The 2025 “One Big Beautiful Bill Act,” signed under President Trump, has radically changed federal student loan options for US college-bound students, capping federal borrowing, raising the cost burden, and rolling back major Biden-era aid like widespread debt forgiveness.

As parents and students now scramble for reliable advice, AI chatbots like ChatGPT, Perplexity, and Grok are likely to become the go-to guides for financial advice on college funding. Last year’s data shows that 47% of Americans have or are considering using generative AI-powered tools to help with managing their personal finances.

InvestorObserver’s researchers have analyzed how these chatbots, or LLMs, respond to questions representative of families affected by the new law, relying exclusively on a qualitative dataset of actual LLM-generated answers.

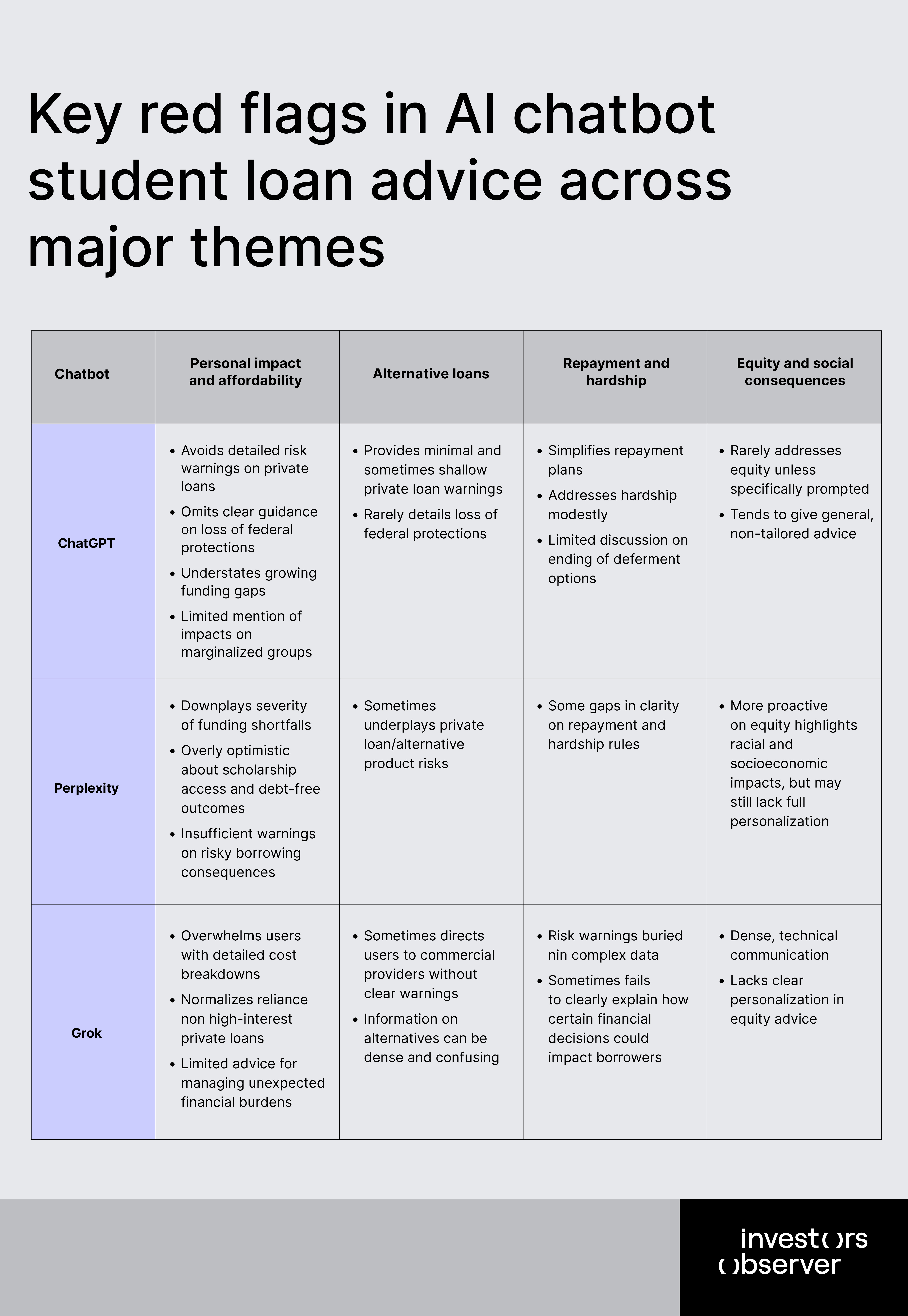

The researchers systematically coded these responses for themes such as affordability, risk, equity, loan repayment, and alternative funding options. They analyzed diverse response styles, levels of detail, handling of risk, and equity awareness – issues critical for families navigating the new higher-education financing conditions.

The aim: to reveal not only what these bots recommend, but how their strengths, weaknesses, and possible biases might shape real financial decisions by regular Americans.

The findings highlight that LLM-generated answers contain several red flags – areas where following chatbot advice could lead to long-term financial loss or increased risk. They hint at nothing less than the future of American social mobility – and who gets left behind.

