Shares of Hims & Hers (HIMS) plunged Monday after Novo Nordisk (NVO) announced it would no longer offer its weight-loss drug Wegovy through the telehealth platform, accusing Hims of circumventing federal laws on compound drug sales.

While much of the market focused on the public fallout between the two companies, one analyst pointed out that Hims may actually be in a stronger position than before.

Despite Novo Nordisk ending its partnership with Hims, the telehealth company used the relationship to grow its customer base by 35%, noted popular market commentator The Long Investor.

That growth helped Hims bolster its financial position and secure $1 billion in cash to acquire Zava, a European digital health provider with over 1.3 million users.

With the Novo Nordisk deal gone, Hims & Hers is essentially back where it started, but with a much larger customer base, The Long Investor said.

“HIMS is not the same company now as it was before the NVO partnership,” they added.

The acquisition of Zava gives Hims a solid foothold in the European market, with analysts suggesting it could boost the company’s long-term valuation.

If that holds true, HIMS investors who weather the short-term turbulence could be rewarded in the long run.

HIMS stock crashes to start the week

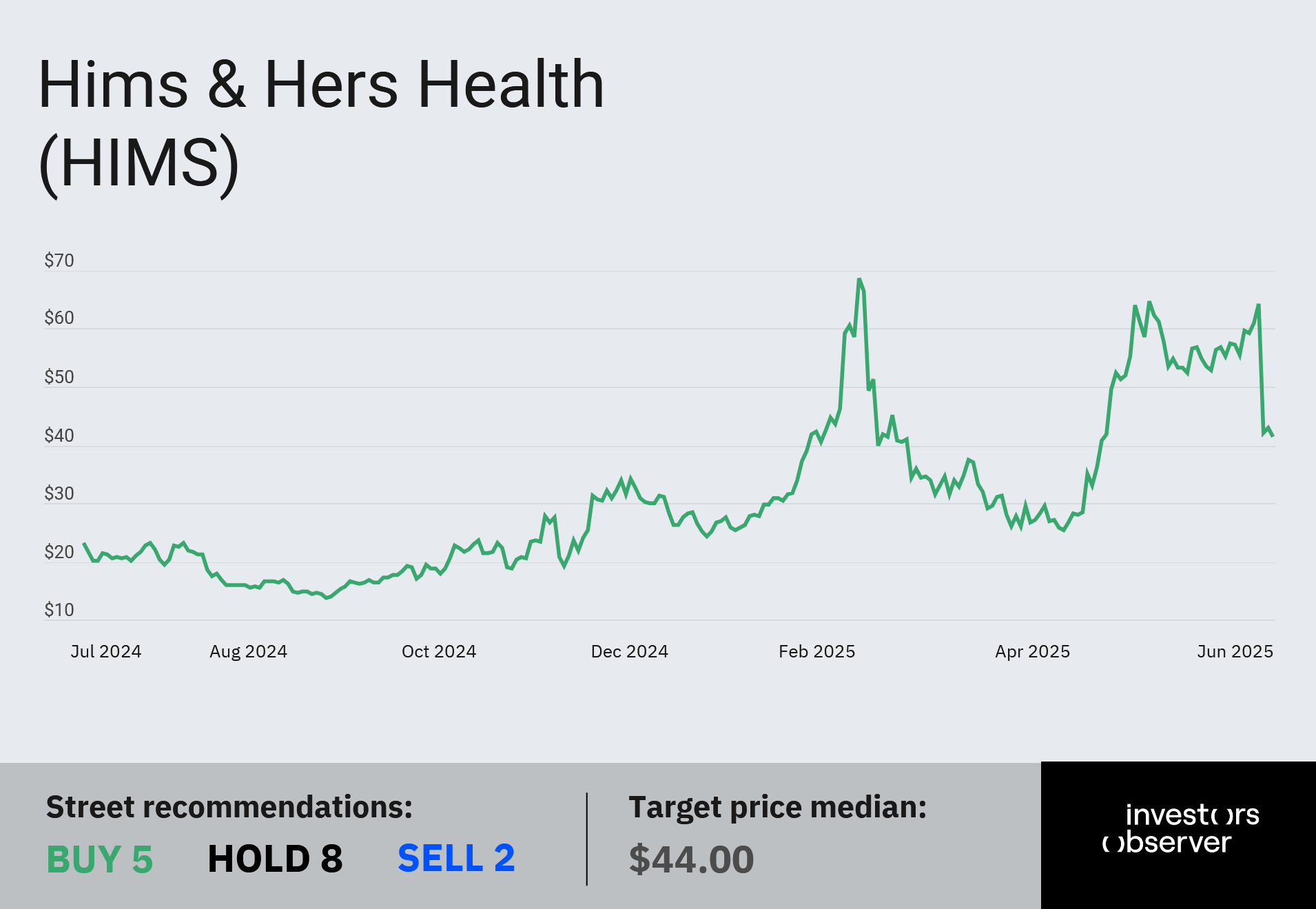

News of the Novo Nordisk breakup sent investors fleeing, triggering a sharp sell-off in HIMS shares that saw the stock plunge 34% on Monday.

Before the drop, HIMS was trading at $64.22. By market close, it had fallen below $42, according to Yahoo Finance data.

At current levels, Hims & Hers holds a market capitalization of just under $10 billion. Despite the steep decline, the stock remains up an impressive 72% year-to-date and has gained more than 96% over the past 12 months.

While some investors have turned bearish, not all analysts are convinced the sell-off is justified.

Canaccord Genuity, for instance, has reiterated its “Buy” rating on HIMS, maintaining a $68 price target, suggesting a potential 62% rebound from Monday’s close.

Analysts at Canaccord argue that Hims’ revenue and earnings goals remain within reach, even without the Novo Nordisk partnership. They cite the company’s expanding product portfolio, international growth strategy, and increased marketing spend as key drivers of future top-line performance.

Hims & Hers is scheduled to deliver its next quarterly earnings report on Aug. 5. Early projections show another quarter of solid earnings and revenue growth.

As Investors Observer reported, Hims generated $586 million in sales last quarter, including $230 million from its GLP-1 segment.

Your email address will not be published. Required fields are markedmarked