dip into savings, or rely on extended family and public assistance.

Underlying this gap is a legacy of wage stagnation, economic shifts away from manufacturing, and uneven job recovery since the 2008 recession. Despite modest childcare costs of $28,204 annually – below many metros – other essentials drive total expenses high: housing in adjacent suburbs and transportation costs are substantial, and medical expenses have risen faster than local incomes.

Affordable neighborhoods have become scarce, pushing families further into the suburbs where commuting times – and associated costs – increase sharply. Educational quality varies widely, prompting some parents to pay for private or charter schools, adding further strain. Detroit’s high child poverty rate, at nearly 35%, underscores the burden: one in three children grows up in households unable to meet basic needs without assistance.

Employers face a challenge attracting and retaining talent, as professionals balk at the prospect of raising a family under such financial pressure. Local policymakers have rolled out subsidies for childcare and expansion of Head Start programs, but these efforts only scratch the surface of a broader affordability crisis.

Until Detroit revives higher-wage sectors and invests in affordable housing with supportive childcare infrastructure, the gap between what families earn and what they need to raise children is likely to persist.

2. Cleveland

In Cleveland, the required annual incomes before taxes are approximately $91,521 for one child, $115,537 for two children, and $136,401 for three children. The median married-couple household income is about $89,067.

This creates deficits of roughly $2,454 for one child, $26,470 for two children, and a substantial $47,334 for three children. These figures highlight the financial strain placed on families in Cleveland relative to child-rearing and household costs.

With an affordability score of 102.8%, Cleveland families teeter on the edge of financial precarity. Basic child care costs, at $35,216 annually, represent nearly 40% of median earnings and inflate total costs.

Housing remains relatively affordable in the urban core but dwindles in value-added suburbs where school quality is better, pushing families into longer – and costlier – commutes. Local wages have shown modest gains in healthcare and education sectors, yet average earnings for the 2.1-million metro trail national averages. High energy costs and property taxes further erode family budgets.

Public assistance programs, such as subsidized childcare and reduced-fee health services, alleviate some strain, but eligibility gaps and limited capacity leave many middle-income families without support. The region’s high charter school enrollment reflects parental strike at public school performance, often translating to out-of-pocket education costs. Transportation infrastructure improvements are underway, but without robust public transit, families face inflated vehicle and fuel expenditures.

Workforce development initiatives aim to upskill residents, but immediate relief is scant. City leaders are piloting sliding-scale childcare subsidies and incentivizing employers to offer on-site care, yet these programs have limited reach. Unless transformative investments increase median household incomes – through higher-paying industry diversification and expanded job opportunities – the financial tension for Cleveland’s families will remain acute.

3. Philadelphia

Philadelphia’s affordability score is 102%. Families require approximately $107,604 annually before taxes to raise one child, $136,795 for two children, and $166,096 for three children. The median married-couple household income is about $105,488.

This creates deficits of roughly $2,116 for one child, $31,307 for two children, and a significant $60,608 for three children. These deficits illustrate the considerable financial challenges Philadelphia families face in covering essential child-rearing and household expenses.

With basic childcare costs of $38,445, Philadelphia ranks among the highest for early education spending. Rising housing costs in popular neighborhoods like Fishtown and Mount Airy force families to choose between quality schools and affordable rents.

While the metro’s biomedical and higher education clusters offer high-wage roles, many parents work in healthcare support, hospitality, or retail – sectors with limited pay growth. Transportation costs add to burdens: SEPTA fare hikes squeeze family budgets already stretched by inflation. Food and medical expenses have also increased, narrowing room for discretionary spending.

Philadelphia’s property taxes remain among the highest in Pennsylvania, further denting household budgets. Subsidized childcare slots remain scarce, with long waitlists for state-funded Pre-K and Head Start, pushing families toward costly private options or informal – and less vetted – care arrangements.

Employers in the region have begun offering childcare stipends and flexible work arrangements to attract talent, but these benefits are unevenly distributed. Geographic inequalities persist: families in gentrifying neighborhoods face staggering rental increases, while suburban families contend with tuition costs for county-run schools. Policy proposals to cap childcare costs and expand universal Pre-K have stalled amidst budget debates.

For Philadelphia’s middle-income families, the narrow margin between earnings and child-rearing costs means any unexpected expense – job loss, medical emergency – can quickly derail household finances.

4. McAllen

McAllen’s status as the fourth least affordable metro surprises many, given its lower absolute costs. Its affordability score is 101.6%. The required annual incomes before taxes are approximately $73,870 for one child, $89,025 for two children, and $105,344 for three children.