Key findings

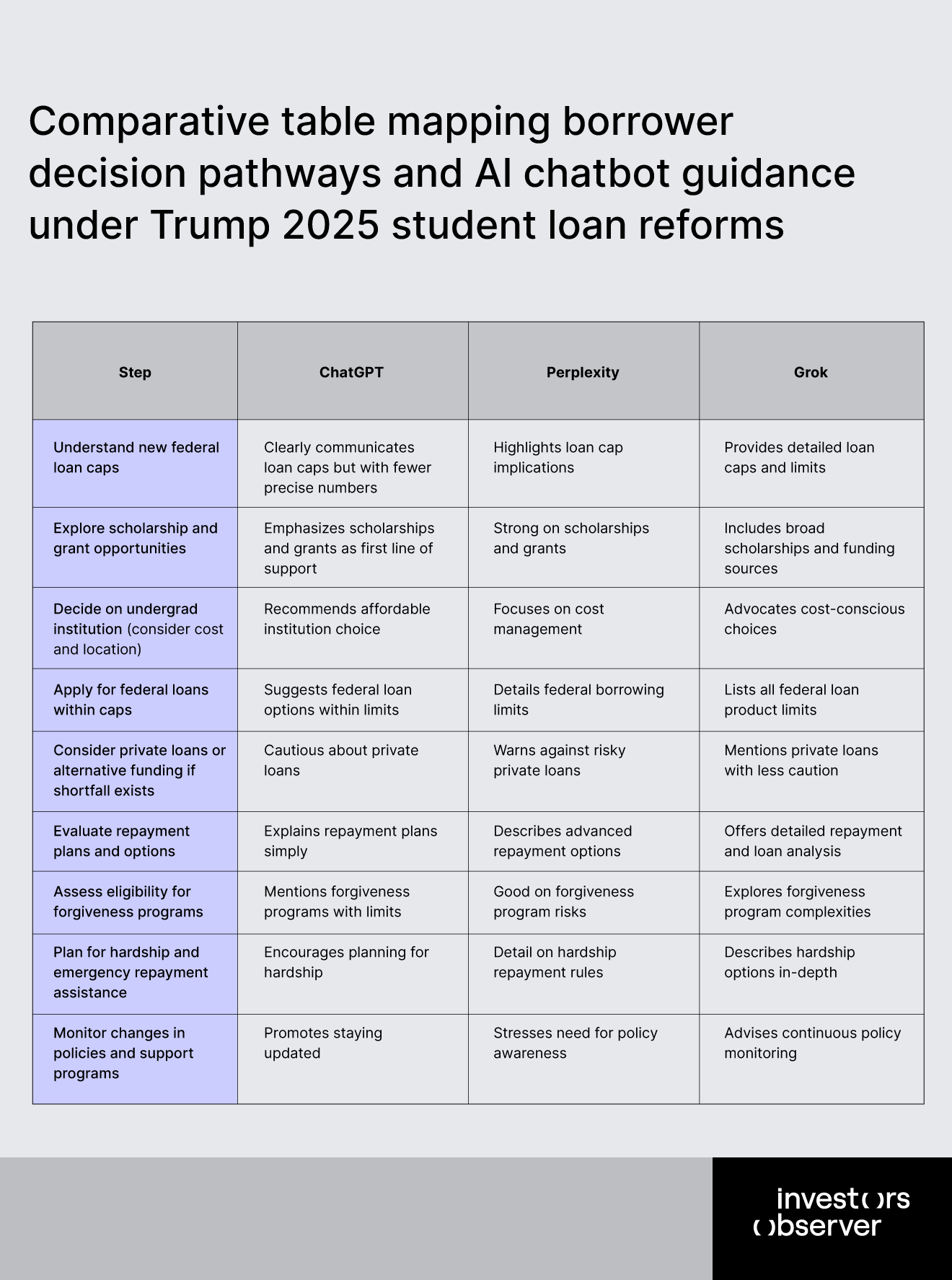

- All chatbots mention strict new caps on federal student loans ($31,000–$57,500 lifetime, depending on context; $5,500–$7,500/year), but Grok gives the most precise numerical analysis.

- ChatGPT provides clear, accessible advice focusing on affordability but tends to understate risks of private loans and the loss of federal protections.

- Perplexity emphasizes caution and strategic planning, highlighting scholarships and 529 plans, yet can give overly optimistic views on graduating debt-free.

- Private loans and alternative funding options are consistently presented as last resorts but warnings about their risks are often mild or incomplete.

- Grok offers the most detailed data and comparisons but can overwhelm users and sometimes downplays the dangers of high-interest private loans.

- Equity issues are better addressed by Perplexity and Grok, whereas ChatGPT tends to be neutral unless prompted.

- The complexity and limits of chatbot advice emphasize the importance of cautious interpretation and cross-verification to avoid costly financial mistakes.

Personal impact and affordability: who bears the new burden?

The category of personal impact and affordability addresses how well the chatbots help users understand the financial burden imposed by the Trump administration’s “Big Beautiful Bill” on student borrowing and overall college funding.

ChatGPT

ChatGPT delivers accessible and user-friendly advice but contains notable red flags due to its optimistic framing around federal loan options and undercommunication of risks.

For example, in the scenario of a working parent from Ohio struggling to afford tuition, ChatGPT recommends “maximizing federal student loans (including capped Parent PLUS loans)” and “comparing private student loans with strong co-signers for better rates.”

While practical, this advice does not sufficiently warn about the limited federal caps or the high-interest risks and stricter repayment terms associated with private loans. This omission could leave families underprepared for large funding gaps once federal loan limits are reached.

