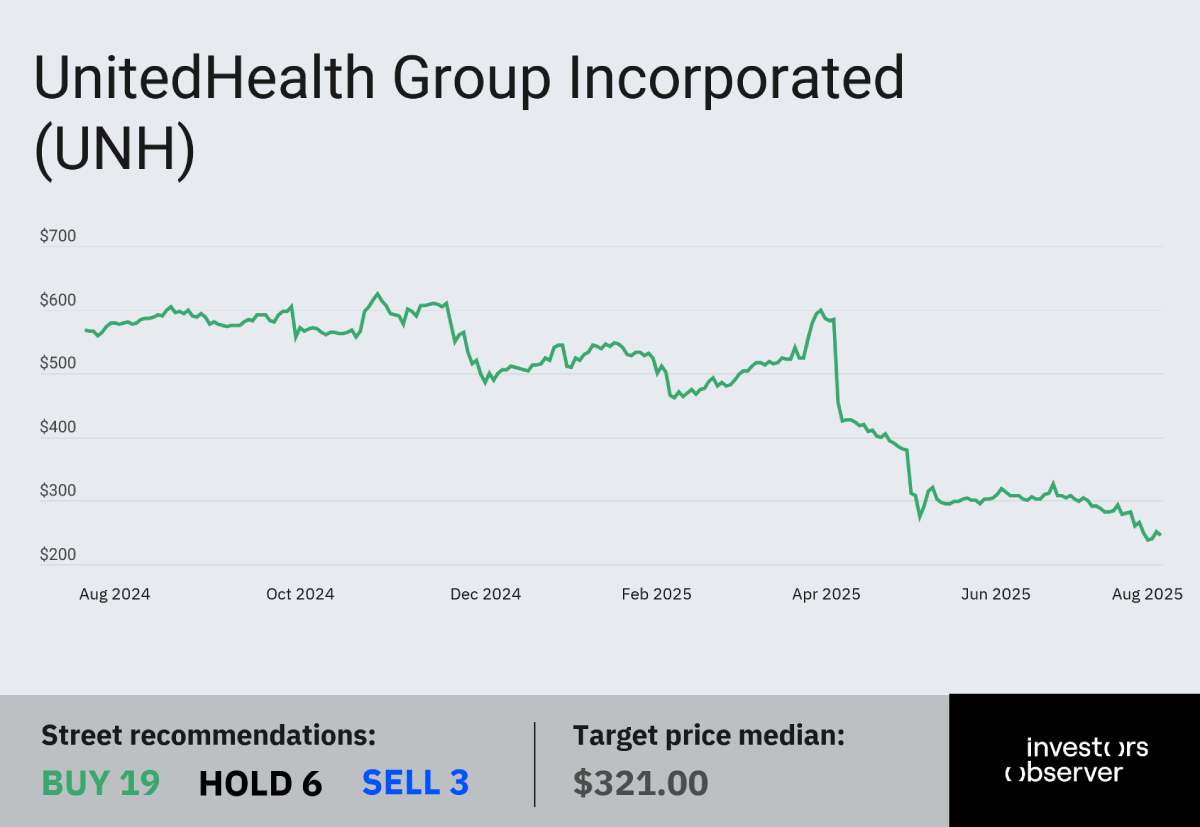

UnitedHealth’s (UNH) historic meltdown has left Wall Street rattled, raising fears the insurance titan may not fully recover. But some investors are looking past the carnage to reassess the stock’s long-term story.

Last week’s second-quarter earnings didn’t help. While UnitedHealth reported better-than-expected revenue — up 12% year-over-year to $111.62 billion — earnings landed at just $4.08 per share, well below the $4.48 forecast.

On the flip side, Optum, UnitedHealth’s tech-forward pharmacy and care services arm, pulled in $4.8 billion in revenue for the quarter.

For context, Palantir (PLTR), a darling of the AI and defense contracting world, brought in $2.87 billion over all of last year. Yet Palantir’s market cap now dwarfs UnitedHealth’s.

That comparison may be apples to oranges, but Palantir is priced like a high-growth rocket ship, while UnitedHealth is seen as a creaky legacy play. But the contrast underscores how far sentiment has swung.

That raises the question: Has UNH become too cheap to ignore?

That’s the argument made by analyst and Capitalist Letters author Oguz Erkan, who sees UnitedHealth’s Optum Insight as a sleeping giant.

“UnitedHealth is building an operating system for healthcare via its subsidiary Optum Insight,” he said, suggesting the market is missing the long-term tech story buried inside the insurance behemoth.

Technical indicators may also support a rebound case. Analysts have flagged that UnitedHealth shares are now oversold across multiple timeframes, signalling the worst of the sell-off may be over.

if a thing is commonly known - it is absolutely priced in and useless$UNH is cheap - everyone knows that$PLTR is expensive - everyone knows that$DXY is oversold - everyone knows that$NVDA and $AMD overextended - everyone knows that

undefined Ruth Capital (@ruth_capital) July 29, 2025

smart furu rides the wave

UNH bleeding continues

Investors aren’t buying the turnaround story just yet.

Following its earnings release, UNH has slid another 9% to fresh 52-week lows. The stock now trades around $240, down nearly 60% over the past year, and 20% over the past month alone.

That puts UnitedHealth below its mid-2020 pandemic levels and erases nearly five years of gains.

The company is also still grappling with a federal fraud investigation into its billing practices. CEO Tim Noel attempted to calm nerves during the earnings call, saying the company is ramping up cooperation with the Department of Justice.

“We have stepped up our audit, clinical policy and payment integrity tools to protect customers and patients from unnecessary costs,” Noel said.

Whether that’s enough to stop the freefall and regain investor trust remains to be seen. But with valuations this compressed and Optum quietly building, some on Wall Street are starting to sniff out a bottom.

Your email address will not be published. Required fields are markedmarked