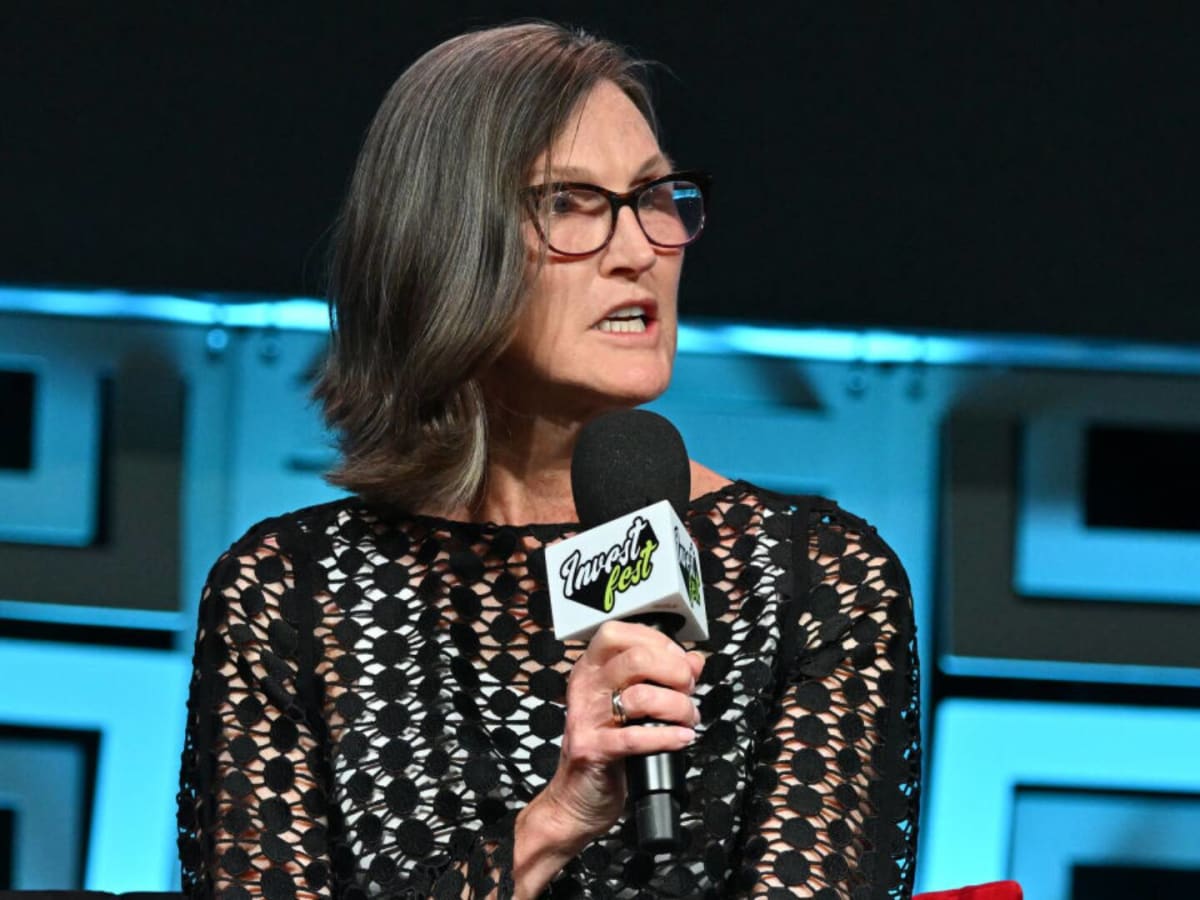

As Tempus AI’s (TEM) stock has gone through a bit of a swoon over the past month, Ark Invest founder Cathie Wood is doubling down on the healthcare tech company.

Shares of TEM have been down 14.5% over the past month, after its earnings missed on some analyst’s forecasts.

However, Wood acquired 445,958 shares of Tempus AI last month via her flagship Ark Innovation ETF (ARKK stock) and the ARK Genomic Revolution ETF (ARKG stock).

ARKK purchased 367,388 shares, while ARKG added 78,570 shares. And then earlier this month, Wood bought another 94,251 shares of Tempus AI, worth $4.29 million.

ARKG now lists TEM as its second-largest portfolio holding with a 9.19% weighting and a market value of $92.8 million. Meanwhile, ARKK lists TEM as its sixth-largest portfolio holding with a 5.33% weighting and a market value of $314 million.

Wood’s endorsement of Tempus appears to be paying off: TEM has surged 57.7% this year so far.

‘The most underappreciated application of AI’

Cathie Wood made her name backing Tesla — ARKK’s largest holding — and crypto, with Coinbase sitting at No. 3. Lately, though, she’s been just as vocal about AI’s potential to transform medicine and healthcare.

“I think the most underappreciated application of AI is healthcare,” she told CNBC in a recent interview. “I think healthcare is responsible for an incredible amount of storage out there right now. Data is the name of the game.”

Tempus, a Chicago-based company, uses AI for genome sequencing and precision medicine.

It claims to have the world’s largest clinical and molecular database — a resource used by cardiologists, oncologists, research centers, and pharmaceutical companies.

In its Q4 and full-year 2024 earnings report last month, Tempus said fourth-quarter revenue rose 35.8% year over year to $200.7 million. Gross profit climbed 49.7% to $122.1 million. For the full year, revenue grew 30.4% to $693.4 million.

Looking ahead, the company expects full-year 2025 revenue of roughly $1.24 billion — a 79% jump.

One reason for the bullish forecast: Tempus has been active on the M&A front.

In February, it announced the acquisition of Ambry Genetics, a leader in genetic testing. Then earlier this month, it snapped up Deep 6 AI — an AI-powered research platform used by healthcare organizations and life sciences companies.

Cathie Wood told CNBC that AI is where the internet was in the early-to-mid ’90s — still in its early innings.

And while she believes AI’s impact on healthcare may be “underappreciated” today, she’s clearly bullish on the space.

“While robotaxis might be the biggest application short-term — $10 trillion in the whole ecosystem over the next five to 10 years — we think the most profound application is in healthcare and it will lead to curing disease,” she said. “It already is.”

Your email address will not be published. Required fields are markedmarked