A fundamental shift is reshaping American retirement planning as younger generations abandon traditional investment strategies in favor of new approaches that could dramatically impact their financial futures. With retirement increasingly self-funded through 401(k) plans, Gen Z and Millennials are choosing different strategies than their parents.

Investors Observer's research examines how each generation navigates their 401(k) investments during this period of quick financial innovation and market volatility. By analyzing fund performance data, survey results, and investment flows through mid-2025, we uncover which strategies are winning and what that means for the future of retirement security in America.

Key findings

- ETFs are increasingly popular in retirement accounts: 75% of Gen Z and 81% of Millennials hold ETFs in their retirement accounts, compared to just 60% of Boomers.

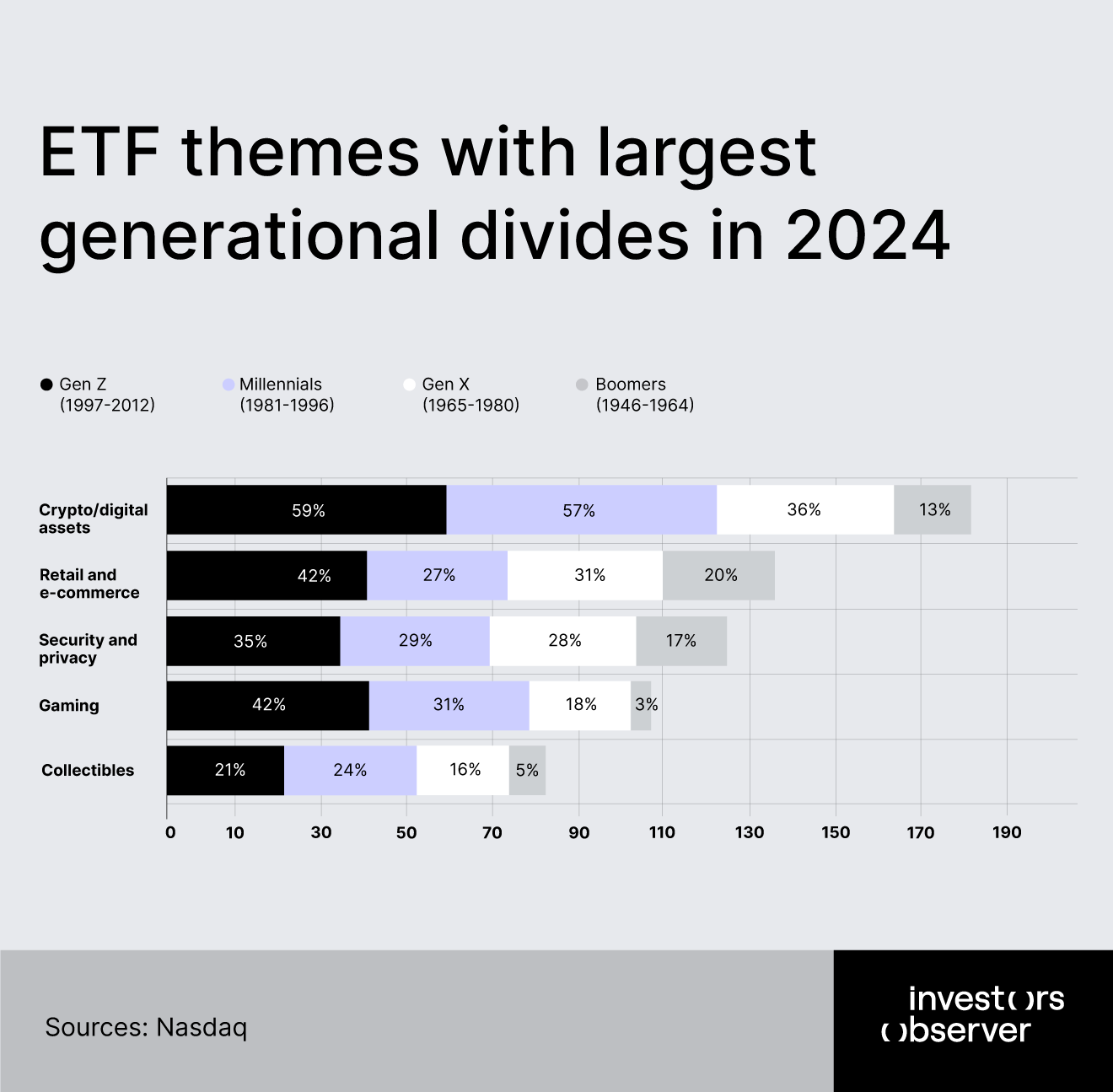

- Crypto/digital asset ETFs are vastly more popular with Gen Z (59%) and Millennials (57%) than with Gen X (36%) and Boomers (13%).

- YieldMax MSTR Option Income Strategy ETF, likely popular with younger investors, delivered an impressive 105.98% year-over-year return.

- Tech-focused mutual funds delivered strong performance with Fidelity Growth Strategies returning 22% year-over-year.

- International equity ETFs showed exceptional performance, with Dimensional International Value ETF returning 21.44% YTD.

