After years of reputational ruin, federal indictments, and nearly $90 billion in lost market value, Wall Street is suddenly warming back up to Boeing (BA).

And behind the shift is a mix of new leadership and some well-timed help from President Trump.

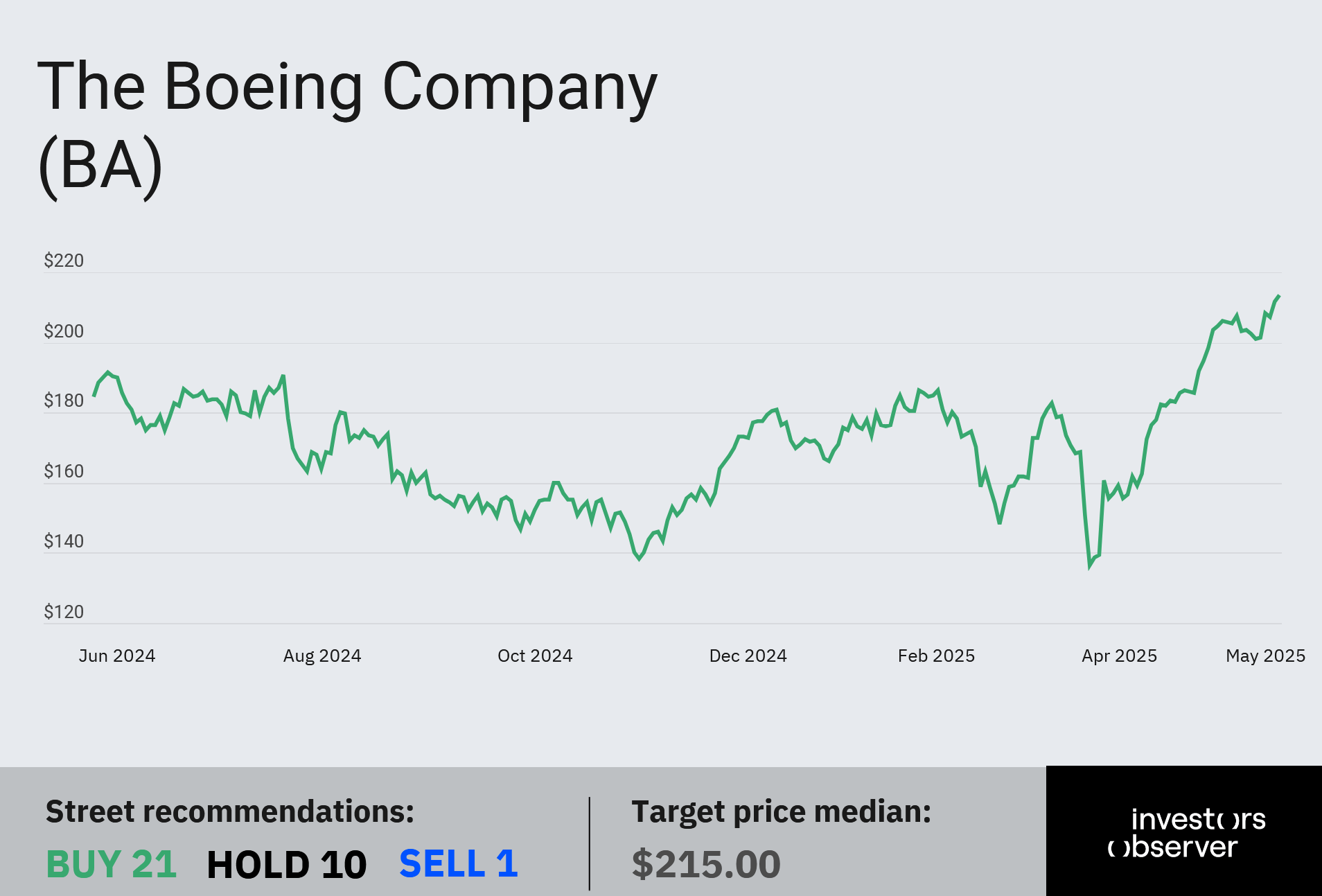

Boeing shares are up 21% year-to-date and 16% over the past 12 months, shaking off years of crisis sparked by two fatal 737 MAX crashes, a DOJ fraud charge, a $2.5 billion settlement, and yet another grounding just last year.

Now Bank of America has upgraded the stock to “Buy,” citing new CEO Robert “Kelly” Ortberg’s steady hand.

Since taking the reins last August, Ortberg has moved quickly to stabilize production, refocus the company on core operations, and divest non-essential assets.

“Under Kelly’s leadership, we are more confident BA can break the ‘doom loop,’” BofA analysts wrote.

That doom loop began in 2018 with the crash of a 737 MAX in Indonesia, followed by another in Ethiopia in 2019, which killed 346 people and led to a worldwide grounding.

Then came a DOJ criminal case, a record-breaking settlement, and most recently, a mid-air panel blowout that put the MAX back in the spotlight. Boeing shareholders lost an estimated $87 billion between 2018 and 2024.

But now, Ortberg’s early steps — and a return to Trump-era industrial policy — are giving investors fresh reasons to believe.

Boeing (BA) becomes a Trump trade weapon

Bank of America noted that Boeing has become a “trade tool” under President Trump.

That was on full display during Trump’s Middle East visit last month, where Qatar Airways placed a historic order for up to 210 Boeing jets, a deal Ortberg joined the president to announce.

In May, China Airlines also ordered 14 new Boeing aircraft, marking a thaw in U.S.-China aviation trade.

“These deals set a precedent for future global trade negotiations — to [Boeing’s] benefit,” BofA said.

Speaking at the Bernstein Strategic Decisions Conference last week, Ortberg openly acknowledged Boeing’s new role in rebalancing trade flows.

“As you look at this tariff environment... there’s no better way to do that than through the purchase of aircraft,” he said.

Bernstein recently named Boeing its top aerospace pick, calling it a “momentum stock” and reiterating its “Outperform” rating.

Meanwhile, the Justice Department last week asked a federal judge to drop charges against Boeing tied to the 737 MAX crashes.

As part of the agreement, Boeing will pay and invest over $1.1 billion, including $445 million in new compensation for victims’ families.

That said, BofA warned that public trust in the company remains “extremely fragile.” But on Wall Street, at least, the pivot appears to be taking hold.

Your email address will not be published. Required fields are markedmarked