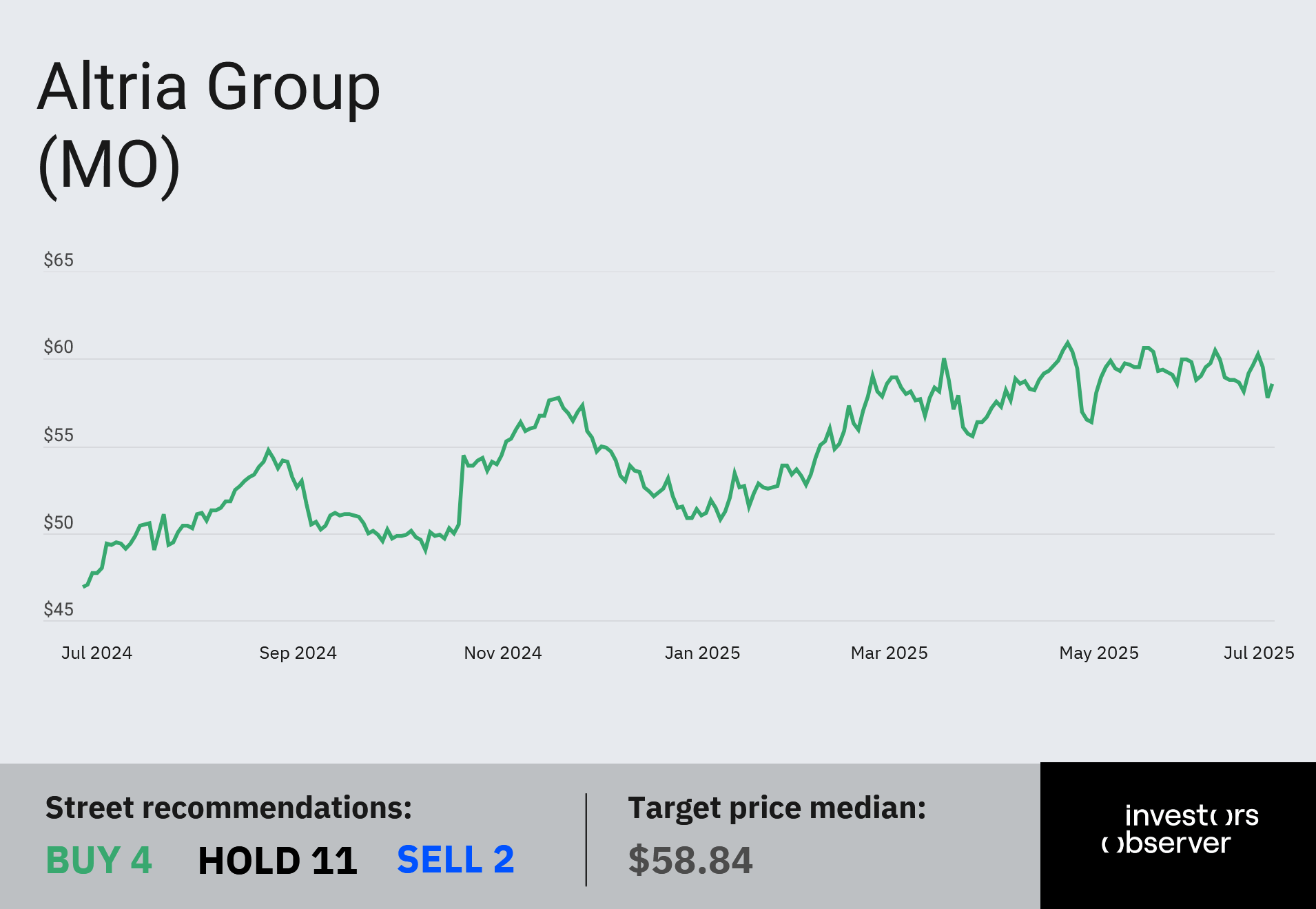

Despite a booming year for tobacco stocks, one major Wall Street firm is breaking from the crowd, casting doubt on Altria’s (MO) valuation as the stock hovers near 12-month highs.

Jefferies analyst Edward Mundy initiated coverage on Altria this week with an “underperform” rating and a $50 price target, roughly 14% below where the stock closed Thursday at $58.24.

Mundy cited a “demanding valuation” as one of the key reasons for the bearish view.

While Altria shares were flat on the day, they’re still up nearly 12% year-to-date and have gained 24.8% over the past 12 months, leaving some bears sidelined.