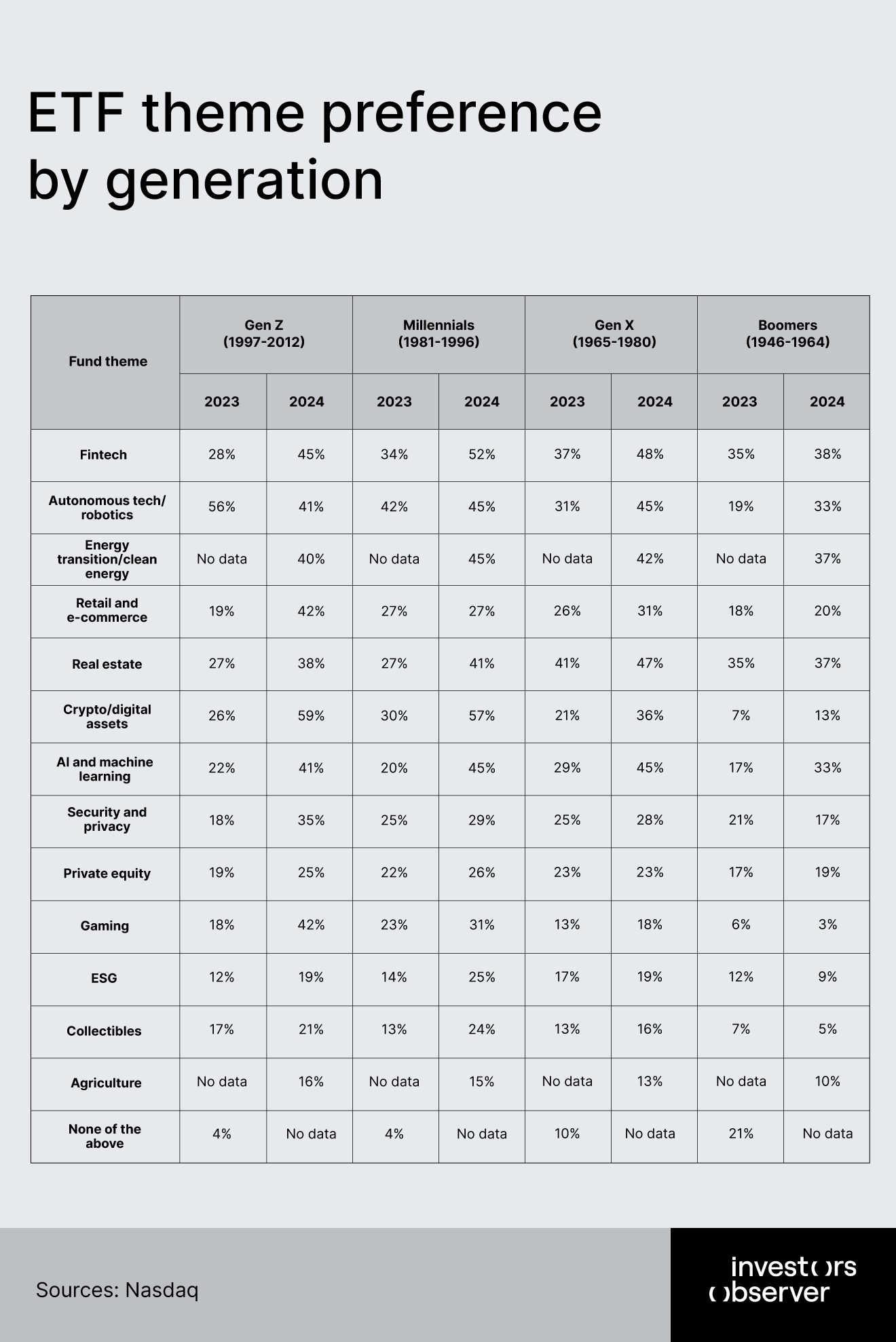

How Americans’ 401(k) theme preferences shifted between 2023 and 2024

From 2023 to 2024, the theme preferences for ETFs in 401(k) accounts shifted sharply among American generations. Younger cohorts, like Gen Z and Millennials, showed the most notable changes toward new and innovative sectors, while Boomers and Gen X kept steadier, more traditional preferences.

Gen Z’s preference for crypto and digital asset ETFs more than doubled, jumping from 26% in 2023 to 59% in 2024. Millennials also made a significant leap in crypto themes, rising from 30% to 57%. Even Gen X increased their interest, moving from 21% to 36%.

Boomers, however, stayed cautious, with only a small climb from 7% to 13%. This illustrates a strong generational divide: young investors are much more interested in high-risk, high-reward, and innovative sectors, while older investors are less likely to prioritize them in their retirement plans.

Fintech ETFs also had robust growth in preference. Gen Z’s interest jumped from 28% in 2023 to 45% in 2024, and Millennials from 34% to 52%. In comparison, Gen X went from 37% to 48%, and Boomers from 35% to just 38%.

AI/Robotics themes became much more favored, as Gen Z grew from 22% (based on combined AI and robotics in 2023) to 41%. Millennials went from 20% to 45%, while Boomers showed an increase from 17% to 33%. These sectors represent quickly evolving innovation and are drawing the bulk of their popularity from younger age groups.

