Uber (UBER) has come a long way since its rocky IPO. After years of questions about profitability, the ride-hailing giant has been on a tear, and analysts say there may be more room to run.

Amid recession fears and rising global trade tensions, Uber has quietly strengthened its business by expanding beyond rideshare and sharpening its focus on profit.

The turnaround began in earnest back in 2022. As of the first quarter of 2025, Uber has now posted four straight quarters of profit, fueled by growing demand across both rides and delivery.

In Q1, revenue rose 14% year-over-year to $11.5 billion. Gross bookings also climbed 14% to $42.8 billion, and total trips grew 18% to 3 billion. Monthly active users jumped 14%.

That growth helped the company deliver $1.9 billion in adjusted earnings for the quarter.

Looking ahead, Uber expects up to 20% growth in gross bookings in Q2 — even with currency headwinds — and adjusted earnings could rise as much as 35%, to $2.12 billion.

Still investing in driverless tech

On the company’s earnings call, CEO Dara Khosrowshahi said autonomous vehicles remain a top priority, even if progress has been slower than hoped.

“We have conviction that Uber will be the indispensable go-to-market partner for [autonomous vehicle] players,” he said.

In the meantime, he added, Uber is strong enough to hold its ground. “We can rest for a second. And because of our global position and the unique platform we have, we think we can hold our own — and then some.”

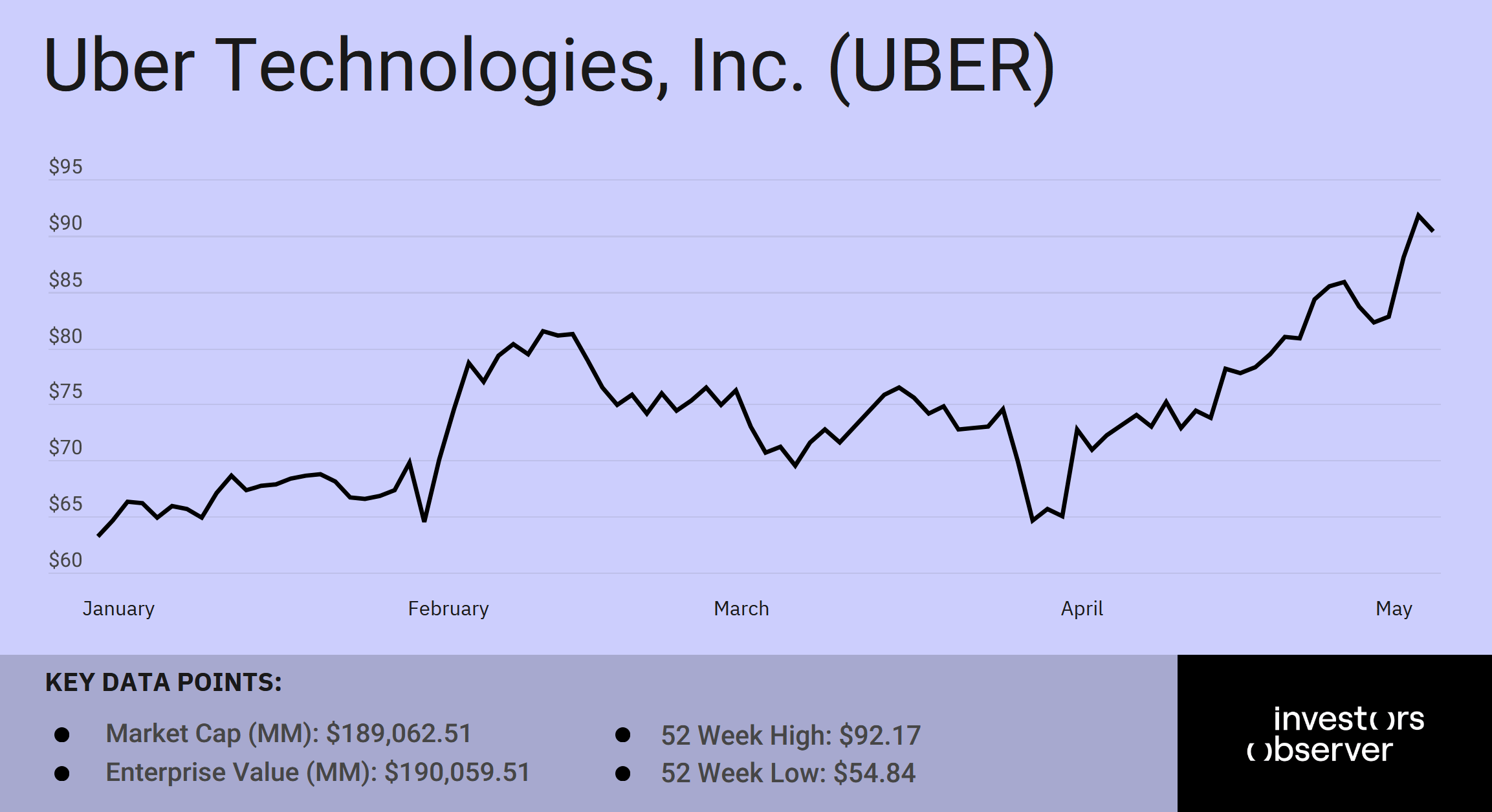

Uber shares have surged more than 50% in 2025, recently hitting a record high of around $92 with the company’s market cap now sitting at $192 billion.

That rally has outpaced both the S&P 500 and the Nasdaq, which only recently recovered their year-to-date losses.

Citi analysts recently raised their price target to $102, an 11% gain from current levels. The upgrade reflects confidence in Uber’s rideshare and delivery businesses, which Citi says “continue to deliver impressive results.”

RBC Capital set a slightly lower target of $94, but still sees more upside ahead.

Most analysts tracked by The Wall Street Journal continue to rate the stock a “buy” or “overweight,” a rating that’s held steady since the start of the year.

Your email address will not be published. Required fields are markedmarked