The U.S. stock market staged a euphoric relief rally late Wednesday after President Trump announced a 90-day pause on select tariffs, fueling optimism that trade talks may be back on the table.

Following a four-day bloodbath on Wall Street, the Dow Jones Industrial Average surged 2,962.86 points, or 7.8%, to close at 40,608.45—its biggest rally in five years.

The large-cap S&P 500 Index jumped 9.5% to 5,456.90, while the tech-heavy Nasdaq soared 12.2% to 17,124.97, marking its biggest single-day gain since 2001.

The rally came in the wake of a Truth Social post from Trump claim that “more than 75 countries have called to negotiate a solution” to the ongoing trade war.

“I have authorized a 90-day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately,” Trump wrote.

The timing was no coincidence. Trump had previously vowed to unleash sweeping tariffs starting April 9. Analysts have likened his trade tactics to a high-stakes game of chicken, waiting to see who flinches first.

But lost in the market’s rally was a major escalation.

Trump hiked tariffs on Chinese imports to a staggering 125% on Wednesday — up from 104% the day before. China remains, in Trump’s words, the “biggest abuser” in global trade.

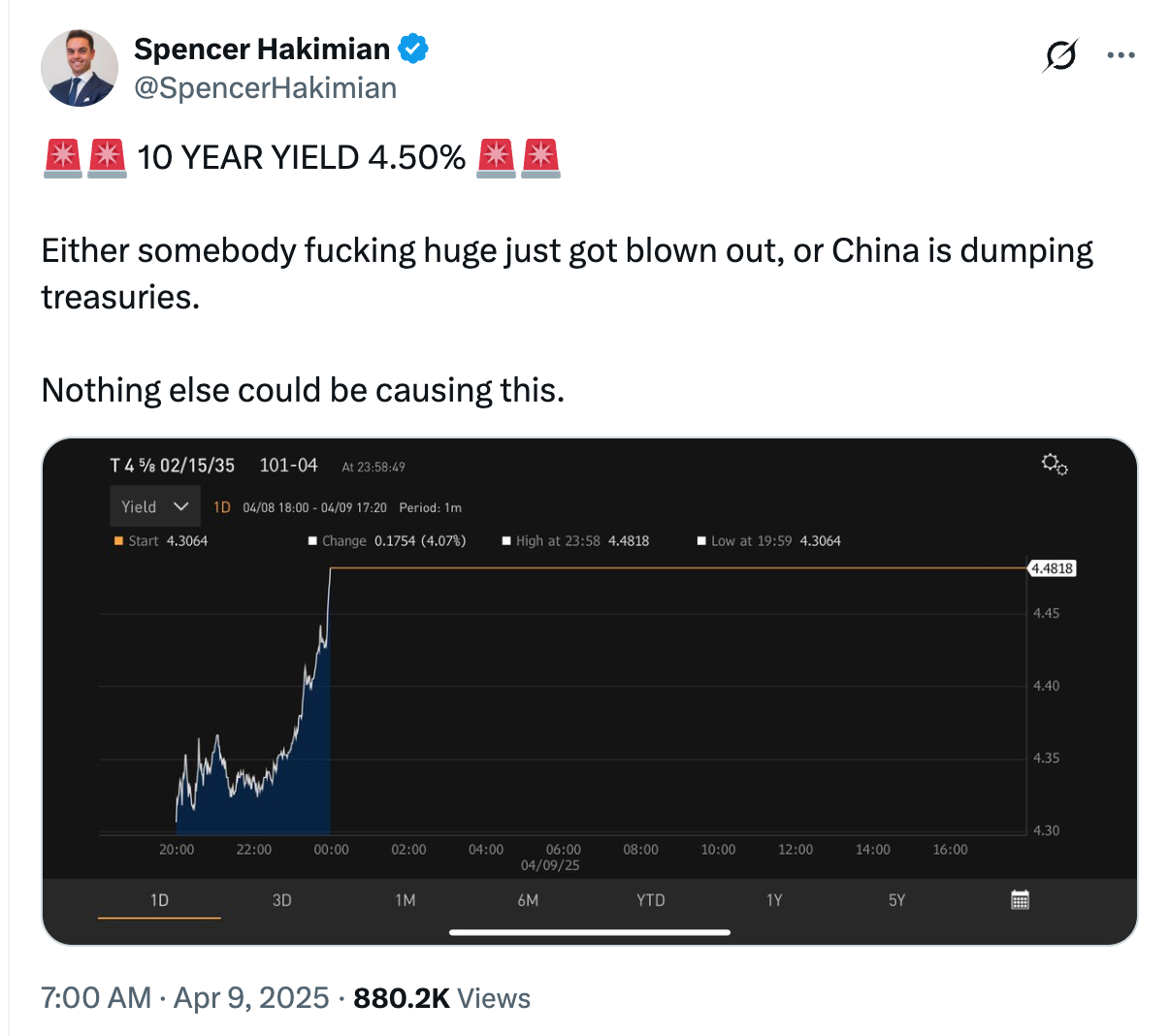

Is China dumping Treasuries?

Trump’s tariff pause may have been a move to calm jittery markets that, in his words, “were getting a little bit yippy, a little bit afraid.”

“Nothing is over yet,” he added, vowing to keep pressure on China until a deal is reached.

For investors, the trade war escalation has left few places to hide. “Asset selloffs are defying historical correlations,” said analyst Adam Kobeissi.

It’s rare to see all major asset classes fall at once, from stocks to bonds to commodities, Kobeissi noted.

Of particular concern is the bond market, where a broad selloff sent the 10-year Treasury yield soaring to 4.5%. That’s a sharp turnaround from earlier in the week, when yields had dipped below 4% before suddenly reversing on Tuesday.

Spencer Hakimian, founder of Tolou Capital Management, speculated the spike might be linked to China offloading U.S. Treasuries.

SoFi CEO Anthony Noto echoed that view, saying China could be dumping U.S. bonds “as a countermeasure to tariffs.”

As of January, China held roughly $760 billion in U.S. Treasury debt — second only to Japan — according to Treasury Department data. Beijing’s holdings have remained relatively stable over the past year.

Your email address will not be published. Required fields are markedmarked