Clean energy and energy transition ETFs became more appealing across all generations. Gen Z's preference grew from 27% to 40%, Millennials from 27% to 45%, Gen X reached 42%, and Boomers rose to 37%. While the increase is seen in all age groups, younger generations again led the upward trend, showing increased environmental interest in retirement investing.

Traditional sectors tell a different story. Boomers favored healthcare and real estate ETFs most strongly in 2024, with 39% and 37% preference, respectively. Gen X also kept healthcare (33%) and real estate (47%) as top choices.

Although younger generations increased their preference for real estate ETFs from 27% in 2023 to 38% for Gen Z and 41% for Millennials in 2024, Boomers maintained a clear lead in both traditional sectors, highlighting their focus on stability and long-standing investment categories.

Consumer, entertainment, and emerging market themes show further generational divide. Gen Z more than doubled their preference for retail and e-commerce (from 19% to 42%) and gaming ETFs (from 18% to 42%). Millennials increased their interest in gaming from 23% to 31%. Boomers, by contrast, actually reduced their gaming ETF preference from 6% to just 3%, showing a widening difference in investment appetites across generations.

Other sectors, such as ESG, collectibles, security and privacy, and agriculture, saw smaller but notable changes. Millennials’ preference for ESG ETFs grew from 14% to 25%. Collectibles also saw mild growth among younger groups, with Gen Z moving from 17% to 21%. Across all generations, sectors like private equity, agriculture, and collectibles remained less popular, signaling these as niche interests.