Moreover, ChatGPT’s reluctance to detail the phasing out of crucial safeguards, like income-driven repayment plans or unemployment deferment, means that borrowers may overestimate the protections available to them.

For example, it advises to “avoid dipping into retirement savings unless it’s a last resort,” but gives less urgency around the risks of accumulating private debt or diminished forgiveness options.

Without explicit warnings, families might overborrow under the false assumption that federal protections will ease repayment challenges. Overall, ChatGPT’s advice risks fostering a false sense of security that could lead to unmanageable debt over time.

Perplexity

Perplexity’s guidance emphasizes caution and conservative borrowing, encouraging minimal reliance on debt and comprehensive use of savings and scholarships.

However, its reassurance that “graduating debt-free remains possible with careful planning” may be overly optimistic and potentially misleading for families facing significant unmet costs under the new caps.

In the response to the first-generation student query, Perplexity notes the availability of up to "$57,500 in federal loans for undergrad" and stresses scholarships and part-time work. Yet, it does not quantify the substantial shortfall between these loan limits and actual tuition plus living expenses, which can routinely rise above $60,000 annually at many public universities.

This absence of quantification risks underinforming families about the scale of funding gaps, possibly encouraging delayed or insufficient financial contingency planning.

Also, Perplexity advises to “avoid private loans if possible” but does not strongly highlight that without federal forgiveness or forbearance options – now largely phased out – private borrowing might become unavoidable, often on harsher terms.

Coupled with limited focus on the elimination of income-driven repayment programs, this could leave users unprepared for the long-term liabilities and higher interest accrual associated with private debt.