These figures exceed the median married-couple household income of $72,700. This results in deficits of about $13,170 for one child, $17,275 for two children, and $32,644 for three children, underlining the challenges families face in balancing income and essential living expenses. Although the child care cost is modest at $25,463, limited local wages in retail, service, and cross-border trade suppress household earnings.

McAllen’s economy, heavily reliant on low-wage sectors and seasonal employment tied to agriculture and maquiladoras, fails to generate sufficient high-paying roles. Healthcare and education are underfunded, and professional opportunities for upward mobility are scarce. Housing remains low-cost, but maintenance and utility expenses can be unpredictable in this subtropical region.

Families often juggle multiple part-time jobs, which can compromise childcare consistency and increase reliance on informal care networks with varying quality standards. The metro faces a 20% child poverty rate, pressuring social services and schools. Limited public transit options force families into car ownership, further eroding budgets. Educational attainment levels lag national averages, reducing access to higher-wage roles.

Local nonprofits have expanded sliding-scale daycare and parenting support programs, but funding constraints limit capacity. Roadmap initiatives to diversify the economy into higher-value manufacturing and cross-border logistics are in early stages.

Until wage growth accelerates and childcare subsidies expand, McAllen families will continue to face the paradox of low costs paired with even lower incomes, making child-rearing financially precarious.

5. Milwaukee

Milwaukee’s affordability score is 97.8%. The required annual income before taxes to raise one child is approximately $90,038, for two children about $113,446, and for three children around $134,312. The median married-couple household income is roughly $89,067, leading to deficits of approximately $1,059 for one child, $24,379 for two children, and $45,245 for three children.

These figures highlight the financial challenges many families face, as the costs for childcare, housing, and other essentials often outpace household income, especially for larger families.

Milwaukee’s strong manufacturing base provides middle-income jobs, yet wage growth has stagnated in recent years, and service-sector roles are disproportionately low-paying. Racial and geographic disparities exacerbate affordability: predominantly Black neighborhoods in the city core face higher unemployment and underinvestment, while suburban enclaves offer better schools but higher housing costs.

Transportation costs are moderate, thanks to MCTS transit, but limited service routes force many families into dual-vehicle dependence. Milwaukee’s property taxes are rising, adding to the financial squeeze. Nonprofit collaborations have launched “Employer-Assisted Childcare” pilots, subsidizing costs for lower-wage workers, but uptake remains limited outside large employers.

School choice initiatives have seen mixed results, sometimes increasing out-of-pocket schooling costs. Healthcare affordability is comparatively better due to state-funded clinics, yet unexpected medical expenses still disrupt family budgets.

Local policy discussions focus on expanding universal Pre-K and childcare tax credits, but long-term funding is uncertain. Without meaningful wage growth or expanded public support, Milwaukee families face persistent affordability challenges that mirror broader Midwestern economic trends.

6. Miami

Miami’s affordability score is 95.9%. Families must earn approximately $96,274 annually before taxes to cover the essential costs for raising one child, $115,244 for two children, and $140,172 for three children. The median married-couple household income is about $100,348.

This results in deficits of roughly $3,926 for one child, $14,896 for two children, and $39,824 for three children. Basic childcare costs alone, amounting to $29,732, account for nearly 30% of earnings, reflecting the steep expenses families face related to after-school programs and early education.

Miami’s economy, driven by tourism, retail, and international trade, offers seasonal and commission-based roles that lack consistent pay, undermining stable household income.

Housing is a dominant cost driver: rental markets in Miami-Dade have surged by 25% over five years, pushing families to commute from more affordable but distant suburbs, increasing transportation expenses. Public transit expansions, like the Metrorail extension, aim to reduce commute costs, but coverage remains limited.

Healthcare costs are inflated by a high uninsured rate among immigrant families, causing families to allocate additional savings for emergency care. Educational quality varies starkly across districts, prompting out-of-pocket tutoring or private school costs.

Statewide policy caps on local taxes restrict municipal budgets for childcare subsidies or early education programs. Nonprofits have stepped in with sliding-scale daycare and assistance for dual-income families, but demand outstrips supply.

Miami employers are beginning to offer childcare benefits to attract skilled workers, but these remain the exception rather than the norm. For middle-income Miami families, the interplay of high rents, irregular wage patterns, and elevated childcare expenses means that raising a child demands nearly the entirety of household earnings, leaving little buffer for savings or emergencies.

7. New York City

New York City’s affordability score is 94.8%. Living here requires families to earn approximately $116,195 annually to meet child-rearing costs for one child, $145,669 for two children, and $176,038 for three children. The median married-couple household income in New York City stands at about $122,622.