Overall, the data shows younger Americans are rapidly shifting their ETF preferences toward tech innovation, digital assets, and “future-facing” industries for their 401(k) plans. Older generations remain more committed to sectors with a long track record of stability – such as healthcare and real estate.

This generational gap in theme preferences reflects differences in risk tolerance, market outlook, and the types of changes each age group expects to see in the economy and technology as they build their retirement savings.

Sector-specific fund performance

Analyzing sector-specific performance helps explain why these generational preferences matter. The contrast between winning and losing sectors in both mutual funds and active ETFs reveals how dramatically investment choices can impact retirement outcomes, with some sectors delivering returns that are literally 10 times better than others.

In the mutual fund area, the performance gap between sectors is significant. Technology-focused funds have emerged as clear winners, with funds like BlackRock Technology Opportunities and Fidelity Advisor Technology posting solid 13-14% annual returns while charging reasonable fees under 1%.

But the real story lies in the outliers. Kinetics Market Opportunities, a mutual fund which boldly allocated capital to Bitcoin and energy assets, delivered an astounding 35% return over the past year. Its sister fund, Kinetics Paradigm, wasn't far behind with 27% returns. These funds validated younger investors' appetite for alternative assets, though they came with hefty price tags – expense ratios exceeding 1.2% that would eat into returns over time.

The active ETF space tells an even more dramatic story of sector winners and losers. The YieldMax MSTR Option Income Strategy ETF, riding the cryptocurrency wave through a covered call strategy on MicroStrategy stock, exploded with a 106% return that would have doubled investors' money in just one year.

ARK Innovation ETF, despite experiencing massive outflows of nearly $3 billion as nervous investors fled, rewarded those who stayed with a 46% return by betting on disruptive technologies. These funds captured exactly the sectors where Gen Z and Millennials concentrate their investments – crypto, innovation, and technology.

The traditional "safe" sectors favored by older investors told a different story. Real estate funds, once considered retirement portfolio staples, managed just 4% returns through vehicles like the Vanguard Real Estate Index.

Many Boomers (39%) show a strong interest in healthcare-themed ETFs, compared to just 27% of Gen Z investors. According to data from mid-2025, active healthcare ETFs – especially those focused on biotechnology – delivered strong returns so far this year. For example, the SPDR Biotech ETF gained 16.8%, and the Virtus LifeSci Biotech Clinical Trials ETF returned 16.2%.

Broad healthcare ETFs like the Vanguard Health Care ETF and iShares U.S. Healthcare ETF also performed well, with gains around 11.7% to 11.9%. This solid performance shows that healthcare remains an important and profitable sector for ETF investors, particularly for Boomers who focus more on this theme than younger generations.

The geographic diversification advantage

International exposure emerged as another crucial differentiator as globally diversified funds often outperformed. The Dimensional International Value ETF delivered 22.88% returns by venturing beyond American borders, while Avantis International Small Cap Value posted an impressive 25% gain.

Even emerging market funds, traditionally viewed as risky, rewarded investors with double-digit returns. The Fidelity Total International Index mutual fund gained 13% while charging just 0.6% in fees, proving that geographic diversification doesn't require expensive active management.