Grok

Grok offers the most detailed financial breakdowns, including explicit loan limits, interest rates, and repayment strategies.

This granular data can benefit users seeking deeper insight but also introduces risks, particularly for less financially sophisticated borrowers who may be overwhelmed or misinterpret the information.

For example, Grok explicitly states in the Illinois family case that Parent PLUS loans carry a “9% interest” rate and reach a maximum of $65,000, and calls out private loan rates “up to 16%.”

While informative, presenting these figures without equally strong cautionary language about the strict repayment terms and absence of income-driven repayment post-July 2026 might inadvertently normalize high-cost borrowing.

Highlighting multiple private scholarship search companies (such as Fastweb) without clarifying the variability in legitimacy and quality may mislead families into relying on third-party services that could incur unexpected fees or provide incomplete aid leads.

Furthermore, Grok’s dense presentation style often buries critical warnings – such as the phasing out of federal loan safety nets – which could be overlooked amidst detailed cost comparisons and repayment options.

This information overload risks leaving users ill-equipped to fully grasp the seriousness of the new loan restrictions and repayment challenges, potentially exposing families to subtle but significant long-term financial loss.

Repayment, forgiveness, and hardship: the outflow narrows

All three chatbots sound reasonable but exhibit gaps – either in communication clarity, quantified risk framing, or presentation – that could expose users to severe repayment hardships and long-term financial loss if users take the advice at face value without further professional counsel or official guidance.

ChatGPT

ChatGPT warns borrowers graduating after July 2027 that income-driven repayment plans like SAVE, PAYE, IBR, and ICR are eliminated, meaning “new borrowers will face higher monthly payments, longer repayment terms, and fewer hardship protections” and “options like deferment or forbearance will be harder to access.”

However, it gives a broad overview without quantifying just how much payments might increase or detailing the elimination of $0 monthly payment options, which could lead users to underestimate future financial burdens.

Regarding forgiveness, ChatGPT cautions that “forgiveness is no longer guaranteed for future borrowers” and that only limited options like Public Service Loan Forgiveness (PSLF) remain. But it does not emphasize that most plans borrowers might have counted on are entirely phased out, which could leave many unprepared for decades of extra payments.

On hardship and unemployment, ChatGPT is clear that “traditional deferment for unemployment or economic hardship will no longer be available,” and that forbearance is “capped at 9 months every 2 years” with accruing interest.

It warns that “if your income drops, you’ll still owe something monthly, and you’ll have far less flexibility than borrowers did in the past.” Yet, its advice remains somewhat general and may not convey the full urgency that sudden financial shocks will almost certainly increase the risk of default or ballooning loan balances.

Finally, for Parent PLUS loans, ChatGPT states “Parent PLUS loans no longer qualify for income-driven repayment, and monthly payments will be fixed, with limited hardship options.” This warning about payment inflexibility and hardship protections is critical but not deeply explored, potentially leaving parents vulnerable to unexpected payment shocks.

When asked about repayment, forgiveness and hardship, ChatGPT’s red flags revolve around the risk that broad or qualitative warnings about harsher repayment conditions and fading forgiveness do not convey the gravity or specifics necessary for borrowers to fully grasp their new financial exposure.

Perplexity

Perplexity gives clearer, more quantified warnings that repayment conditions post-July 2027 will be harsher. It highlights that monthly payments will be “significantly higher – potentially $50-$300 more per month for moderate incomes,” and crucially “there will be no $0 payments, even for very low incomes.” This specificity is a valuable red flag because it underlines how borrowers who face low income or unemployment still must make minimum payments, increasing default risk.

On forgiveness, Perplexity points out that “programs like PSLF and PAYE no longer apply to new loans after July 1, 2026,” and warns borrowers “should prepare for higher payments and stricter repayment terms.” It stresses the disappearing availability of economic hardship deferments for loans after July 1, 2027, a critical factor in managing financial shocks.