This means families have a surplus of roughly $6,427 when raising one child, but face deficits of approximately $23,047 and $53,416 when raising two and three children, respectively. These figures show the high cost of living in New York City and the significant financial challenges families encounter to meet essential expenses such as housing, childcare, healthcare, and transportation while raising children.

With childcare at $40,020 annually, NYC remains one of the costliest markets for early education. Housing costs dwarf all other expenses: even in outer boroughs, the typical rent-to-income ratio exceeds 35%, consuming what little surplus families might have after paying for childcare.

Dual-income households rely heavily on after-school programs, nannies, or co-op babysitting networks, each with its own financial and logistical challenges. While high-paying finance and tech jobs bolster median incomes, these are concentrated in Manhattan and parts of Brooklyn, leaving families in other boroughs with significantly lower earnings.

Transportation costs are somewhat mitigated by the subway system, but families in transit deserts – such as parts of Staten Island and Southeast Queens – face long drives and high parking fees. Educational inequities drive families toward expensive private or parochial schools, further eroding any residual income. City-run childcare subsidies are limited and administered on a lottery basis, leaving many families without relief.

The city’s universal Pre-K program has expanded access for 4-year-olds but still excludes younger children. Proposed policies to cap childcare costs and expand paid family leave have stalled amid budgetary constraints. For New York families, the convergence of sky-high housing, childcare, and living costs means that even substantial professional salaries can leave households financially stretched.

8. Riverside–San Bernardino

Riverside–San Bernardino’s affordability score is 90.8%. Families require approximately $109,359 annually before taxes to cover child-rearing costs for one child. For two children, the required income rises to about $131,093, and for three children, it increases to roughly $157,906. The median married-couple household income in this metro area is approximately $120,456.

This results in a surplus of $11,097 for one child, a deficit of $10,637 for two children, and a larger deficit of $37,450 for three children once housing, transportation, childcare costs, and other essentials are included. These financial dynamics reflect the varying degrees of affordability families face, with manageable costs for smaller families but tightening budgets as family size grows.

The region has experienced rapid population growth – nearly 2% annually – straining housing supply and inflating rents by 18% over three years. Many families live in Riverside or San Bernardino but commute to Los Angeles for higher-paying jobs, incurring long commutes, fuel costs, and vehicle maintenance expenses that add thousands to annual household budgets.

Childcare shortages in suburban neighborhoods force families to travel significant distances or rely on informal care arrangements. Educational disparities between districts drive some families to pay for charter or private schooling.

Healthcare access remains uneven, with some rural pockets lacking pediatric specialists, resulting in higher out-of-area medical bills. Despite a lower overall cost of living than Southern California coastal metros, the rapid cost growth has outstripped wage increases in logistics and warehousing – major local employers. County initiatives to develop in-region job centers and incentivize affordable housing construction have yet to produce significant relief.

Public transit expansions like the Metrolink extensions promise future savings but are incomplete. Without a recalibration of housing development, improved local job opportunities, and expanded childcare infrastructure, families in the Inland Empire will continue to face the paradox of moderate incomes overshadowed by exploding living costs.

9. Los Angeles

Los Angeles has an affordability score of 90.1%. It presents one of the toughest affordability challenges for families, with required incomes before taxes of approximately $113,795 for one child, $139,621 for two children, and $173,216 for three children.

The median married-couple household income in Los Angeles is about $126,364. This results in a surplus of $12,569 when raising one child but deficits of $13,257 and $46,852 when raising two and three children, respectively.

Basic childcare costs alone, totaling $32,753, coupled with housing expenses that consume over 40% of earnings, put significant financial pressure on families. These costs shape the affordability landscape, highlighting why Los Angeles ranks among the most challenging metros for family living expenses.

The sprawling metro forces many to choose between expensive Westside neighborhoods with strong schools and more affordable eastern suburbs with longer, congested commutes. Transportation costs, including high insurance and gas prices, add thousands annually.

The city’s diverse economy offers high-wage jobs in entertainment, tech, and aerospace, but these are geographically concentrated and highly competitive. Many parents work in hospitality, retail, and service sectors that pay near minimum wage, creating a dual-tier affordability crisis.

Public childcare subsidies and Head Start slots exist but reach only a fraction of eligible families, leaving mid-income households without support. LAUSD’s size and complexity lead to uneven school quality, prompting private school tuition or supplemental education expenses. Employer partnerships offering on-site daycare are limited mostly to large corporate campuses.

Efforts to increase affordable housing near job centers are making slow progress due to zoning battles. For LA families, the convergence of high housing, childcare, and transportation costs demands deep household resources, forcing many to delay or forgo having children altogether.