Fee structures and their long-term impact

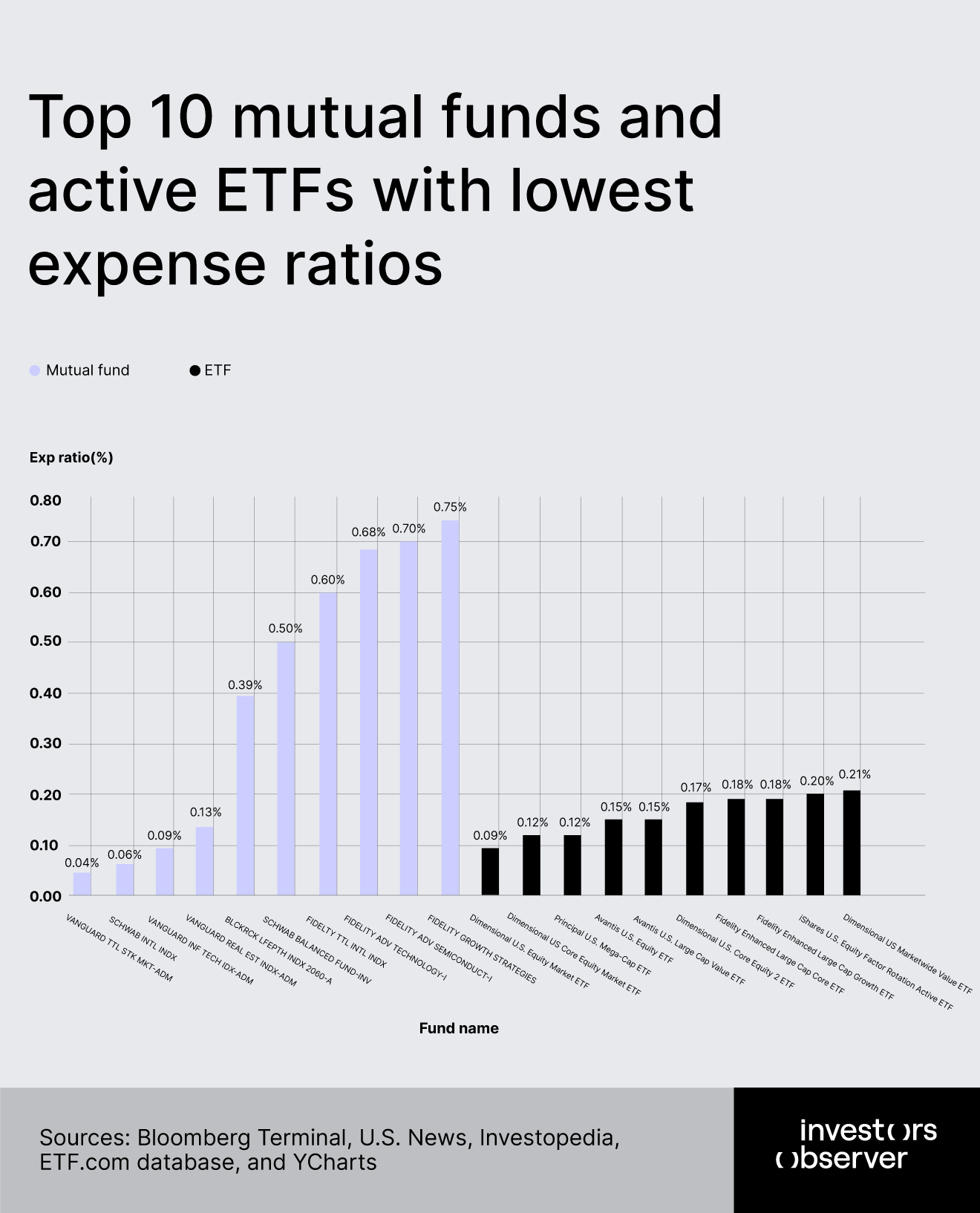

The fee structure across sectors of mutual funds and ETFs reveals another critical pattern. High-performing sectors don't necessarily charge higher fees – in fact, some of the best performers maintain rock-bottom costs.

Vanguard's Information Technology Index delivered 12% returns while charging just 0.09%, essentially giving investors free exposure to the market's hottest sector. Contrast this with Baron Partners Fund, which charged nearly 2% in fees for the privilege of losing 6% year-to-date, largely due to concentrated Tesla exposure that backfired.

