As tensions mount ahead of the July 9 deadline for a new U.S.-EU trade agreement, the prospect of a blanket 50% tariff on all EU goods exported to the US is very realistic. Based on 2024 export data, this would result in a staggering $304.45 billion tariff burden for the EU.

The impact, however, is not evenly distributed. A new Investors Observer’s analysis of country-level exposure reveals which economies face the highest risks and which may escape with relatively minor damage.

Key findings

- Total EU tariff burden: $304.45B annually at 50% tariff rates.

- Top 3 countries (Germany, Ireland, Italy) account for 56.7% of the total EU tariff burden.

- The top 10 countries with the largest exposure represent over 89% of the total EU tariff impact, and together face $271.2 billion in tariff costs.

- The 10 least affected EU countries together face less than $7.11 billion in tariff costs.

Top 10 EU countries with the biggest tariff burden if U.S. and EU fail to reach a deal

We ranked each EU country according to its projected tariff burden in billions of USD if the U.S. and EU do not reach a deal.

Germany faces a projected tariff burden of $81.50 billion if the U.S. and the EU fail to reach a trade deal, making it the most exposed EU country. This is largely due to its robust vehicle exports, which surged to $34.87 billion in 2024. Machinery and pharmaceuticals also contribute significantly. Though overall exports rose only 1.2%, the spike in automotive trade leaves Germany especially vulnerable to U.S. protectionism and supply chain shifts if a 50% tariff is enforced.

Ireland’s projected tariff burden – $52.00 billion. Its tariff exposure is driven by its pharmaceutical sector, which exported a staggering $50.32 billion to the U.S. in 2024. Home to major drug manufacturers, the country’s export reliance on a single high-value industry makes it especially sensitive to tariffs. Any disruption could affect GDP, jobs, and foreign direct investment in Ireland’s booming life sciences sector.

Italy’s $39.2 billion tariff burden stems from industrial machinery exports ($14.21 billion), followed by pharmaceuticals and vehicles. The country increased its U.S.-bound exports by 11% in 2024, highlighting deepening trade ties. Tariffs would disproportionately affect engineering and manufacturing sectors – cornerstones of Italy’s industrial economy – potentially reversing recent gains in transatlantic trade momentum and hurting small-to-medium enterprises.

France risks $30.55 billion in tariffs, with key exports in machinery ($10.59 billion), aerospace, and beverages. While aircraft may fall under separate negotiations, the looming tariffs threaten vital sectors of the French economy. Given France’s export diversity, the impact may be diffuse but still economically painful – especially for industrial and luxury producers reliant on U.S. demand.

Despite a 6% contraction in exports to the U.S. in 2024, the Netherlands faces a $17.5 billion tariff hit. Pharmaceuticals lead at $6.99 billion, with machinery and unspecified commodities following. The country’s trade deficit with the U.S. could widen further. With Rotterdam as a logistics hub, tariff hikes may ripple across broader EU supply chains.

Belgium’s pharmaceutical exports exploded over 250% from 2023 to 2024, driving its $14.15 billion tariff burden. Other significant exports include commodities and precious metals. The rapid growth makes Belgium newly exposed to U.S. trade policy risk. A 50% tariff could curb pharma momentum and squeeze margins, especially for multinational firms operating within Belgian borders.

Spain faces an $11.05 billion tariff burden, driven by machinery ($2.52 billion), pharmaceuticals, and electronics. Though smaller in export volume than core EU economies, Spain’s exposure has grown due to rising industrial capacity. A 50% tariff would hurt exporters and could undermine economic recovery efforts following recent domestic slowdowns, particularly in advanced manufacturing sectors.

Sweden’s $9.25 billion tariff risk is fueled by a strong automotive sector ($4.29 billion), complemented by machinery and pharmaceutical exports. As a key player in high-tech and sustainable manufacturing, Sweden's reliance on U.S. trade ties increases vulnerability. Tariff hikes would strain industrial competitiveness and could slow innovation-focused export growth in vehicles and clean technologies.

