Cloud data firm Snowflake (SNOW) ticked higher on Wednesday after UBS upgraded the stock to “Buy,” calling it a long-term winner in the AI infrastructure arms race.

UBS analysts admitted they may be late to the trade but argued the market is still early in a multi-year investment cycle in data infrastructure, with AI demand accelerating the shift.

“We’re late, we get it. But, if this data investment cycle has duration, as we think it does, then it isn’t too late,” wrote UBS analyst Karl Keirstead.

Even though Snowflake is already up 35% this year, Keirsread believes that’s just the first inning in the grand scheme of things.

“The stock is up merely 19% over the last two years, Snowflake’s results have only really “turned” in the last 2-3 quarters, and the AI-driven lift to the broader data layer investment cycle has barely kicked in,” he added.

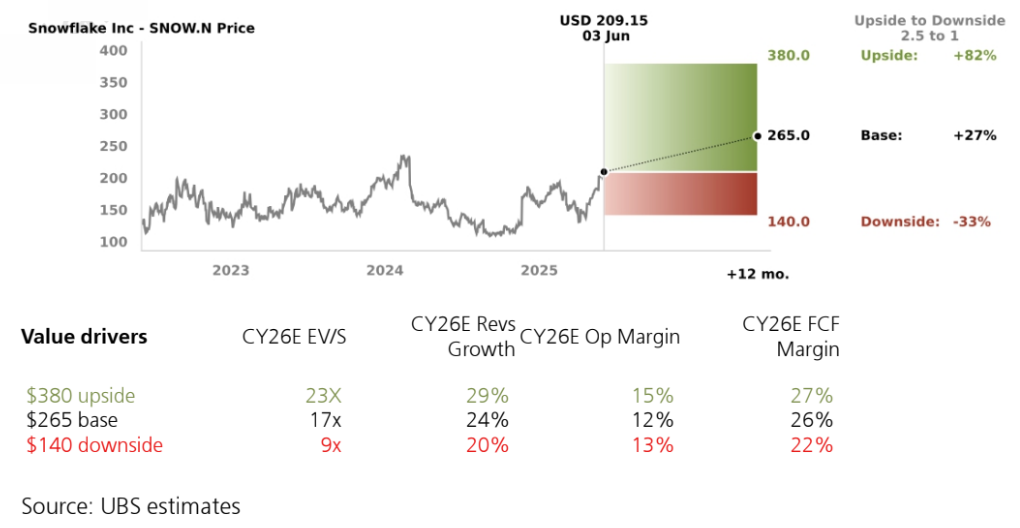

UBS raised its 12-month price target to $265, implying a 26% upside from Wednesday’s close at $209. In a more bullish scenario, the firm sees SNOW reaching $380.

Snowflake’s growth is increasingly coming from outside its core data warehouse product. Features like Dynamic Tables, Cortex, and Snowpark are exceeding expectations.

UBS estimates data engineering workloads alone could generate $250 million to $300 million in annual recurring revenue, roughly 8% of total sales.

The firm also highlighted Snowflake’s growing footprint in the AI ecosystem, pointing to OpenAI as a rising customer. Now a top-20 client with $40 million in annual revenue, OpenAI could soon join Snowflake’s top-10 customer list.

That’s not so much a sales milestone as it is a signal of relevance.

Keirstead noted that OpenAI chose Snowflake for SQL analytics over alternatives like Databricks and Microsoft Synapse, which it called “a strong endorsement” of Snowflake’s positioning in the modern AI data stack.

Snowflake’s Q1 earnings beat and raised guidance

UBS’s bullish upgrade comes on the heels of a strong earnings report for the last quarter.

Revenue jumped 26% year-over-year to $996.8 million, beating Wall Street’s $952.2 million estimate. Adjusted earnings landed at $0.24 per share, topping forecasts for $0.21.

Meanwhile, enterprise sales continue to grow. Snowflake now counts 606 customers, generating over $1 million in annual product revenue, up from 485 a year ago.

Its total customer base surpassed 11,000, including 754 companies from the Forbes Global 2000 list.

The company raised its Q2 revenue forecast to $1.04 billion, ahead of the $1.021 billion consensus tracked by LSEG. It also bumped up its full-year outlook, targeting $4.325 billion in fiscal 2026 revenue.

Snowflake is expected to report second-quarter results in mid-August.

Your email address will not be published. Required fields are markedmarked