Regarding hardship and unemployment, Perplexity explicitly states that “you cannot pause your student loan payments simply because you lose your job or face financial difficulty.” It notes that “interest will continue to accrue during forbearance, increasing your total debt,” and that “missing payments may lead to default more quickly.” By combining these facts with a clear caution to “plan ahead” and “budget carefully,” Perplexity communicates that borrowers face a more unforgiving repayment environment.

In the context of Parent PLUS loans, Perplexity emphasizes that borrowing is capped and advises that private loans should be “a last resort due to higher costs,” subtly warning about the risks of expensive, inflexible debt.

Overall, Perplexity consistently highlights the increasing costs and risks in measurable terms but could further amplify warnings about the new repayment inflexibility’s long-term consequences.

Grok

Grok provides the most detailed, numeric breakdowns of repayment scenarios, which can be both beneficial and risky. It explains the two main repayment routes after July 2027: the Standard Plan ($370/month for $31,000 at 6.5% over 10 years) and the Repayment Assistance Plan (RAP) that ranges from 1-10% of income but can result in payments like ~$667/month at an $80,000 salary, representing an ~85% increase over former plans like SAVE or PAYE. While this aids users in understanding payment hikes, the wealth of figures may overwhelm or confuse borrowers unfamiliar with these terms.

Regarding forgiveness, Grok notes RAP includes “30-year forgiveness,” but contrasts this with eliminated plans like SAVE and PAYE that required shorter repayment periods, meaning many will pay longer and more. It mentions Public Service Loan Forgiveness (PSLF) as a possibility but does not clearly emphasize how restrictive or competitive PSLF has become.

On hardship and unemployment deferment, Grok discusses that deferment is “limited to 12 months” and that interest accrual can add ~$2,000/year to a $31,000 loan. While it accurately states the repayment minimums and accrued costs, this detailed presentation might bury the critical warning that borrowers will have “limited deferment, rising RAP payments,” and could be at risk of default without clear, upfront emphasis.

For Parent PLUS loans, Grok outlines caps and highlights that these loans “lack income-driven repayment and hardship deferment, risking default.” It also stresses the high repayment amount (e.g., ~$780/month in Arizona) and the insufficiency of the caps to cover high-cost universities, signaling a substantial risk if families rely too heavily on these loans.

Grok provides very detailed and data-rich information about loan repayment plans, interest rates, and forgiveness options. However, this information is often presented in a very dense, technical way with many numbers and comparisons.

For users who are less familiar with financial concepts or who find extensive numerical data overwhelming, this can make it difficult to understand the most important warnings. Consequently, they might miss key points such as the reduced flexibility in repayment options, the fact that interest continues to accrue during forbearance or deferment, and the elimination or reduction of many forgiveness programs.

Without clearly highlighting these risks, borrowers may misunderstand or underestimate the challenges they face, which increases the chance of costly long-term financial problems.

Navigating alternatives: private loans, scholarships, ISAs

All three chatbots identify federal loan caps that limit total borrowing and recognize that private loans or alternative financing may be necessary. However, their red flags primarily revolve around how fully and clearly they communicate the risks of these alternative paths.

ChatGPT

ChatGPT consistently recommends private loans as a fallback option when federal loans and scholarships do not cover costs, but it presents this advice with relatively limited warnings about the full extent of risks associated with private borrowing.

For example, ChatGPT acknowledges that private loans “come with higher interest, no income-driven repayment, and fewer protections” and advises to “borrow carefully,” but does not emphasize how steep those interest rates can be, nor does it stress the rigid repayment schedules or lack of forgiveness options that dramatically increase long-term cost and risk.

This softer tone around private loans could encourage overreliance on costly credit, especially for students attracted to private universities or programs where federal loans fall far short.

While ChatGPT highlights scholarships and grants as the best option because they “don’t need repayment,” it oversimplifies the competitiveness and limited coverage of such aid. It also briefly mentions income-share agreements, or ISAs, warning they “may cost more long-term and are less regulated,” but does not detail the complex terms or possible hidden fees that burden students financially over time.

For example, in the Denver senior’s question about private vs. public colleges, ChatGPT mentions that private school costs “likely need private loans” but doesn’t sufficiently emphasise the severe borrowing gap or quantify possible debt levels, which could lead a student to underestimate the financial impact of choosing a costly private institution.

