While Wall Street waited for Nvidia’s (NVDA) blockbuster earnings report this week, one little-known semiconductor company was already on a tear.

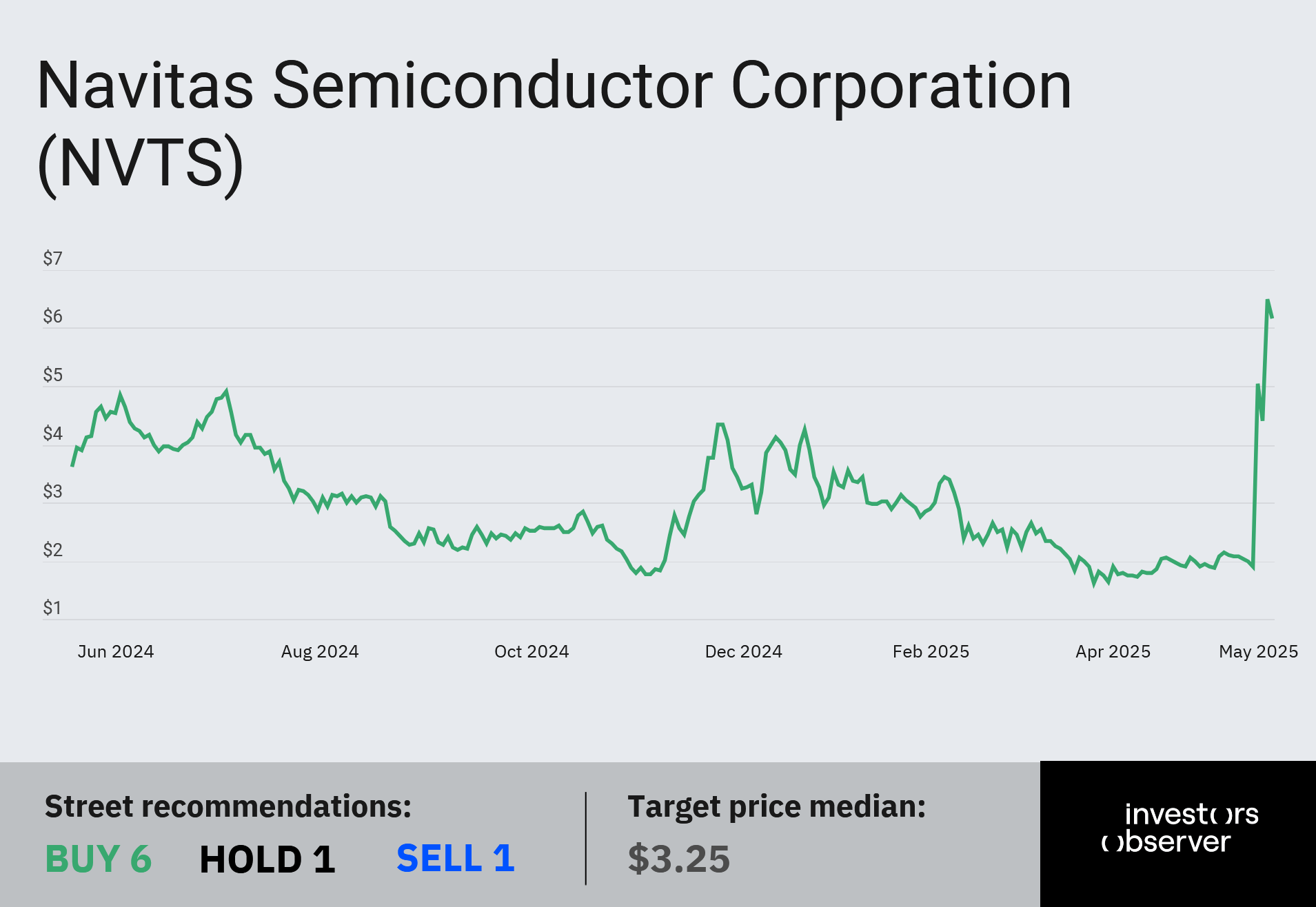

Navitas Semiconductor (NVTS) surged 105% over the past week after announcing it will supply power chips for Nvidia’s next-generation AI infrastructure.

The small-cap firm will support Nvidia’s upcoming 800 V HVDC rack systems (a major shift from current 54 V designs), using its gallium nitride (GaNFast) and silicon carbide (GeneSiC) power semiconductors.

These high-voltage setups are key to powering the next wave of data centers, which now require energy at a scale measured in gigawatts, not just kilowatts.

According to Navitas, traditional data center designs are hitting physical limits on copper use, power density, and efficiency, and Nvidia’s new 800 V HVDC architecture aims to solve that.

"With our wide portfolio range, we can support NVIDIA’s 800V HVDC infrastructure, from grid to the GPU,” Navitas CEO Gene Sheridan said in a statement.

The new systems will power Nvidia’s latest GPUs, including the upcoming Rubin Ultra chips. Nvidia plans to roll out the full architecture in 2027, giving Navitas a long runway for potential growth.

On X, Shay Boloor, host of the Stocktwits show, called the partnership “a signal.”

“When [Nvidia] — the most important compute company on the planet — taps a small-cap like Navitas to co-develop its next-gen 800 V HVDC architecture, it’s a signal,” he wrote. “As AI demand surges, the bottleneck isn’t model size — it’s power.”

The move has clearly resonated with the market. Navitas, which traded below $2 just last week, closed at $6.16 on Wednesday. The company’s market cap now sits at $1.26 billion.

Revenue down, risks looming

Not everything is firing on all cylinders for Navitas Semiconductor just yet.

In its Q1 earnings, Navitas reported $14 million in revenue, which is a major drop from $23.2 million a year ago and $18 million in Q4. Navitas CFO Todd Glickman blamed it on “seasonality and soft demand with associated inventory correction.”

For Q2, the company expects more of the same, forecasting revenue between $14 million and $15 million, thanks to slowing demand across solar, electric vehicle, and industrial markets.

The company hasn't steered clear of the tariff turmoil, either.

Sheridan acknowledged that most of the company’s silicon carbide revenue, which is a small but strategic segment, comes from China. But he also added that the company’s local focus limits risk.

“We have a very strong China for China strategy that I think serves us really well in these geopolitically complicated times,” he said. “Most of our packaging is in China.”

The management, however, is confident the company is ready for possible disruptions. “We have things well underway that could move us into different territories,” Sheridan told an analyst. “If the worst case scenario plays out.”

Even though revenue is down and risks are looming, investors are betting that Navitas' deal with Nvidia could be the start of something big.

Your email address will not be published. Required fields are markedmarked