Quantum Computing Inc (QUBT) stock witnessed a fairytale surge in 2024… rising 1,781% over this period. What followed next was a stomach-churning year-to-date drop of 72%.

QUBT's dramatic reversal of fortunes can partly be linked to Trump's tariffs and wider Wall Street sell-offs, but there are other factors at play.

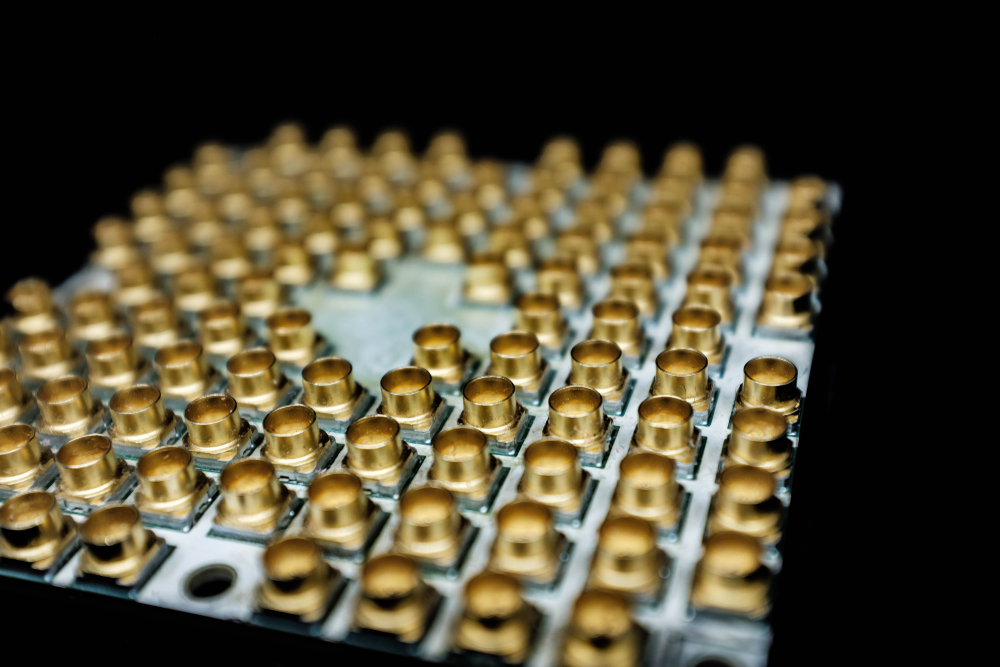

One of them is a flurry of big tech's announcements about significant breakthroughs in the race to build full-fledged quantum chips.

To put this into context, take a look at Willow, Alphabet's recently unveiled new chip. It apparently can solve problems in five minutes that would be impossible for traditional computers to ever crack… even if they had more time than the history of the universe.

Soon after introducing Willow, Microsoft pulled back the curtain on its Majorana 1 quantum computing chip, touting it as a breakthrough that "carves a new path for quantum computing" and could solve "meaningful, industrial-scale problems in years, not decades."

Amazon joined the club by unveiling Ocelot, which it says is a watershed moment "in the pursuit to build fault-tolerant quantum computers capable of solving problems of commercial and scientific importance."

There are also signs of sparring between all three of these tech giants.

An email recently obtained by Business Insider suggests Amazon's head of quantum computing, Simone Severeni, openly questioned Microsoft's announcement in an email to chief executive Andy Jassy.

Overshadowed by big tech

All of this posturing and competition detracts attention and precious column inches from Quantum Computing Inc, a company that doesn't have the benefit of generating billions in profits from other revenue streams.

This matters given there's questions over how long it will take for quantum computers to achieve commercial viability and mainstream adoption.

At an event back in January, Nvidia CEO Jensen Huang said: ""If you kind of said 15 years for very useful quantum computers, that would probably be on the early side. If you said 30, it's probably on the late side."

Those remarks were a crushing blow to QUBT's price, which plunged from $17.49 to $9.91 in a single day.

Also hanging over Quantum Computing Inc is the threat of a class action lawsuit, amid allegations that "false and/or misleading statements" overstated the capabilities of its technology, and its relationship with NASA.

Investors who suffered a loss after purchasing QUBT stock between March 2020 and January 2025 have been told they have until April 28 to join.

Your email address will not be published. Required fields are markedmarked