The compounding effect of fees over decades means the choice between higher-fee mutual funds and lower-fee ETFs can be a critical determinant of retirement success. First, even a small difference in fees compounds exponentially. For example, an annual fee difference of just 0.5% can reduce portfolio value by over 15-20% after 30 years.

Active mutual funds with higher expense ratios must consistently outperform their benchmarks by more than their fee gap after tax and inflation effects to be worthwhile. This is a challenging benchmark, and many fail to deliver consistent excess returns.

The data shows younger generations are increasingly adopting ETFs, attracted by their low fees and thematic options. Over 75% of Gen Z and Millennials hold ETFs in their retirement accounts, compared to about 60% of Boomers. This ETF tilt may give younger investors a cost advantage over time.

Aggressive mutual funds like those from Kinetics may charge higher fees (up to 1.4%) but offer exposure to niche sectors, increasingly popular between younger generations, and sometimes deliver high short-term returns (e.g., 35% year-over-year in some cases). However, this comes with higher risk, volatility, and no guarantee of long-term outperformance.

The income trap and concentration risk

Income-focused strategies, popular among retirees and near-retirees, present a fascinating paradox. The JPMorgan Equity Premium Income ETF attracted more money than almost any other fund – nearly $7 billion in new investments – despite significantly underperforming the market.

Its 8% return might sound respectable until you realize the S&P 500 returned 12.45% with lower risk. This suggests many investors, particularly older ones, sacrifice substantial growth for the psychological comfort of regular dividend payments.

The concentration risk in sector investing also became apparent. Funds that went all-in on specific themes experienced extreme volatility. The crypto-focused fund that gained 106% also suffered a 61% drawdown from its peak – a reminder that sector bets can cut both ways.

Technology funds loaded with Nvidia and Microsoft generally performed well, but those caught on the wrong side of sector rotations, like Baron Partners with its Tesla concentration, suffered painful losses despite high fees.

Asset size and economy of scale

The data shows a significant difference in fund size and fees, which influences investor choices and portfolio outcomes. For example, the Vanguard Total Stock Market Index Fund manages a massive $1.41 trillion in assets and charges a very low expense ratio of just 0.04%, offering broad market exposure with high operational efficiency.

In contrast, smaller actively managed funds like Kinetics Market Opportunities have only about $295 million in assets and carry higher fees around 1.2%. These smaller funds also tend to adopt more aggressive, concentrated investment strategies, as reflected by Kinetics Market Opportunities’ strong 35% year-over-year return.

While there is no direct link of specific funds to particular generations, generational ETF preferences show that younger investors – Gen Z and Millennials – favor niche, thematic sectors such as fintech, crypto, and gaming, which often align with smaller, specialized funds.

Meanwhile, Boomers tend to prefer larger, low-cost funds with broader diversification, consistent with their higher allocation to sectors like healthcare. This suggests younger investors may be more willing to accept higher fees in pursuit of growth through specialized, smaller funds, whereas older investors prioritize cost-efficiency and stability by choosing large, broad-market funds.

Younger investors are gaining an edge – but no one has won yet

Older investors prioritize established funds, diversification, and low fees, whereas younger generations drive the adoption of ETFs focused on high-growth, tech-driven, and alternative sectors – even at the cost of higher fees.

This generational divide reflects broader differences in risk appetite and financial goals, with Millennials and Gen Z seeking outperformance through innovation, and Boomers and Gen X focusing on consistency, cost efficiency, and risk mitigation.

The lesson for retirement savers is clear: sector selection can make or break your retirement timeline. A portfolio tilted toward technology, innovation, and global growth might experience more volatility, but the long-term rewards appear to justify the risk.

Meanwhile, hiding in "safe" sectors like utilities, real estate, and healthcare while paying high mutual fund fees is proving to be anything but safe for retirement security. The generational divide in investment preferences is translating into dramatically different financial outcomes that could define retirement lifestyles for decades to come.

