Super Micro Computer’s (SMCI) stock extended its rebound on Friday, rising 9% to close at $30.82. This caps off a week of strong recovery, with shares surging more than 70% from last week’s 18-month low.

The rally comes as Wall Street responded positively to news that Super Micro had filed an appeal with Nasdaq to resolve its compliance issues.

While the company has been found in violation of Nasdaq’s listing rules due to delayed SEC filings, the exchange confirmed it would not delist the stock while the appeal is under review.

Super Micro stock has outlined a plan to regain Nasdaq compliance, restoring hope among investors

Tuesday’s 31.2% jump, coupled with today's near-10% gain, solidifies Super Micro as a standout performer among S&P 500 companies this week. Despite the recent rally, the stock remains down approximately 35% for the month and is only marginally higher year-to-date.

Analysts have taken the developments as a positive signal.

Vijay Rakesh, an analyst at Mizuho Securities, expressed optimism that Nasdaq’s approval could come within 2-5 weeks. He sees Super Micro’s decision to hire BDO USA, a top-tier auditing firm, as a sign of hope.

AI-driven growth potential remains intact

Super Micro’s long-term growth prospects remain promising, underpinned by its leadership in the AI hardware market.

The company’s fiscal 2024 performance featured adjusted earnings of $2.21 per share, a nearly 90% increase, alongside a 110% revenue surge to $15 billion. Analysts project earnings growth of 40% and a 70% increase in revenues for 2025, as reported by Yahoo Finance.

With a diverse client roster including Nvidia, Intel, and AMD, Supermicro is well-positioned to benefit from the burgeoning AI hardware market, which could grow to $85 billion by 2031, according to SkyQuest. The company recently unveiled its next-generation AI servers, featuring Nvidia’s advanced Blackwell chips, at the Supercomputing Conference in Atlanta.

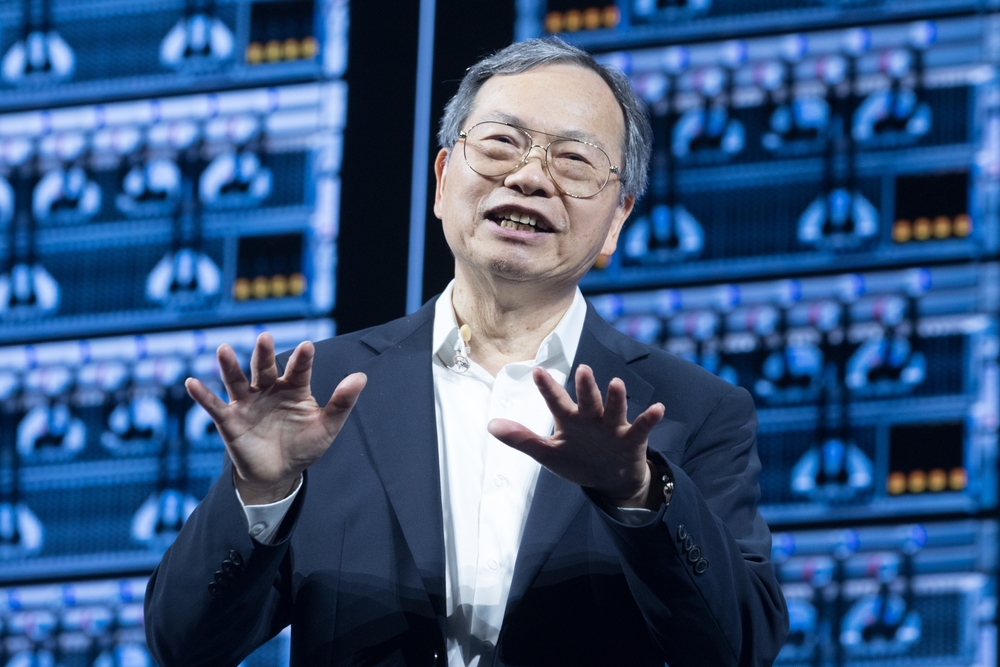

“Supermicro has the expertise, delivery speed, and capacity to deploy the largest liquid-cooled AI data center projects in the world,” said CEO Charles Lang.

While the stock’s recovery is encouraging, the outcome of its Nasdaq appeal remains critical to sustaining investor confidence.

If successful, the company’s robust fundamentals and AI-driven growth potential could continue to drive the stock price in the months ahead. However, any setbacks in compliance could reignite volatility, keeping investors on edge.

Your email address will not be published. Required fields are markedmarked