It’s not quite a recession, but for lenders, the current economic uncertainty still feels like a headache.

Relatively high rates, sticky inflation, and fears of a downturn aren’t exactly the perfect backdrop for a company handing out personal loans.

But Dave Girouard, CEO of AI lending platform Upstart (UPST), says the company isn’t sweating it.

“We don’t see any weakening in the consumer credit performance,” Girouard told Yahoo Finance. “Our business is pretty rapidly diversifying.”

That diversification includes a big push into super-prime loans, with borrowers with credit scores above 720 now accounting for roughly a third of Upstart’s business.

Until recently, that segment wasn’t even on its radar.

Strong quarter, digital expansion

The company’s first-quarter earnings back up Girouard's optimism.

Originations more than doubled to 240,706 loans, up 102% year-over-year. Conversion rates climbed to 19.1%, up from 14% a year ago.

Revenue jumped 67% to $213 million, easily beating the Street’s $203.4 million forecast. Fee revenue hit $185 million, up 34% YoY.

And while the company still hasn't turned a profit yet, top-line growth is impressive.

But it wasn’t an all-out earnings beat. Upstart’s Q2 revenue guidance came in lighter than expected at $225 million versus Wall Street’s $227.8 million estimate.

Girouard said the company is being cautious in the face of uncertainty, and made clear that no Fed rate cuts are baked into that outlook.

“Our guidance does not assume any rate cuts from the Fed, which I think is a good place to stand. And it doesn’t assume any massive change in the macro from where it stands today.”

It’s also the first time Upstart has issued second-quarter guidance, hinting at a new playbook as the company tries to build investor confidence.

Meanwhile, Upstart is expanding its reach with new credit union partners.

On Wednesday, it announced a deal with All In Credit Union in Daleville, Alabama, to offer personal loans to its 200,000 members.

“We’re expanding our membership digitally,” said Todd Peeples, SVP of sales and lending at All In Credit Union.

That growth comes as the digital lending market is poised to explode.

A new report projects the sector will grow from $13 billion last year to more than $106 billion by 2033, translating to a compound annual growth rate of 24.1%.

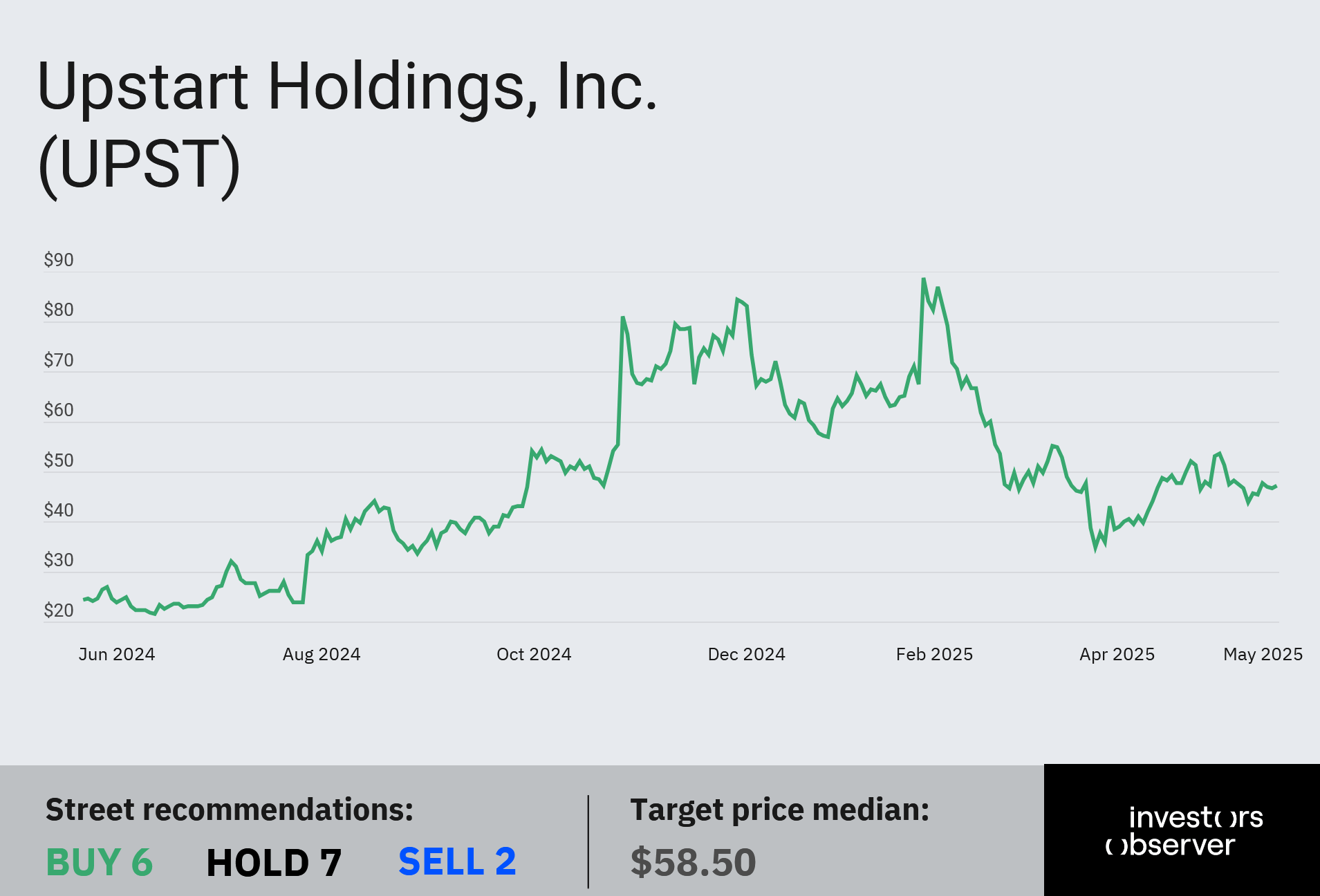

Upstart stock is down 24.6% year-to-date, but it's still up 99% over the past 12 months.

Whether it can keep the rally going may depend on how long the economy holds up, and whether that super-prime segment keeps expanding.

Your email address will not be published. Required fields are markedmarked