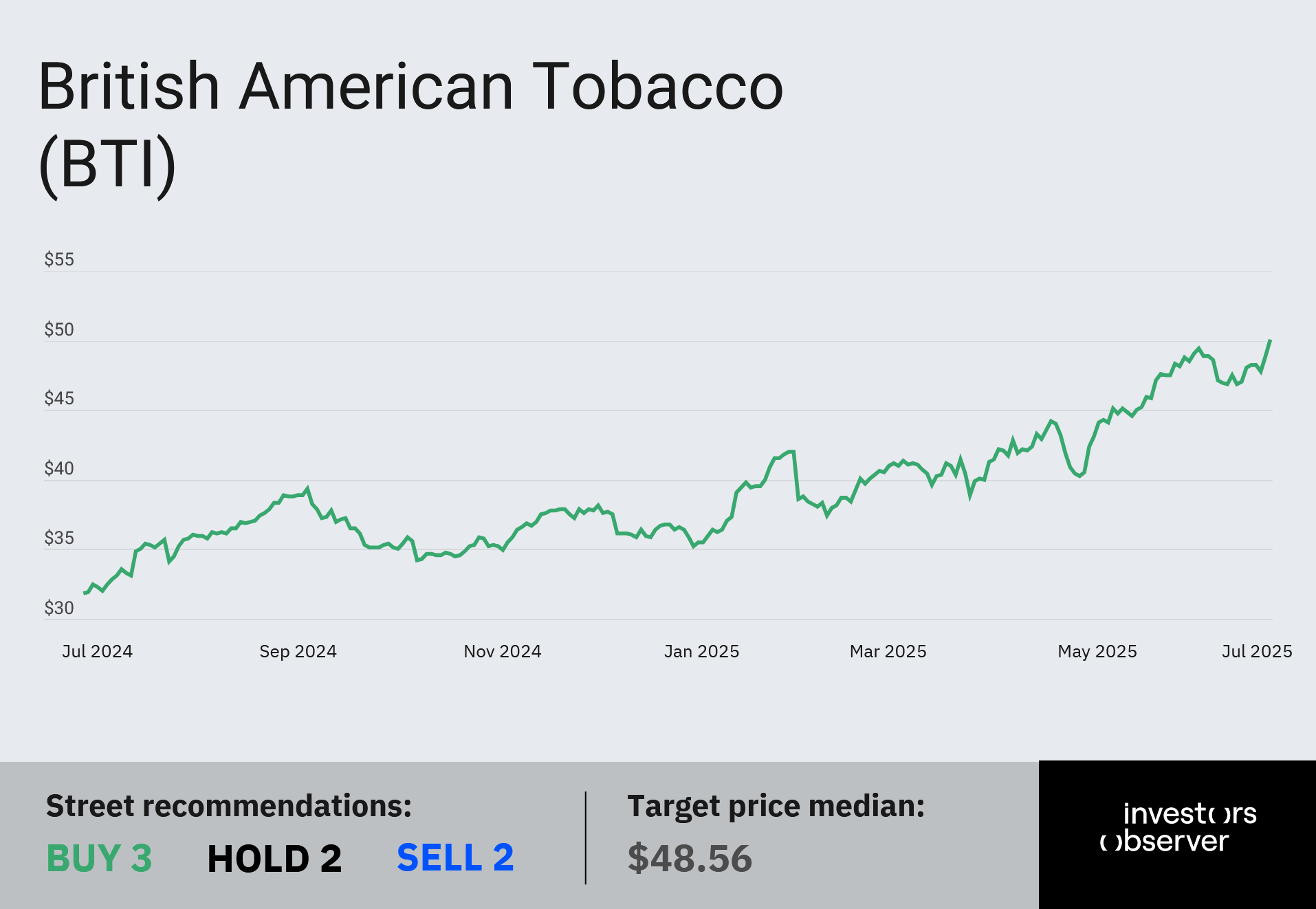

Jefferies favors BAT over Altria

Jefferies isn’t bearish on tobacco as a whole.

In fact, the firm is optimistic about low single-digit growth from both traditional combustibles and smoke-free alternatives, which now make up about 16% of global nicotine sales.

But Mundy’s pick is British American Tobacco (BTI), not Altria. BTI stock have outpaced MO by a wide margin, rising 39.4% year-to-date and nearly 58% over the past year.

“We see BAT as an underappreciated Smoke-Free improver thanks to the major success of Velo in the U.S. and Europe, a long-term margin improvement trend, high cash returns and attractive valuation,” Jefferies analyst Andrei Andon-Ionita wrote in a note.

Industry insiders agree that Altria is losing ground.

“The share price ratio continues to collapse,” noted Tobacco Insider on X, pointing out that BAT now trades just above $50 a share, a price last matched with Altria in July 2022.

“At the same share price, BAT’s market cap would be 30% more than Altria’s.”

As of Thursday, BAT’s market cap stands at $110.7 billion, roughly $12 billion above Altria’s $98.1 billion.

