GDP may be rising, but America’s middle class is falling behind… and a growing number of economists and political voices are sounding the alarm over President Trump’s latest tax proposal.

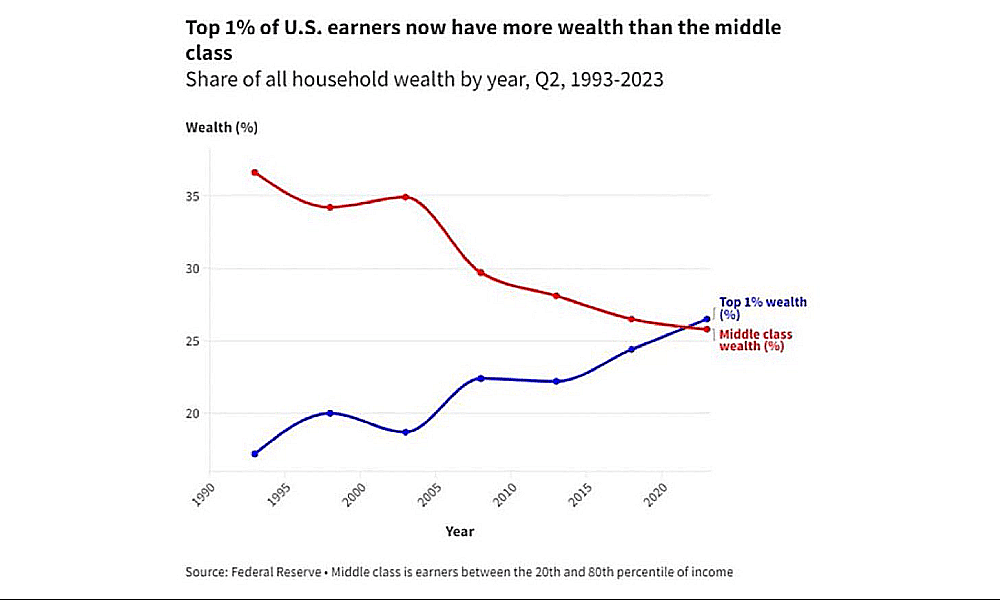

Since the pandemic, the richest 1% of Americans have officially surpassed the entire middle class in terms of wealth, marking a historic inequality tipping point.

The Top 1% of U.S. earners now have more wealth than the entire middle class pic.twitter.com/ffKWfnEZls

undefined Barchart (@Barchart) June 10, 2025

The “middle class” is defined here as those between the 20th and 80th percentiles of income.

That crossing underscores a decade-long divergence in the U.S. economy where the top earners have pulled far ahead of what many call the “real economy.”

Since the 2008 recession, Wall Street and the wealthiest Americans, with most of their net worth tied up in stocks, grew their wealth off of asset price inflation fueled by loose monetary policy.

But for most households, stagnant wages, rent spikes, and shrinking purchasing power have chipped away at any real wealth gains.

Analysts say the financialization of the U.S. economy is largely to blame.

“Underlying economic activity as measured by global GDP has been growing more slowly,” wrote Hung Tran of the Atlantic Council.

“The result has been an ever-larger gap between the volume and value of financial activity relative to the real economy.”

🧾 Critics blast Trump’s $2.4 trillion big, beautiful bill as a gift to the ultra-wealthy

At the center of the current firestorm is Trump’s 2025 “Big Beautiful Bill,” a sweeping package that would extend and expand the 2017 Tax Cuts and Jobs Act.

While the administration claims it includes provisions for lower-income households, critics argue the bill’s largest and most permanent tax breaks overwhelmingly favor wealthy Americans and corporations.

Perhaps the most staggering is the estimate from the Congressional Budget Office that the bill would add $2.4 trillion to the primary deficit over the next decade.

“Why do rich Americans need more tax cuts? The top 10% already own nearly 70% of the nation’s wealth,” wrote columnist and geopolitics analyst S.L. Kanthan.

Even Peter Schiff, a hardline capitalist and frequent government critic, called it fiscally reckless:

“At a time when our nation’s deficits have never been bigger… bragging about a bill that delivers the largest tax cuts in our nation’s history will go down as one of the biggest blunders any president or Congress has ever made.”

Some Republican lawmakers have also broken ranks.

Senator Rand Paul labeled the bill a “fiscal disaster,” while former Congressman Justin Amash likened it to “a family drowning in debt deciding to max out every credit card.”

Even Elon Musk — who helped shape the Trump administration’s early business strategy — has turned on the bill, calling it an “abomination,” and warning, “Bankrupting America is not OK.”

As the 2025 election cycle heats up, the battle lines over Trump’s tax vision are hardening, and the stakes for America’s economic future are only getting bigger.

Your email address will not be published. Required fields are markedmarked