Perplexity

Perplexity provides more detailed context about loan limits, typical cost gaps, and the strategic use of aid and borrowing. It highlights federal loan caps clearly (e.g., $31,000–$57,500 total for undergrad loans) and warns that private loans “have higher risks” and “fewer protections,” which is crucial for realistic planning.

It advises explicitly to use net price calculators and to estimate borrowing needs carefully based on expected post-graduation salaries. This concrete cost-awareness helps reduce the chance of surprise financial shortfalls.

However, Perplexity’s discussion of alternative funding options like scholarships, private loans, and ISAs contains implicit red flags. While it correctly notes that scholarships and grants are best because “they don’t require repayment,” it does not sufficiently highlight how highly competitive or limited these are, nor the work involved in obtaining them.

On private loans, Perplexity warns they “often have higher interest and fewer protections,” but like ChatGPT, it does not emphasize how inflexible or dangerous repayment can be in practice if income-driven plans and forgiveness disappear.

Regarding ISAs, Perplexity states their terms are variable and that “total costs may be unclear,” but stops short of alerting users to often costly payment caps or contracts that can extend financial burden well after typical loan repayments. It also omits mention of alternative risks like potential predatory practices or regulatory gaps in ISAs.

For example, Perplexity’s advice to “minimize loans and consider starting at a public college if private aid isn’t enough” is cautious, but if users do not heed this fully, they may still fall into steep private debt without fully appreciating the consequences.

Grok

Grok offers the most comprehensive, data-rich, and numeric detail on financing alternatives, with explicit figures on loan caps, private loan interest rates (up to ~17.95%), and ISA repayment rates (2%–10% income for 48 months). While this granular data can empower financially savvy users, it poses important red flags for broader audiences.

First, Grok’s frequent citing of very high private loan interest rates could alarm some users, but without clarifying that actual rates vary and can be lower with good credit, it may discourage prudent borrowing or cause panic.

Conversely, discussing ISAs with vague terms like “complex terms” and “high total costs” without concrete examples risks either disregarding or overwhelming users with ambiguity rather than clear warnings. The detailed presentation may also bury crucial cautions within dense information, risking that users overlook how seriously these financing tools can inflate long-term debt burdens.

Additionally, Grok’s approach of including third-party scholarship search engines and the suggestion to “compare private loan lenders for fixed rates” could inadvertently steer students toward vendors or products with variable quality or hidden costs. This raises a risk that families might engage with unfamiliar, less-regulated financial products without fully understanding consequences.

For instance, in its response to the Denver student, Grok clearly states private loans could cause ~$200,000 debt at private universities, versus ~$96,000 at public colleges, highlighting a huge financial gap. Yet, the sheer volume of figures and percentages might obscure the critical takeaway for some readers: choosing the expensive private route without sufficient aid likely leads to very high, risky debt.

Equity, access, and the American Dream: who gets left out?

These chatbots – now widely used by students and families for financial planning – may inadvertently worsen the very inequities they’re meant to reduce. By either glossing over, downplaying, or burying warnings about the diminished reach of federal aid, dangers of private debt, and the sheer improbability of winning sufficient scholarships, these platforms risk steering marginalized students toward unmanageable financial risk.

ChatGPT

ChatGPT frequently opens its responses with immediate, unequivocal “yes” or “no” statements on the hardships new loan caps impose, especially for first-generation, low-income, or underrepresented students. While this directness is clear, the significant red flag lies in how quickly the analysis shifts toward individualized “smart planning” advice – like choosing “affordable undergrad paths,” “maximizing grants,” and leveraging “service-based programs” – without fully confronting the systemic barriers now magnified by federal policy.

It consistently refers students to private loans as a gap-filler, telling users to “compare terms carefully” and “borrow only what you truly need.” However, it underplays how the shift to private debt can trap vulnerable students in high-interest, inflexible repayment with no federal safety nets, limited hardship protections, and no guarantee of repayment flexibility if their post-degree income falls short.