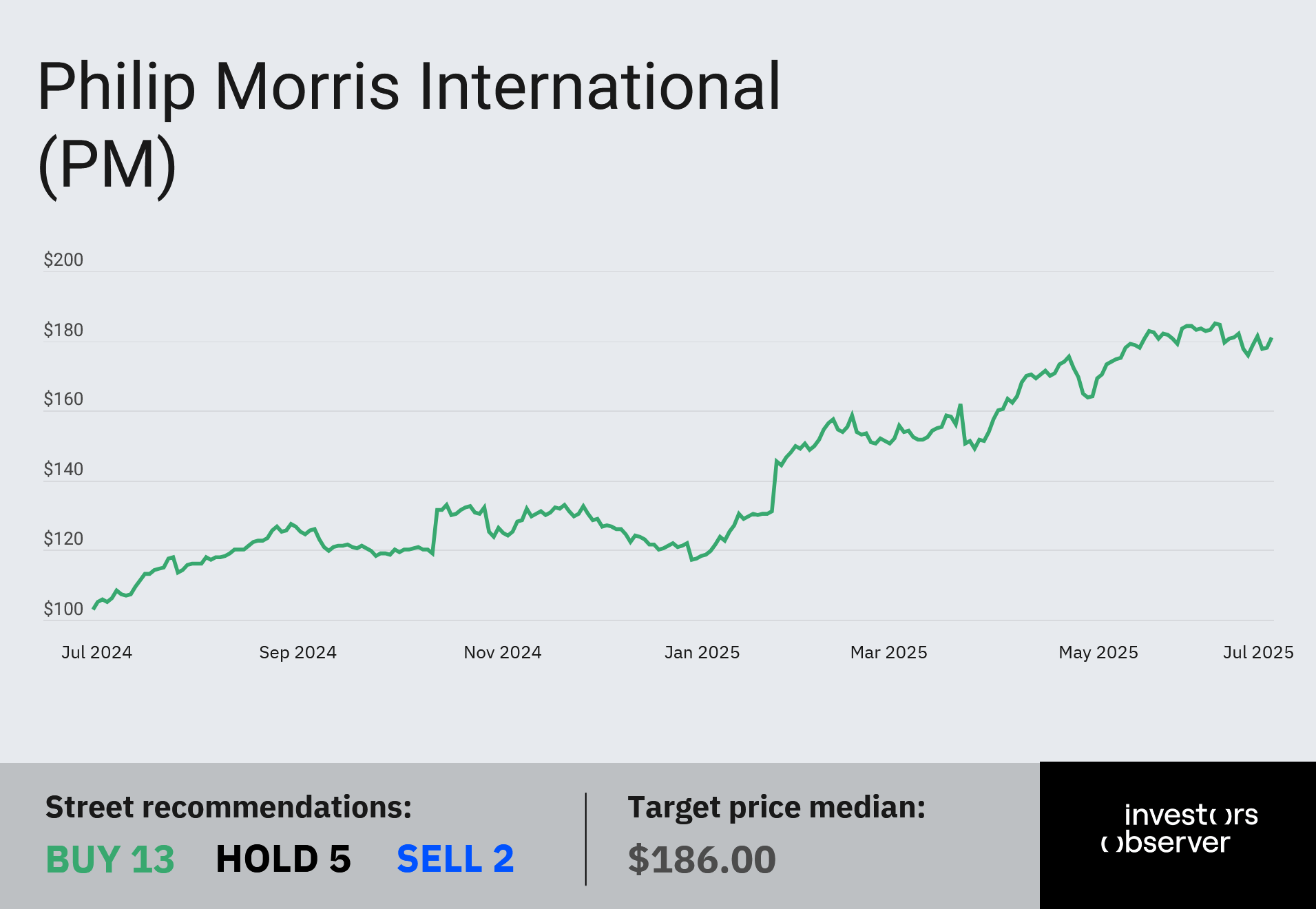

Meanwhile, Philip Morris is on a ZYN-fueled tear

Mundy was more upbeat on Philip Morris International (PM), initiating coverage with a “buy” rating and a $220 price target.

While Philip Morris is best known for Marlboro, the company’s nicotine pouch business (led by the explosive growth of ZYN) is driving much of its momentum.

ZYN sales surged 63% year-over-year in Q1, with over 200 million cans sold in the first three months of 2025. The brand has even become a cultural flashpoint in the U.S., reflecting both its popularity and its political relevance.

Philip Morris shares closed at $179.83 on Thursday. The stock is up 49.4% year-to-date and nearly 75% over the past year.

“Tobacco stocks are on a tear as bears are left with no other choice than to capitulate,” wrote Tobacco Insider on X.

Your email address will not be published. Required fields are markedmarked