First with its Creative Suite platform and now with its Creative Cloud, Adobe (ADBE) has long built tools used by artists working in mediums such as graphic design and video.

But as the company ramps up its AI offerings the way nearly every software company is at the moment, it faces an interesting challenge: How does it show Wall Street it remains at the vanguard of innovation while also not alienating its core user base of artists - many of whom see AI as a threat to art and creativity in general?

As it stands, Adobe doesn’t appear to see any conflict between its generative AI tools and the creative work being carried out by many of its customers.

In fact, in an interview last year with The Verge, Alexandru Costin, vice president of generative AI at Adobe, said that artists are “not going to be successful in this new world without using it.”

“Our goal is to make our customers successful, and we think that in order for them to be successful, they need to embrace the tech,” he added.

This did not go over well with everyone.

Analysts waiting for Adobe’s AI solutions to ‘move the needle’

But Adobe also has a significant base of customers working in creative fields within the corporate world who are actually seeking out gen-AI tools that can improve their work.

The company is delivering this through its AI-assisted Firefly platform, which lets users generate

images, video, audio and vectors.

The company has emphasized that Firefly is “commercially safe” - which is another way of saying that it can be used without infringing on another person’s intellectual property or trademark.

This has become an especially touchy subject, especially as lawsuits have been filed against OpenAI and Microsoft over its own gen-AI tools.

But even as Adobe goes all-in on AI tools, Wall Street is not convinced that it has gone far enough.

When the company released its fiscal Q2 earnings earlier this month, it posted better-than-expected performance, including record quarterly revenue of $5.87 billion, up 11% year-over-year.

Its stock nonetheless closed down 5%.

"The key investor question remains when (if) AI innovation can move the needle," Morgan Stanley analysts wrote in a client note.

Although the bank gave the company an “overweight” rating, it added that Adobe’s quarterly performance "brought little to quell the bear concern around AI contribution being unable to reaccelerate growth while bulls must remain patient for encouraging AI metrics to move the needle."

Jeffries analysts reiterated its “buy” rating, while also acknowledging that the AI progress it made in the quarter was “maybe not enough to appease the bears.”

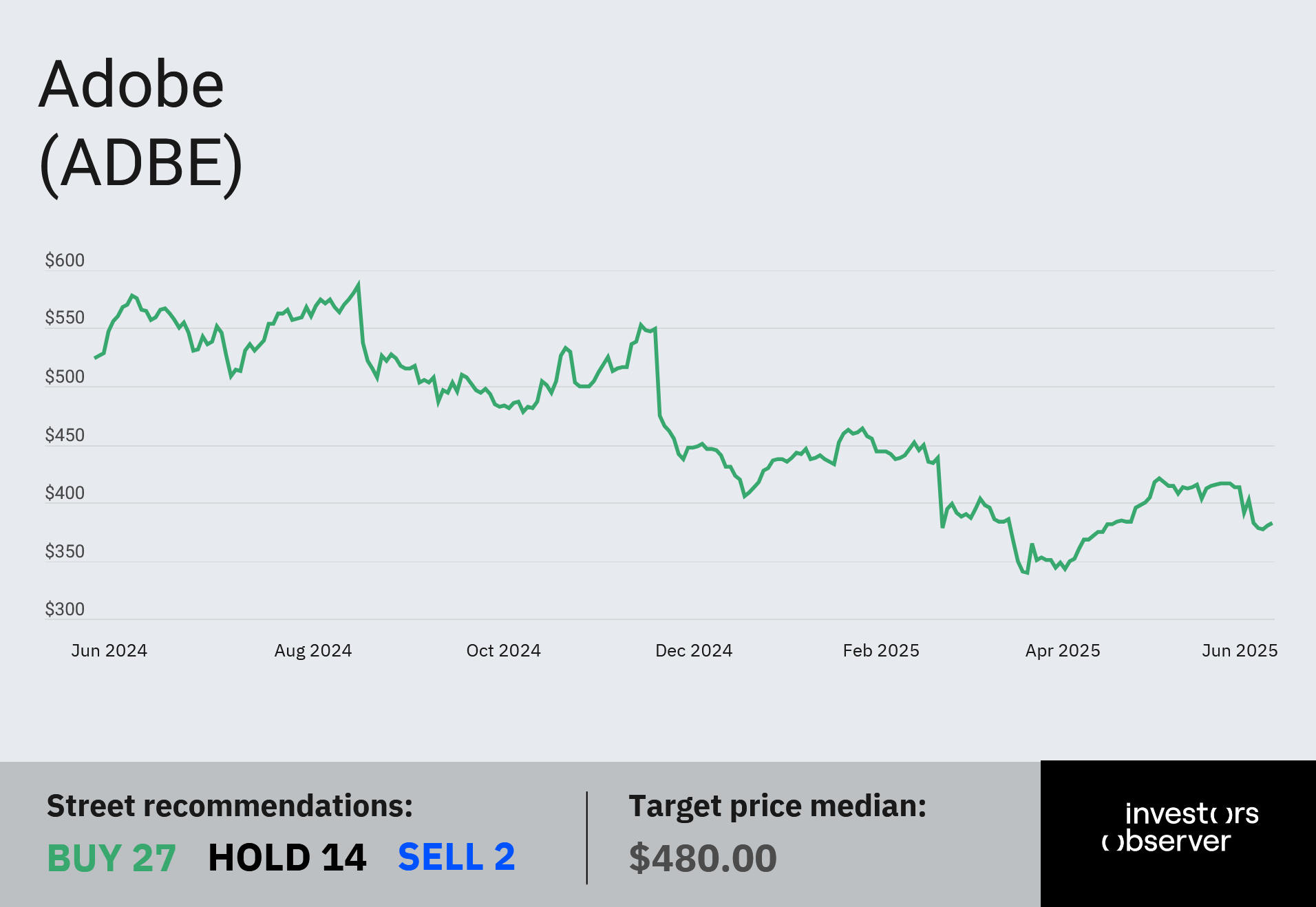

Thus far the bears are winning out as Adobe’s stock is down 14.5% YTD. It’s also dropped 28.7% over the past year.

But Ernest Wong, head of research at Baskin Wealth, remains bullish on Adobe and said in a post on X that the company “is in an unusual situation where the gap between the fundamentals and the market narrative keeps getting wider.”

Wong points to the “especially notable” collaboration between Adobe and The Coca-Cola Company (KO) to create Fizzion, an AI-powered design intelligence platform that assists brands with content creation.

This shows Adobe’s ability to generate growth with enterprise customers because “brands really do value Adobe’s brand-safety focus,” Wong said.

Your email address will not be published. Required fields are markedmarked