For example, a first-gen medical school aspirant from rural Alabama is told to “plan ahead” and “use every available scholarship or grant,” but ChatGPT doesn’t highlight how few such scholarships exist compared to need, nor does it name-check persistent disparities faced by marginalized groups.

In addressing the “American Dream” for a working-class Latino student in Texas, ChatGPT mentions “breaking the cycle” through “smart planning,” but it largely sidesteps the broader context of how reduced federal support widens the equity gap itself, rather than merely increasing individual responsibility. The collective effect is advice that, while optimistic, risks leaving at-risk groups overexposed to private loan debt and unexpectedly limited by new policy barriers, making generational mobility even harder to achieve.

Perplexity

Perplexity stands out for more explicitly linking Trump’s “Big Beautiful Bill” to challenges facing first-generation, low-income, and underrepresented students, repeatedly acknowledging the “significant funding gaps” and risk of being forced into “risky private loans” due to tighter caps.

Still, the primary red flag is how the platform frames the pursuit of scholarships, grants, and state aid as a broadly achievable solution, stating – with perhaps misleading reassurance – that “with careful planning and resourcefulness, you can still pursue medical school despite these new limits.” This positivity downplays the brutal competitiveness of coveted scholarships and rarely addresses the well-documented limitations on transferability and adequacy of external aid, especially for advanced or professional degrees.

In several answers, Perplexity recommends maximizing “grants and scholarships,” starting at “community college,” and “budgeting to stay within federal loan limits” – steps that are prudent but, in practice, insufficient for many students who face tuition and living costs far outstripping all available resources.

It warns about the higher risks of private loans and the loss of protections, but sometimes frames these debts as manageable with “responsible borrowing” or community support programs without scrutinizing the structural disadvantages certain groups face. The implication is that institutional obstacles can be overcome by informed choices alone, which could lead vulnerable students to underestimate their risk of dropping out, accumulating unsustainable debt, or missing key opportunities for upward mobility.

Grok

Grok delivers the most granular detail – loan caps, tuition price tags, scholarship amounts – but introduces a different kind of equity risk, one especially newsworthy in the context of widening divides. The chatbot’s information-rich, comparative style can overwhelm users with figures (“~$257,500 lifetime” cap, “private loans >6.53%”) without consistently emphasizing how these numbers translate to real-world hardship.

By focusing on numerical planning and suggesting that students take “gap years to save $10,000–$20,000,” pursue “fixed-rate private loans,” or seek “majors with strong ROI,” Grok risks promoting survival strategies that in reality may be out of reach for those with the least support – while possibly over-normalizing unaffordable private borrowing without significant warnings about lack of federal protections.

Importantly, while Grok recommends high-value national scholarships (e.g., Horatio Alger, Gates Millennium) and specific transfer pathways, these are intensely selective and not a systemic answer to broad access challenges. Grok’s approach also risks steering students toward external scholarship search platforms – some commercial or of “variable quality” – with little attention to scam risks or information fatigue.

By failing to emphasize deeply entrenched educational and financial barriers, Grok’s data dumps may leave students from underrepresented backgrounds with too many numbers and not enough actionable guidance, exacerbating inequities in college attainment and lifelong earnings.

Should students rely on AI for life-changing financial decisions?

None of the chatbot answers show hallucinations or nonsensical statements. The responses fairly accurately reflect current student loan policies such as loan caps, elimination of forgiveness programs, and restrictions on deferment. While some answers may oversimplify or omit nuanced details, they do not contain fabricated facts or irrelevant content.

While these AI advisors offer convenience, speed, and sometimes remarkable breadth, their guidance is far from foolproof – especially when stakes involve college affordability, professional mobility, and lifetime debt burdens.

Our review highlights that while each LLM brings certain strengths, all exhibit red flags such as incomplete risk disclosure, misplaced optimism, or communication that is either too vague or too dense for effective decision-making.

These limitations mean AI-generated answers, if incorrectly trusted or used in isolation, can expose real people to long-term financial harm, particularly as student loan programs become more complex and less protective.

