Intuitive Machines (LUNR) has become one of the hottest yet polarizing names in the emerging space economy.

The reason is that despite lofty ambitions and major contracts, the company has yet to stick the landing. Literally.

Its first two lunar missions — part of NASA’s Commercial Lunar Payload Services (CLPS) program — both ended with landers tipping over shortly after touching down on the Moon.

The latest attempt, which sent the Athena lander atop a SpaceX Falcon 9 rocket on Feb. 27, missed its landing target by 250 meters and tipped over before running out of battery the next day.

Despite the mishap, CEO Steve Altemus declared the mission a “success” for reaching the lunar surface.

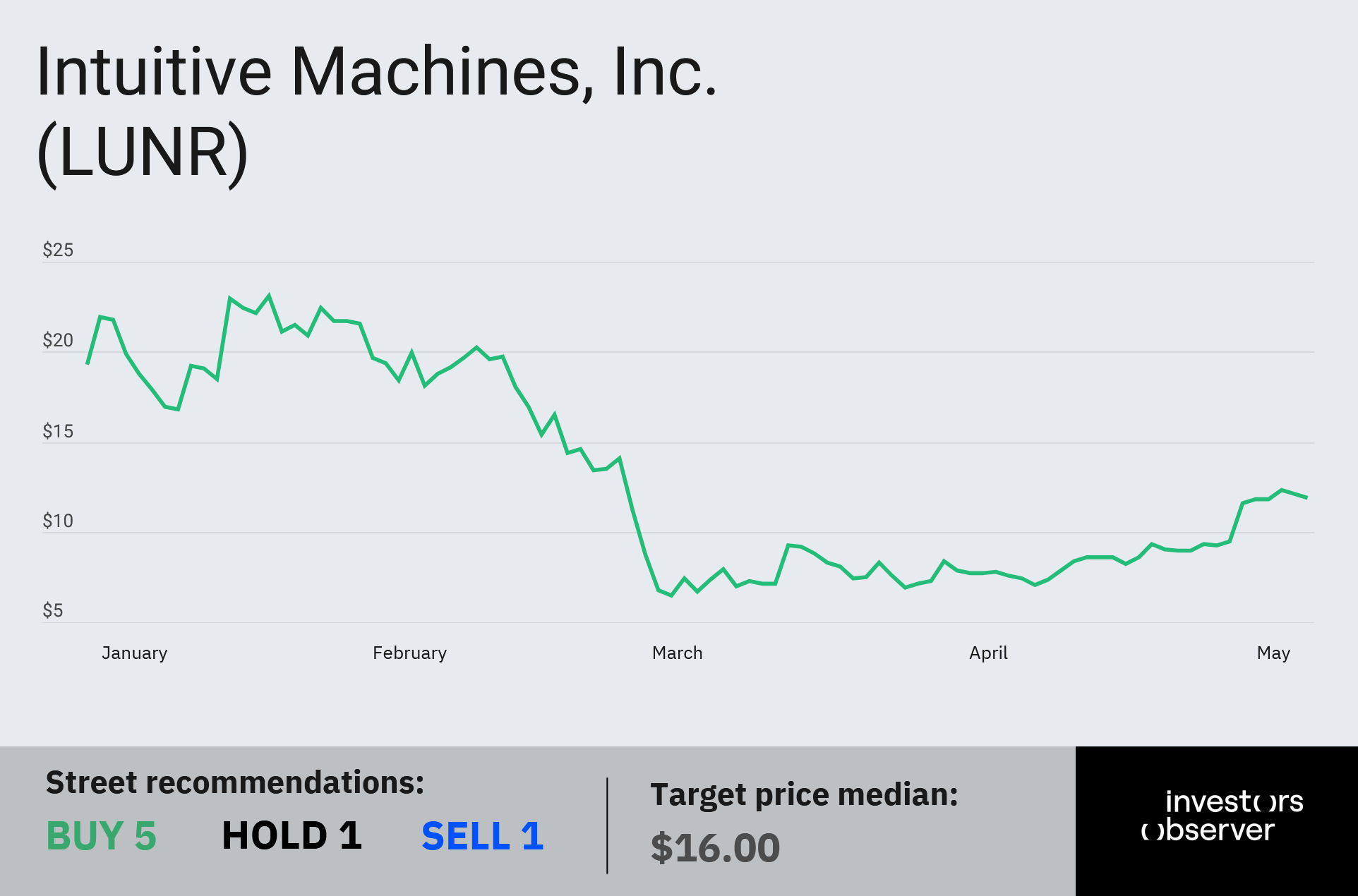

That comment didn’t sit well with investors. LUNR stock fell 42% in the two days following the announcement.

But during last week's first-quarter earnings call, Altemus struck a more serious tone. He said the company conducted a "comprehensive post-mission review," bringing in independent analysts to dissect what went wrong.

The review identified three key issues: interference with Athena’s laser altimeter, difficult terrain and lighting conditions, and errors in crater recognition tuning.

“We saw signal noise and distortion that did not allow for accurate altitude readings,” Altemus explained.

“South Pole topography and low-angle sunlight created long shadows and dim lighting conditions that challenged the precision capability of our landing systems.”

Third time’s a charm?

Having learned its lessons, Intuitive Machines is pushing forward with another landing..

NASA selected Intuitive Machines for a third lunar mission, IM-3, which will carry four science payloads to the Reiner Gamma region. That mission comes with a fixed-price contract worth $77.5 million.

Intuitive Machines is also in the running for NASA’s Lunar Terrain Vehicle (LTV) program, competing against Lunar Outpost and Venturi Astrolab. Final proposals are due in July, with a contract expected in November.

Q1 revenue came in at $62.5 million, up 14% from the previous quarter. CFO Pete McGrath credited payments tied to IM-2 and progress milestones from the LTV proposal.

The company projects full-year revenue between $250 million and $300 million.

Altemus also banks on future federal support, citing “continued momentum” from the White House. That’s despite the fact that the Trump administration is mulling budget cuts for lunar landers.

Shares of LUNR are down 34.5% year-to-date.

Your email address will not be published. Required fields are markedmarked