10. Orlando

Orlando’s affordability score is 89.0%. In San Diego, families must earn approximately $91,801 annually before taxes to cover child-rearing costs for one child, $109,943 for two children, and $131,203 for three children. The median married-couple household income is about $103,115. So San Diego families have a surplus of about $11,314 raising one child, but face deficits of $6,828 and $28,088 raising two and three children respectively.

With childcare costs of $28,912 and housing costs rising 12% over two years, Orlando has become less of an affordability haven. The metro’s tourism-driven economy offers plentiful jobs but often at low hourly wages, and many hospitality positions lack benefits like paid family leave or health coverage.

Suburban sprawl forces families into car-dependent commutes, with vehicle expenses adding to budgets already stretched by childcare. Public transit options are limited, and recent expansions have been underfunded. Educational quality varies widely, with high-performing schools concentrated in affluent suburbs, prompting families to pay for tutoring or private school.

Healthcare access is uneven, with some families traveling significant distances for pediatric care. Local policymakers have introduced childcare grants for essential workers, but these programs have tight income caps and limited slots.

The region’s lack of major corporate headquarters limits the availability of high-wage roles that could buoy median incomes. While Orlando’s warm climate and tourism amenities remain attractive, rising living costs and persistent wage gaps mean families face growing tension between income and child-rearing expenses.

Social and economic impact of differences in child-rearing costs

In the least affordable cities, families face chronic financial stress that can delay childbearing, reduce discretionary spending, and erode long-term savings. High child poverty rates undermine educational outcomes and community health, while chronic deficits in household budgets exacerbate mental health challenges and deepen inequality.

Employers in unaffordable metros struggle to attract and retain talent, especially young professionals and dual-income couples, potentially stunting regional economic growth. On the other hand, the most affordable metros stand to reap demographic dividends, as younger families choose to settle where income stretches further, boosting local school enrollments, consumer demand, and a stable workforce pipeline.

In the least affordable cities, families face chronic financial stress that can delay childbearing, reduce discretionary spending, and erode long-term savings. High child poverty rates undermine educational outcomes and community health, while chronic deficits in household budgets exacerbate mental health challenges and deepen inequality.

Cities should increase funding for sliding-scale childcare programs and universal Pre-K to reduce out-of-pocket burdens for working families. Prioritizing slots for middle-income households will bridge gaps where current assistance falls short.

Tax credits and grants can encourage employers – especially small and mid-sized firms – to offer onsite childcare, childcare stipends, and flexible scheduling. By sharing costs with businesses, municipalities can amplify reach and sustainability.

Targeted workforce development in high-demand industries – healthcare, advanced manufacturing, green energy – can raise median incomes where wages have stagnated. Partnerships between community colleges, workforce boards, and major employers can upskill residents for family-supporting roles.

Expanding public transit coverage and subsidizing transit passes for low- and middle-income families will lower commuting costs, freeing household income for child-rearing expenses.

Expanding refundable tax credits for families, such as enhancing the Child Tax Credit and Earned Income Tax Credit, provides direct income support. Simplifying access and increasing benefit amounts can help families in underpaid metros manage deficits.

Methodology

We selected the 50 largest metropolitan areas in the U.S. and added information on the required annual income for each metro area, as well as the estimated cost of raising one, two, and three children.

The required annual income for a two-working-person household is calculated using date from the Living Wage, who calculated the required income by taking into consideration the following components:

- Chilcare

- Food

- Healthcare

- Housing

- Internet and mobile phones

- Transportation

- Civic Engagement

- Other necessities

- Income and payroll taxes

Median married-couple household income is presented before taxes.

We calculated the cost of raising one child in each metro by including only the essential expenses: food, childcare, and medical costs.

Then we calculated the percentage of median married-couple household income that would need to be spent on these three essentials.

Surplus/deficit in this context is calculated as the difference between the median married-couple household income and the required annual income to cover essential family costs, including child-rearing and other household expenses.

Affordability index

Metros were ranked by an affordability score calculated as the required pre-tax household income to raise one child divided by the metro’s median married-couple income, multiplied by 100, where a lower percentage denotes greater affordability.

Affordability Score = Required Income for 1 Child / Median Married-Couple Income × 100

What the scores mean:

- Below 100%: Affordable (median income exceeds child-rearing costs)

- Above 100%: Unaffordable (child-rearing costs exceed median income)

This affordability score is effective because it simultaneously captures both sides of the cost equation – local child-rearing expenses and local earning power. This allows direct, apples-to-apples comparisons across metros.

By expressing total required income as a share of typical family earnings, it reveals where households truly have the financial breathing room to raise children and where costs overwhelm local wages, rather than simply highlighting low costs or high incomes in isolation.

Your email address will not be published. Required fields are markedmarked