After years of sluggish growth and a messy media experiment, AT&T (T) is suddenly looking like a market darling again.

For starters, the telecom giant’s 2022 spinoff of WarnerMedia, meant to slash its mountain of debt and refocus on its core business, is now paying off.

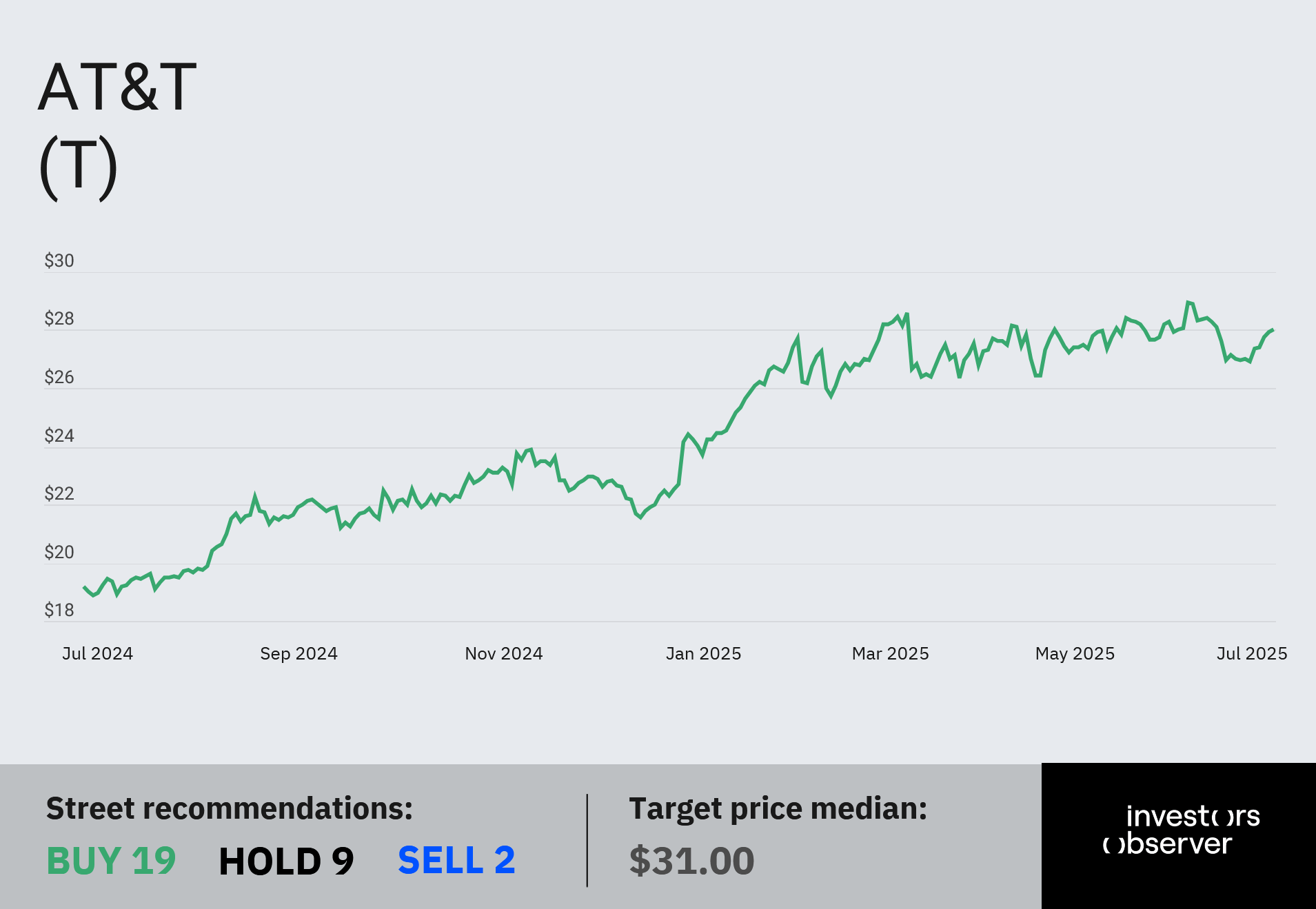

Investors are cashing in on hefty dividends and a rally that has pushed AT&T shares to a 52-week high of $29, nearing pre-pandemic levels. The stock is up 21% year-to-date and an eye-popping 50% over the past 12 months.

Value investors have long loved AT&T’s rich dividend, currently yielding around 4%, well above the industry average. But now, there’s growth to go with the income.

Strong Q2 results

Momentum accelerated last week as AT&T reported second-quarter earnings that blew past Wall Street estimates.

- Revenue: $30.8 billion, up 3.5% year-over-year

- Mobility service revenue: $16.9 billion, up 3.5%

- Adjusted EPS: $0.54, 3 cents higher than last year

- Postpaid net adds: 401,000, smashing analyst forecasts of 302,000

The company reaffirmed its full-year 2025 guidance of $1.97 to $2.07 per share, pointing to robust demand for consumer fiber broadband and sustained wireless growth.

Analysts Pile On

The earnings beat has unleashed a wave of bullish analyst calls.

Bank of America initiated coverage with a “Buy” rating and a $32 target, citing improved margins, stronger cash flow, and potential shareholder returns of $40 billion through dividends and buybacks over the next few years.

Morgan Stanley also reaffirmed its “Overweight” rating and $32 target, while Wells Fargo, Oppenheimer, and Scotiabank also upgraded or maintained positive outlooks.

One major bullish factor is that analysts expect AT&T’s valuation to close the gap with T-Mobile’s as momentum builds and fundamentals strengthen.

Trump’s Tax Boost

Another catalyst is the expected tax windfall from President Trump’s recently passed “Big, Beautiful Bill”.

The legislation, signed earlier this month, is projected to save AT&T $6.5 billion to $8 billion in cash taxes from 2025 to 2027, including $1.5 billion to $2 billion in 2025, followed by $2.5 billion to $3 billion annually in the following years.

With dividend strength, earnings momentum, bullish analyst support, and now a major tax tailwind, AT&T’s comeback story is starting to look like one of 2025’s most powerful telecom turnarounds.

Your email address will not be published. Required fields are markedmarked