Austria’s projected tariff burden of $8.95 billion is led by machinery exports worth $4.91 billion. Pharmaceuticals and vehicles also contribute. The country's mid-sized economy would feel outsized effects from U.S. trade barriers. Austrian engineering firms with U.S. clients may face cost pressures and reduced orders, disrupting business planning and weakening the broader manufacturing sector.

Poland’s $7.05 billion in tariff exposure is anchored in machinery ($4.05 billion), electronics, and medical devices. As a rising manufacturing powerhouse within the EU, Poland is increasingly dependent on U.S. demand. New tariffs threaten to stall its export-driven growth model and could force reconfiguration of transatlantic production networks across Poland’s industrial zones.

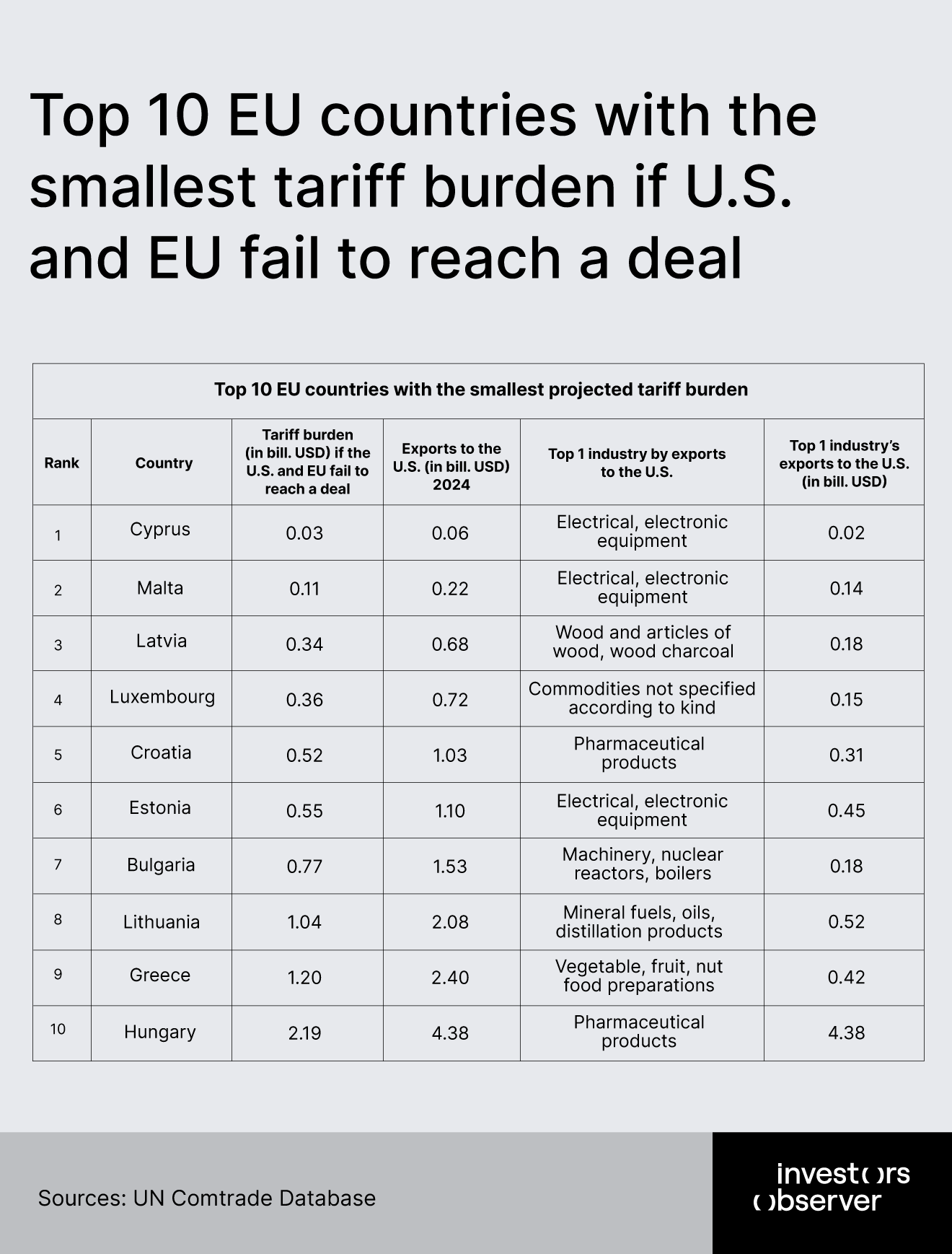

Top 10 EU countries with the smallest tariff burden if U.S. and EU fail to reach a deal

The countries with the smallest tariff burden have been ranked by their tariff burden in billions of USD if the U.S. and EU fail to reach a deal. The ranking starts with the country facing the smallest burden.

Cyprus ($0.03 billion tariff burden) and Malta ($0.11 billion) face minimal exposure due to their small, service-oriented economies and limited export volumes. Cyprus’s $0.06 billion total exports to the U.S. are dominated by electronics (33.3%), while Malta’s $0.22 billion exports focus on electronics (63.6%) and machinery.

Both lack significant industrial sectors targeted by U.S. tariffs, insulating them from broader trade disruptions. Luxembourg ($0.36 billion) follows, with 41.7% of exports classified as “unspecified commodities,” complicating tariff applicability and reducing sector-specific risks.

Mid-tier economies like Croatia ($0.52 billion) and Estonia ($0.55 billion) show niche vulnerabilities. Croatia’s pharmaceutical exports ($0.31 billion) represent just 0.17% of EU-wide pharma trade, while Estonia’s electronics sector ($0.45 billion) already contends with preexisting 20% tech tariffs implemented in April 2025.

Bulgaria ($0.77 billion) and Lithuania ($1.04 billion) face structural challenges: Bulgaria’s machinery exports declined 12% under current tariffs, while Lithuania’s mineral fuels ($0.52 billion) compete with entrenched U.S. shale gas producers.

