The U.S. economy isn't in recession yet, but the slowdown could be closer than policymakers want to admit. Since households account for two-thirds of U.S. GDP, even small pullbacks in spending are worrying enough, experts say.

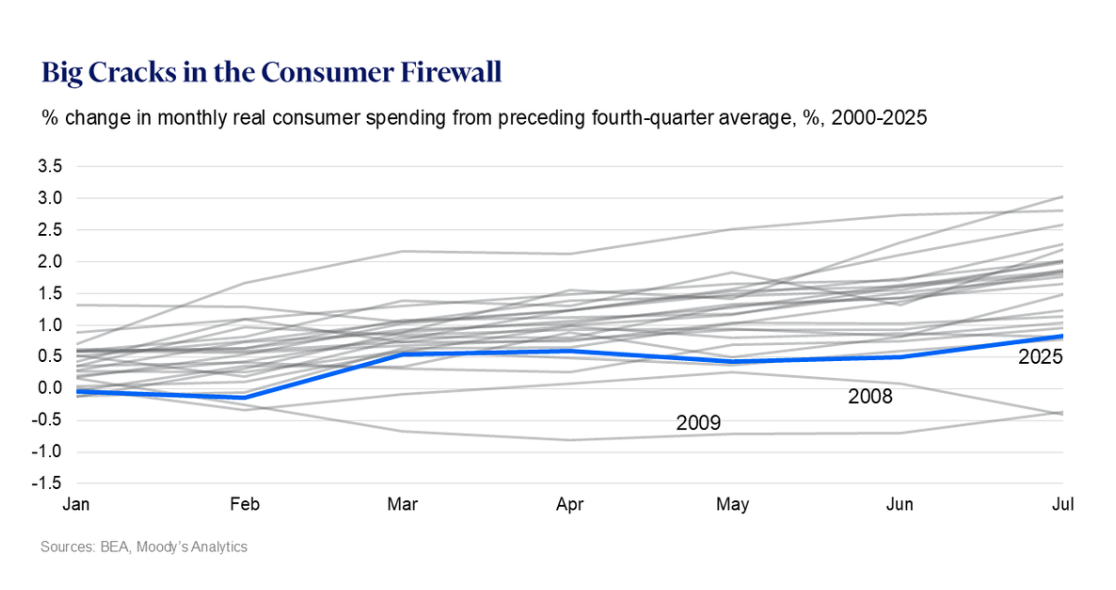

"If there is one chart that sums up the state of the U.S. economy, it's this one," wrote Moody's chief economist Mark Zandi, pointing to data showing the year-over-year change in inflation-adjusted consumer spending.

If there is one chart that sums up the state of the U.S. economy, it is this one courtesy of my colleague, economist @MattColyar. It shows the growth in total consumer spending after inflation since the 4th quarter of the preceding year for every year since 2000. Spending this… pic.twitter.com/Ry2Ye6nABZ

undefined Mark Zandi (@Markzandi) August 31, 2025

The metric tracks real spending growth from the fourth quarter of the prior year and offers a long-term read on household demand.

Zandi noted that "spending this year through July has barely budged from last year's end, worse than any year since 2008-09." While he stopped short of calling it a recession signal, he warned it points to "an economy on the brink of one."

A headline gain with a catch

On paper, consumer spending still looks solid. There was a 0.5% monthly gain in July, topping forecasts. But beneath the surface, Americans are tightening their belts.

According to Deloitte's State of the U.S. Consumer survey, financial well-being is on the decline, and that already shows in discretionary purchases like dining, travel, and home services.

Meanwhile, Morgan Stanley projects consumer spending growth will slow to 3.7% in 2025, down from 5.7% last year. The bank cautioned that the slowdown will hit lower- and middle-income households hardest.

Credit cards keeping the lights on

One reason spending hasn't fallen further is debt. U.S. households now carry a record $1.21 trillion in credit card balances, according to the New York Fed.

Worse, delinquencies are climbing fast, with more than 6.9% of balances transitioning into delinquency over the past year.

Researchers at the Fed warned that households "may have overextended themselves" as they cope with persistently high prices and are forced to borrow just to maintain their standard of living.

The financial strain is also showing up in sentiment.

A survey by Morning Consult for The Century Foundation found a majority of Americans feel financially squeezed, with 60% blaming the Trump administration for higher living costs.

A Fed dilemma

Inflation is not over yet and, in fact, could get worse, with core inflation remaining above the Fed's 2% target. Yet officials are ready to cut rates later this month to shore up the labor market.

Those could lower borrowing costs in the short term, but they also risk re-igniting price growth at a time when many Americans are already stretched thin.

The bottom line is that consumer spending is keeping the economy afloat for now, but with prices on the rise, it could be just a matter of time before it pulls back.

Your email address will not be published. Required fields are markedmarked