Geopolitical conflicts have historically influenced financial markets, prompting investors to seek refuge in safe haven assets. But how do these assets actually perform when crises erupt, and which ones offer the most reliable protection?

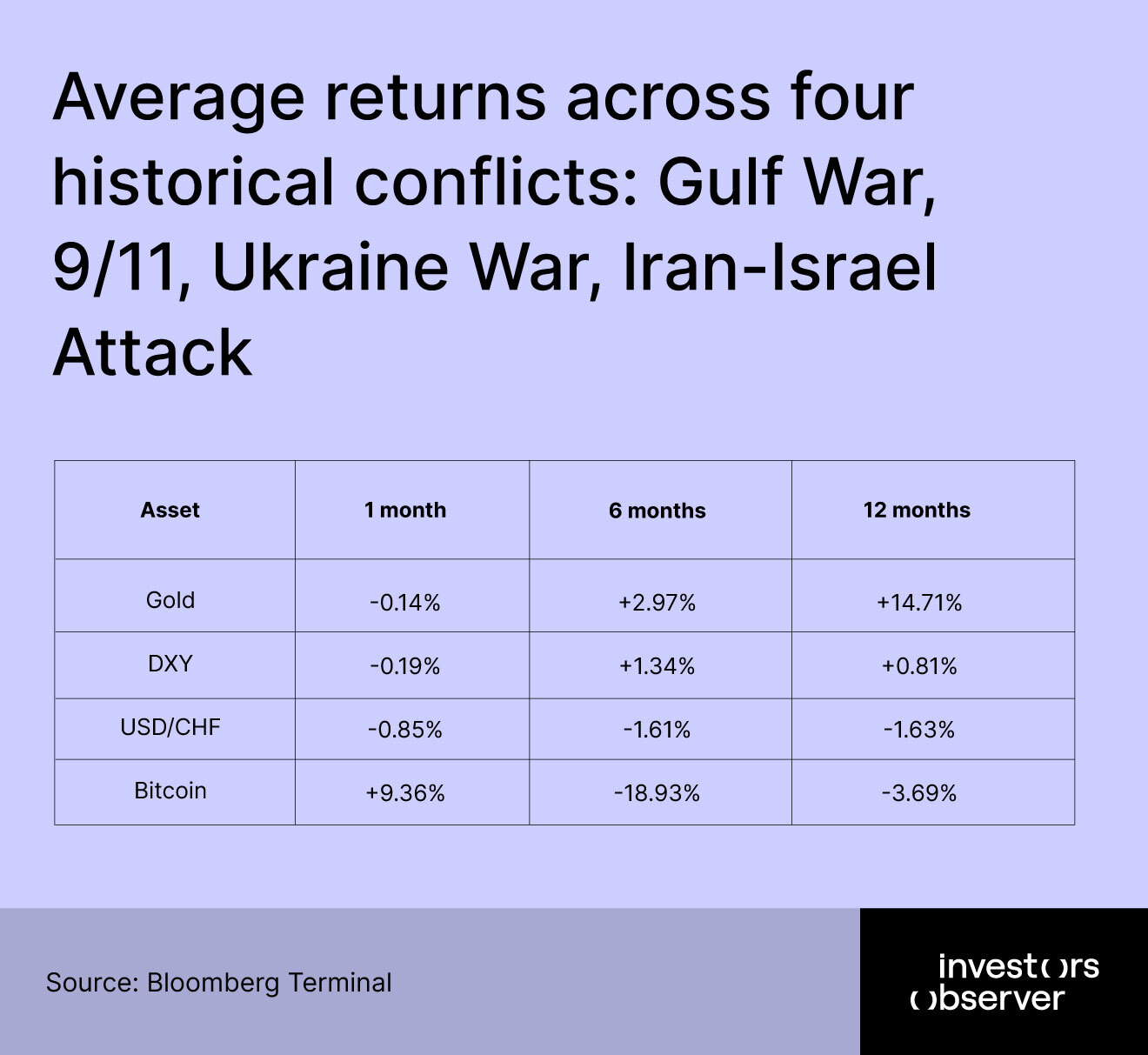

To answer these questions, the Investors Observer's research team analyzed the performance of key safe haven assets – Gold, DXY (U.S. Dollar Index), USD/CHF (Swiss Franc), and Bitcoin – during four major geopolitical events: Iraq’s invasion of Kuwait (1990), 9/11 terrorist attacks (2001), Russia’s invasion of Ukraine (2022), Iran’s missile attack on Israel (2024), and Israel's attack on Iran (2025), also known as Operation Rising Lion.

The study also includes Operation Rising Lion (2025), a recent military escalation between Israel and Iran, and evaluates asset performance over 1-month, 6-month, and 12-month periods.

By identifying patterns and anomalies in asset resilience during crises, this research aims to provide investors and policymakers with evidence-based insights for portfolio protection and risk management in times of global uncertainty.

Key findings

- Gold has historically acted as a reliable safe haven, with an average 0.30% gain in the first week and an 8.98% increase over 12 months following conflicts. This pattern broke during Operation Rising Lion, when gold fell 3.17% as equities rallied.

- The U.S. Dollar Index (DXY) does not always strengthen during war. Its average 1-month performance is slightly negative (-0.19%), and it fell over 5.5% in the year following the 2024 Iran-Israel conflict.