The data suggests that Gen Z and Millennials are gaining several advantages in their retirement investing:

- Lower average fees through greater ETF adoption and preference for low-cost providers

- Stronger sector diversification with meaningful allocations to emerging technologies

- Greater international exposure providing both diversification and access to global growth

- More rapid adaptation to changing market conditions as evidenced by year-over-year allocation shifts

- Willingness to accept short-term volatility for potential long-term outperformance

However, these advantages come with counterbalancing risks, including higher volatility, greater concentration in certain sectors, and potential market timing challenges. None of the generations is "winning" at retirement investing, but rather take different approaches with distinct risk-reward profiles.

What's clear is that retirement investing is changing quickly, with younger generations pioneering approaches that leverage new investment vehicles and emerging economic sectors.

The true test will come through full market cycles, where the ability to maintain investment discipline during downturns will prove as important as allocation strategy during bull markets. The most important factor for long-term success remains consistent contributions over time, regardless of which generation's strategy proves optimal in any given market environment.

Methodology

Research objective

This research analyzes the recent performance, costs, and allocation trends of mutual funds and ETFs commonly found in U.S. 401(k) retirement plans. The goal was to identify key patterns in fund returns, expense structures, and generational investment preferences using both quantitative and qualitative data.

Data collection and sources

Mutual funds: YTD performance % (as of 07/15), YoY performance YoY % (as of 07/15), management fees, top 3 positions, and geo allocation were gathered for more 19 leading mutual funds from major asset managers (Fidelity, Vanguard, Kinetics, etc.). The sources are U.S. News, Investopedia, and Bloomberg Terminal.

ETFs: data on the top 50 actively managed equity ETFs (by assets under management) was collected. This included Asset under management (billions $), YTD performance % (as of 06/16), YoY performance YoY % (as of 06/16), Expense ratio, YTD performance vs benchmark (SPY), YoY performance vs benchmark (SPY), SPY US YTD performance %, SPY US YoY performance %, and Net inflows/outflows YoY (billions $). The data came from the ETF.com database, Bloomberg Terminal, and YCharts.

Investment trends: generational allocation patterns and ETF adoption rates were taken from Nasdaq’s 2024-2025 ETF Retail Survey reports. The dataset includes ETFs allocation by class (2024) – fund name, % held by Gen Z (1997-2012), Millennials (1981-1996) , Gen X (1965-1980), and Boomers (1946-1964) – and ETFs allocation by class (2023) – fund name, % held by Gen Z (1997-2012), Millennials (1981-1996), Gen X (1965-1980), and Boomers (1946-1964).

Analytical approach

Quantitative analysis:

- Calculated year-to-date and year-over-year returns for each mutual fund/ETF.

- Calculated fund averages for key performance indicators (returns, expense ratio, management fee) across the sample.

- Compared performance against relevant benchmarks (e.g., S&P 500 via SPY ETF).

- Ranked funds by performance and expense metrics to identify low-cost leaders, top performers, and high-fee funds.

- Analyzed investor flows to determine shifts in fund popularity.

Rationale and validation

Preference was given to using data from authoritative industry sources (Bloomberg, Nasdaq, ETF.com), with cross-verification between public reporting and proprietary databases to ensure accuracy.

Including both performance and cost metrics enables a comprehensive assessment of the trade-offs between high-fee, high-growth strategies and low-cost, index-oriented investing.

Incorporating survey data provides insight into generational differences and real-world investor behavior that may not be reflected solely in fund statistics.

Limitations

- Some funds, such as recently launched ETFs, may have limited historical data.

- Results may not capture intra-year volatility or changes in fund strategy not reflected in latest holdings data.

- Peer-group and benchmark selection may influence the relative performance findings. Only the S&P 500 is used as a common benchmark for comparison.

Ethical considerations

All data sources utilized are publicly available or widely recognized industry standards. No confidential or proprietary client information was used.

Results are presented objectively, with emphasis on transparency regarding costs, risks, and allocation strategies.

Your email address will not be published. Required fields are markedmarked