Larger but diversified economies round out the list. Greece ($1.20 billion) struggles with agricultural exports ($0.42 billion almonds/olives) facing U.S. farm lobby resistance, while other countries on the list also show limited exposure due to their lower reliance on tariff-sensitive industries like automotive or heavy machinery. This buffers their overall exposure compared to more export-dependent EU members.

Implications for the global economy

The largest EU exporters to the U.S. – Germany, Italy, France, and the Netherlands – account for the majority of EU exports, with key sectors being vehicles, machinery, pharmaceuticals, and aerospace.

If tariffs are implemented, these EU products will become more expensive in the U.S., likely reducing import volumes and increasing costs for American businesses and consumers who rely on these goods.

U.S. companies that depend on EU imports – such as automakers sourcing German vehicles, manufacturers using Italian machinery, or pharmaceutical firms relying on Irish and Belgian drugs – could face higher input costs and supply chain disruptions. This may squeeze profit margins for these sectors and could lead to price increases for U.S. consumers.

On the other hand, U.S. producers in competing industries (e.g., American carmakers, machinery manufacturers, or pharmaceutical firms) might benefit from reduced EU competition and higher demand for domestically produced goods.

However, the broader economic impact could be negative for the U.S. as well. Tariffs may provoke EU retaliation, potentially targeting U.S. exports to Europe and disrupting the highly integrated transatlantic supply chains that underpin many industries.

The uncertainty created by the tariff threat has already led to volatility in global markets and could further dampen business investment and consumer confidence in both regions. U.S. investors should therefore consider the risks of higher costs, supply chain volatility, and possible retaliatory measures when making investment decisions in sectors with significant exposure to EU trade.

Methodology

For the ranking of EU countries, the main metric used was the “Tariff burden in (bill. USD) if the U.S. and EU fail to reach a deal,” calculated by applying a projected 50% tariff rate to each country’s total exports to the US in 2024.

Sources

- UN Comtrade Database

Your email address will not be published. Required fields are markedmarked