After a prolonged slump, Citi Research analysts are calling for a rebound in the analog semiconductor sector — aka "low-end" chips.

Citi analyst Christopher Danley wrote in a note Wednesday that the firm has turned bullish on analog chipmakers because “we believe inventory is low, margins and EPS are close to a trough, and a recovery in sales is imminent, which should drive upside to consensus estimates.”

Citi now forecasts a recovery that could drive average EPS growth of 70% by the second half of 2026.

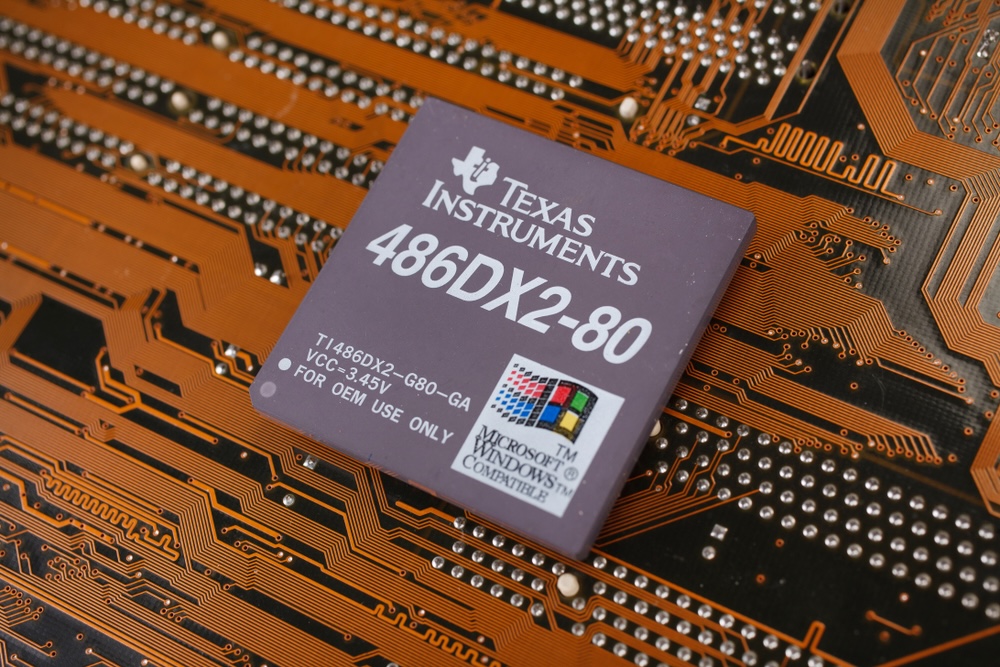

Danley named Texas Instruments (TXN) as his top pick, citing its strong risk-reward profile. But Citi is bullish on the entire sector, pointing to improving signs of a turnaround.

“We are beginning to see signs of such a recovery with multiple analog companies experiencing an increase in bookings,” Danley wrote.

Citi has issued Buy ratings for all the analog semiconductor stocks it covers, including Microchip Technology (MCHP), Analog Devices (ADI), and NXP Semiconductors (NXPI).

Still, the market hasn’t rallied around the sector — at least not yet. Texas Instruments is down 4.9% year-to-date, Analog Devices has fallen 3.7%, Microchip is off 9.3%, and NXP is down 3.74%.

Prolonged slide that may be nearing its end

Unlike the high-end chips powering AI models from Nvidia and Apple, analog semiconductors are the “low-end” workhorses found in nearly all electronics — from smartphones and industrial systems to electric vehicles (EVs).

After a pandemic-era surge in demand, the sector was hit by a sharp downturn as supply outpaced slowing orders.

“Many of these names were overly punished for the severe cyclical downturn they encountered within their industrial and automotive end markets,” Morningstar analyst Brian Colello told Barron’s.

“We’re starting to see optimism that the worst of the downturn is over. Even if we’re not fully at the bottom, I think we’re close enough... that investors can see the upturn on the horizon.”

According to Global Market Insights, the global analog semiconductor market was valued at $87.5 billion in 2024 and is projected to grow at a 7.4% CAGR from 2025 to 2034 — reaching $178.9 billion by the end of that period.

In North America alone, the market is expected to hit $46.7 billion by 2034, fueled by the growth in EV manufacturing.

Analog chips play a critical role in EVs — managing power delivery, battery charging, sensor systems, and motor control. As EV adoption accelerates, it's poised to lift the entire analog semiconductor sector.

Your email address will not be published. Required fields are markedmarked