When a company’s stock is floundering and there’s no positive catalyst in sight, few things excite Wall Street more than layoffs.

That’s exactly what happened with Bumble (BMBL). The struggling dating app soared 25.1% on Wednesday after announcing in an 8-K filing with the SEC that it would cut 30% of its workforce, roughly 240 jobs.

The company said the decision “realigns its operating structure to optimize execution on its strategic priorities.”

It expects to take $13 million to $18 million in non-recurring charges tied to severance, benefits, and other costs, most of which will hit in the third and fourth quarters.

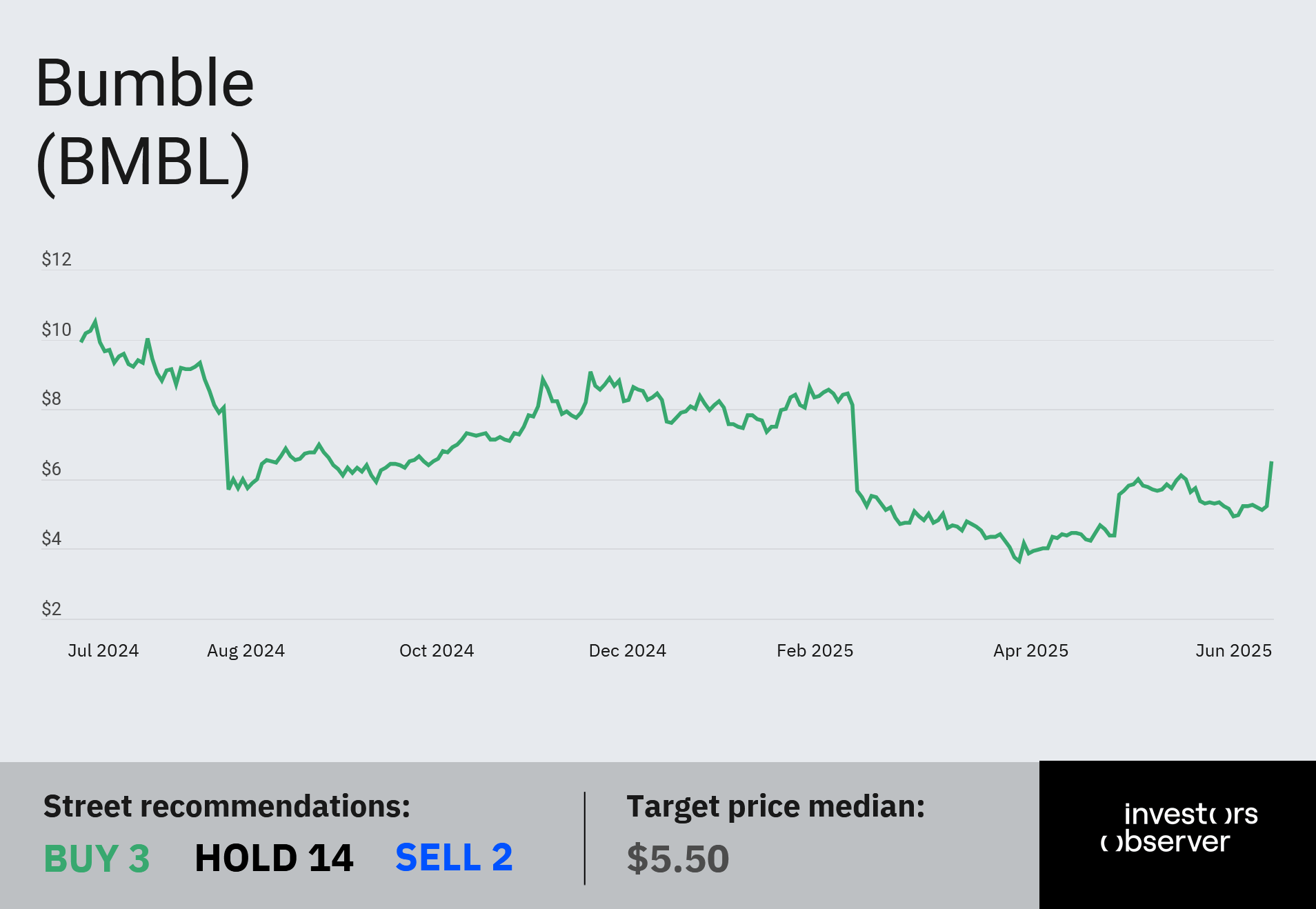

Despite the market reaction, Bumble shares remain down 19.9% year-to-date and have plunged 34.1% over the past 12 months.

A $40B swipe left on dating apps

Bumble expects the layoffs to generate up to $40 million in annual cost savings — the bulk of which will be reinvested in product and technology development, the company said.

The job cuts come as little surprise to industry watchers. Bumble — along with most of the dating app sector outside of Grindr — has struggled to stay relevant with Gen Z users, fueling a dramatic drop in revenues and engagement.

Together, Bumble and Match Group (MTCH) — parent of Tinder, Hinge, and OkCupid — have lost over $40 billion in market cap since 2021.

However, analysts at JPMorgan said the scale of Bumble’s latest cuts “comes as a surprise,” noting the company had already announced $15 million in operating expense reductions for the second half of the year.

Bumble’s spokesperson told Fortune the layoffs “were not made lightly” and that the company is now focused on “strengthen[ing] our core business, continu[ing] to serve our members effectively, and position[ing] us for future growth.”

Guidance ticks up, but pressure remains

Despite the restructuring, Bumble actually raised its Q2 revenue guidance in Wednesday’s filing.

The company now expects revenue between $244 million and $249 million, up from its previous forecast of $235 million to $243 million.

On the flip side, the company reported an 8% drop in Q1 revenue and a 7.3% decline in average revenue per paying user.

Bumble founder Whitney Wolfe Herd returned as CEO in March after stepping away 14 months earlier.

Analysts at JPMorgan said they’re “encouraged by the financial discipline Whitney has shown,” but remain underweight on the stock because "industry trends still challenged and a long way to go to return Bumble app to growth.”

Your email address will not be published. Required fields are markedmarked