- The Swiss Franc (USD/CHF) consistently appreciates against the U.S. dollar during conflicts, with the franc strengthening in all four major and minor wars analyzed.

- Bitcoin data is available only from the Ukraine War onward. Its performance has been mixed: it fell 43.3% over six months during the Ukraine War but rose 0.42% during the 2025 Israel-Iran escalation.

- Safe haven assets do not always move in tandem: the dollar and Swiss franc can respond differently to the same event, reflecting investor preferences for neutrality and financial stability over reserve currency status.

- Diversification remains essential: no single asset provides a foolproof hedge across all conflicts. Combining gold, Swiss franc exposure, and, selectively, Bitcoin can help mitigate the risk of adverse moves in any one asset class.

Gold

Gold has consistently served as a primary crisis hedge, averaging 0.30% gains in the first week and 8.98% over 12 months across historical conflicts. Its appeal stems from tangible value perception and low correlation to equities, as seen during the Gulf War (+0.76% weekly) and 9/11 (+1.12% weekly), where investors prioritized inflation hedges amid uncertainty.

Physical demand surges and central banks buying further amplified returns during prolonged tensions, such as the 2024 Iran-Israel conflict’s 35.8% annual gold surge.

However, gold’s status fractured during Operation Rising Lion, declining 3.17% despite the S&P 500’s rally. This divergence highlights two vulnerabilities: (1) rapid conflict resolution diminishes gold’s short-term appeal as a "crisis insurance" asset, and (2) Bitcoin’s emergence as a digital alternative may fragment capital flows traditionally directed to gold.

The anomaly signals that gold’s reliability is contingent on conflict duration and the availability of competing havens.

U.S. Dollar Index (DXY)

Contrary to assumptions of dollar strength during crises, the DXY averaged a 0.19% 1-month decline historically, with mixed results across events. For instance, it fell 5.7% during the 2024 Iran-Israel conflict as investors favored gold and oil, while rising 11.9% in the Ukraine War’s first six months due to aggressive Fed rate hikes.

This demonstrates that monetary policy often outweighs geopolitical drivers. The dollar’s sensitivity to interest rate differentials and global risk sentiment makes its safe-haven status context-dependent rather than universal.

During Operation Rising Lion, the DXY dipped 0.30%, extending its inconsistent crisis performance. This reinforces that dollar strength is not automatic during wars. Factors like U.S. debt dynamics, trade imbalances, and competing currency flows (e.g., Swiss Franc appreciation) can neutralize or reverse typical haven flows.

Investors should monitor real yields and global liquidity conditions alongside conflict developments when assessing dollar exposure.

Swiss Franc (USD/CHF)

The Swiss Franc appreciated against the dollar in 100% of analyzed conflicts, averaging 0.85% monthly gains – a track record spanning World War I to the 2025 Israel-Iran escalation.

This consistency stems from Switzerland’s political neutrality, robust financial system, and the franc’s historical role as a "clean" haven uncorrelated with reserve currency policies. Even during Operation Rising Lion, the franc gained 0.25% as investors prioritized sovereign stability over dollar liquidity.

The franc’s resilience is further validated by its inverse correlation to the DXY during crises. For example, it rose 2.9% while the dollar fell 5.5% in the 12 months following the 2024 Iran-Israel conflict.

This reliability positions the franc as a pure-play geopolitical hedge, though its low yield and SNB intervention risks (e.g., currency caps) require tactical entry points for optimal allocation.

Bitcoin

Bitcoin’s limited crisis dataset (available post-2022) reveals extreme volatility: it plunged 43.3% over six months during the Ukraine War but gained 32.1% in the year following the 2024 Iran-Israel strikes.

This divergence reflects Bitcoin’s dual identity as both a risk asset (correlating with tech stocks) and an emerging digital haven during currency devaluation fears, particularly in regions with capital controls.

During Operation Rising Lion, Bitcoin rose 0.42% – outperforming gold and the franc but trailing the S&P 500. This suggests its haven appeal is strengthening in short, digitally connected conflicts where investors seek assets outside traditional financial systems.

However, Bitcoin’s 2025 performance (+0.42%) versus its 2022 crash (-43.3%) reveals that its efficacy remains event-specific and highly sensitive to regulatory sentiment and market liquidity conditions.

Implications for investors

Investors should recognize that safe-haven assets exhibit non-uniform responses to geopolitical shocks. Gold’s reliability diminishes during swift de-escalations, while currencies like the Swiss Franc offer more consistent stability.

Bitcoin’s partial decoupling from traditional assets warrants caution. Its performance is highly event-specific and lacks the multi-decade validation of gold or currencies.

Diversification across uncorrelated havens – such as combining gold for long-term stability with Swiss Franc exposure for currency hedging – may mitigate single-asset volatility.

Methodology and sources

Performance data was sourced from the Bloomberg Terminal, with calculations beginning on the event start date for each asset. Returns reflect price changes only, excluding dividends or currency adjustments. Averages for the four historical events exclude Operation Rising Lion. Bitcoin data was available only for events post-2022. The analysis prioritized assets with continuous data across all four primary conflicts to ensure comparability.

Your email address will not be published. Required fields are markedmarked