When AI talks money, don’t let it have the last word

For families navigating college costs, chatbot guidance can offer a helpful orientation, but it’s no substitute for a carefully charted financial plan. Critical next steps include:

1. Treat LLM advice as a starting point, not a final decision

LLMs are helpful for quickly outlining options, summarizing policies, or identifying key questions. However, their answers may omit nuance, fail to reflect the latest regulatory changes, or downplay unique risks tied to a borrower’s background or field of study. Always verify any actionable recommendation with an official resource, such as the U.S. Department of Education’s StudentAid.gov, or a qualified human advisor.

2. Scrutinize risk and limitation warnings closely

Many LLM answers recount loan caps, interest rates, and broad risk categories (“private loans have fewer protections”), but they often lack clear warnings about the full consequences of decisions such as exhausting federal aid or taking on high-interest private debt. Seek out additional information if the chatbot does not quantify likely repayment shortfalls, the competitiveness of scholarships, or the real impact of losing income-driven or hardship protections.

3. Watch for overly simple or overly technical guidance

If advice is framed as “debt-free is possible with careful planning” or “just compare private lenders,” beware – you may be missing vital context about the real obstacles to finding aid or the dangers of unfavorable loan terms. On the other hand, if the answer is overloaded with numbers and narrow scenarios, clarify the key takeaways with a counselor or trusted mentor.

4. Use multiple sources and cross-check facts

Never rely exclusively on any LLM’s summary of critical, high-stakes issues. Instead, treat the response as one input among many. Compare AI advice with that from financial aid offices, federal agencies, and, if applicable, local nonprofits focused on your demographic or field. For technical financial matters, consult with certified professionals or official agencies.

5. Prioritize transparency and self-education

Ask LLMs to clarify the source of their information, whether a policy is provisional, and what risks they are not highlighting. Take responsibility for independently researching any major financial commitments (e.g., terms of private loan contracts, fluctuating interest rates, restrictions on forgiveness).

6. Stay alert to equity and access factors

If you are a first-generation, low-income, or underrepresented student, recognize that LLMs may not automatically account for your unique obstacles or the full impact of policy changes. Seek out tailored support through school-based programs, specialized scholarships, and trusted organizations familiar with your background.

7. Don’t hesitate to pause and seek human help

If the guidance leaves you unsure, overwhelmed, or presented with conflicting options, pause before making any commitments. Financial errors in higher education can have lifelong effects. Schedule a meeting with a school financial aid office or a nonprofit counselor before signing any loan agreement or selecting a school based on AI-generated estimates.

This research shows that LLMs are valuable tools for orientation, brainstorming, and scenario planning, but are only as safe as the user’s willingness to question, supplement, and verify the advice they offer. The best defense against costly errors remains a layered approach: combine AI insights with rigorous fact-checking, personalize with professional guidance, and maintain a healthy skepticism toward any answer that seems either too easy or too complex.

Methodology

We collected 21 scenario-based prompts, each simulating a key real-world financial dilemma or question about college funding, loan repayment, or equity impact under the Trump administration’s 2025 student loan reform. Each prompt was run through three leading LLMs – ChatGPT, Perplexity, and Grok – and all outputs were systematically evaluated on consistency, clarity, risk-awareness, actionable accuracy, and sensitivity to context (e.g., background, state, college type).

The prompts were divided into the following key themes:

- Personal impact and affordability

- Paths alternative to federal loans

- Repayment, forgiveness and hardship

- Equity, access and social consequences

For every answer, we analyzed:

- Numerical accuracy (did figures match government/expert sources?)

- Relevance and completeness (did the advice address the core of the prompt?)

- Depth and clarity (was the response actionable vs. overwhelming?)

- Risk/limitation disclosure (were caveats, risks, and context flagged?)

- Sensitivity to individual and social context (class, race, first-generation status)

Limitations:

- No quantitative "accuracy" percentage: as prompts and assessments are qualitative, accuracy is measured by expert comparison, not by hard numbers.

- No access to user financial data – personalization is limited by the hypothetical nature of prompts.

- Scope: focused exclusively on the Trump administration’s 2025 policy changes, future reforms may alter conclusions.

- Platform variance: changing AI model updates may yield different responses over time.

Your email address will not be published. Required fields are markedmarked