As bitcoin mining has become less profitable due to rising electricity costs and higher competition, many crypto miners are pivoting toward high-performance computing (HPC) to cash in on the booming AI data centers.

Riot Platforms (RIOT), however, isn’t choosing between the two. It’s doubling down on both.

In its latest earnings report, Riot Platforms CEO Jason Les said the company mined 514 bitcoin in May, an 11% increase over April.

“We will continue to prioritize operational excellence as we head into the summer months in Texas and Kentucky,” Les said.

At the same time, Riot is aggressively expanding its HPC capabilities.

Les highlighted that the company recently acquired an additional 355 acres adjacent to its Corsicana, Texas data center facility, setting the stage for even more capacity.

“This additional land will further support the development of data centers to serve high-performance compute, which typically require larger footprints than bitcoin mining to utilize the same power capacity,” Les said.

Earlier this month, Riot named Jonathan Gibbs as Chief Data Center Officer to lead the new HPC division. Gibbs will oversee construction of state-of-the-art facilities aimed at hyperscale and enterprise tenants.

“The creation of this new data center platform furthers Riot's strategy to maximize the value of its assets by expanding into non-bitcoin data centers, diversifying revenues, enhancing long-term cash generation, and strengthening partnerships with leading tech companies,” the company said.

Wall Street likes the pivot

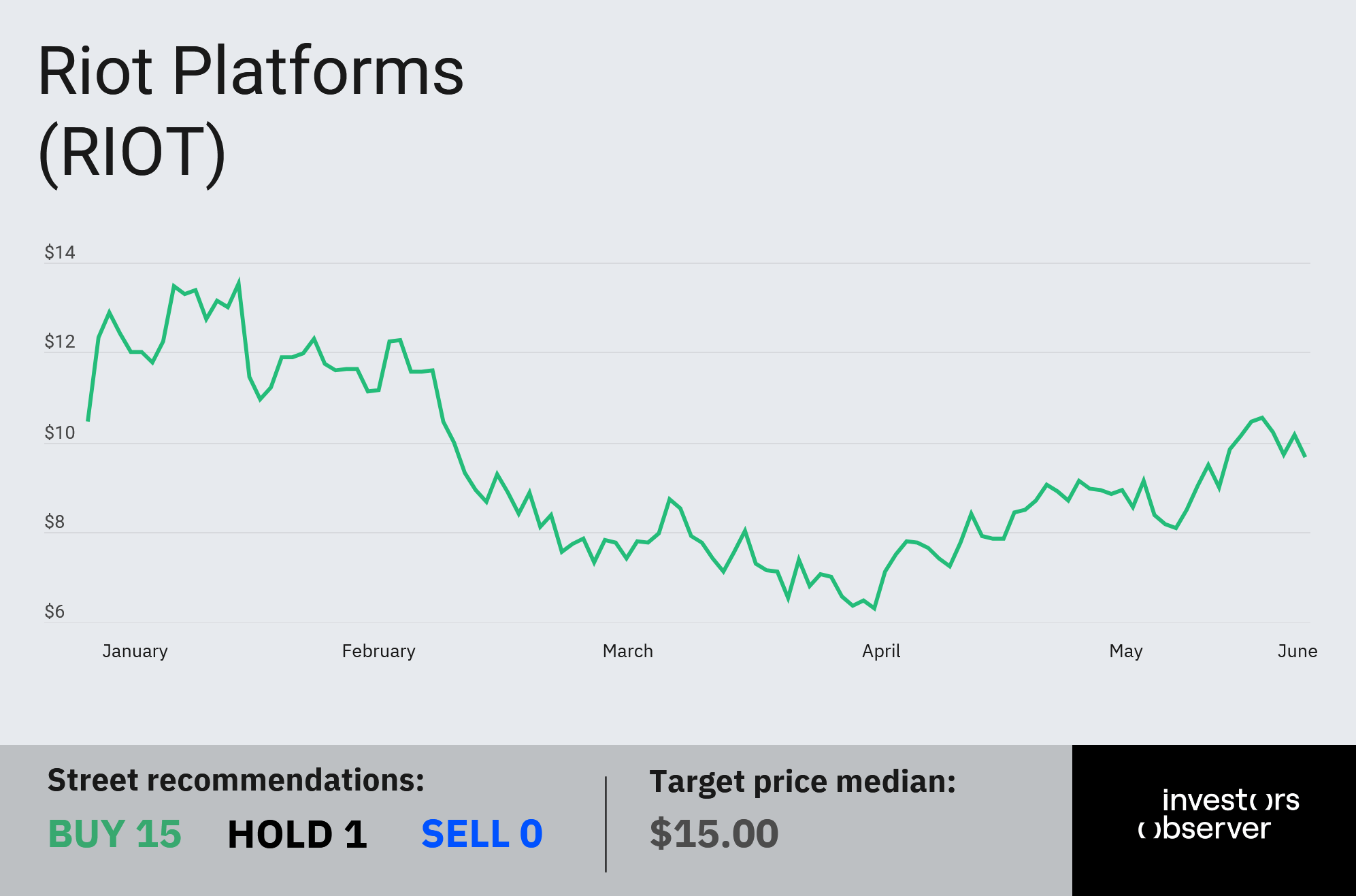

Needham analysts raised their price target on Riot by 25% to $15 from $12, maintaining a “Buy” rating. “We believe Riot's Corsicana site is one of the most attractive HPC sites in our universe,” Needham wrote in a note to clients.

The analysts expect advanced tenant negotiations to begin in the second half of 2025, with potential lease deals materializing in early 2026.

“In a hypothetical lease, we believe Corsicana could contribute $12–$16 in share price,” they added.

J.P. Morgan also raised price targets across the sector, citing higher bitcoin prices and stronger industry economics.

The firm lifted Riot’s target to $14 from $13, while raising CleanSpark (CLSK) to $14 from $12 and MARA Holdings (MARA) to $19 from $18.

Riot shares closed Tuesday at $9.7, but the stock remains down 5.4% year-to-date.

Despite Wall Street’s optimism, a new industry report warns that bitcoin miners’ margins remain under pressure from rising energy costs and heightened competition.

Your email address will not be published. Required fields are markedmarked