As the Elon Musk-Trump bromance falls apart, analysts say the White House is increasingly rethinking its space strategy, which opens the door for new players.

Chief among them is Rocket Lab (RKLB), a smaller, nimbler aerospace firm now seen as one of the top beneficiaries of the ongoing fallout.

“The U.S. space stack is being de-Muskified,” wrote analyst Shay Boloor in a recent X post. “RKLB is a top beneficiary.”

According to Boloor, Washington became “over-leveraged” on Musk’s SpaceX, relying on the billionaire’s infrastructure across everything from satellite launches to astronaut transport.

But that dependency turned into a liability, Boloor argues, when Musk “weaponized his leverage.”

The flashpoint came when Musk threatened to decommission Dragon, which is currently the only U.S. vehicle capable of sending astronauts to the International Space Station.

That was a step too far, and may have helped accelerate the administration’s decision to cut ties. “Sources say contingency planning is already underway,” wrote Boloor.

🛰️ Rocket Lab rises as NASA, DoD shift focus

While best known for its compact Electron rockets, Rocket Lab is increasingly building a broader presence across the space economy, including satellites, deep-space missions, and military applications.

As Investors Observer reported, the company was recently awarded another NASA launch contract for the Aspera spacecraft. The Aspera is part of a long-term study into the formation of the Milky Way. Liftoff is scheduled for 2026.

And in a major move into the defense sector, Rocket Lab acquired Geost, an Arizona-based firm that builds sensor systems for U.S. military clients. The $275 million deal is expected to pad Rocket Lab’s pockets with more government contracts.

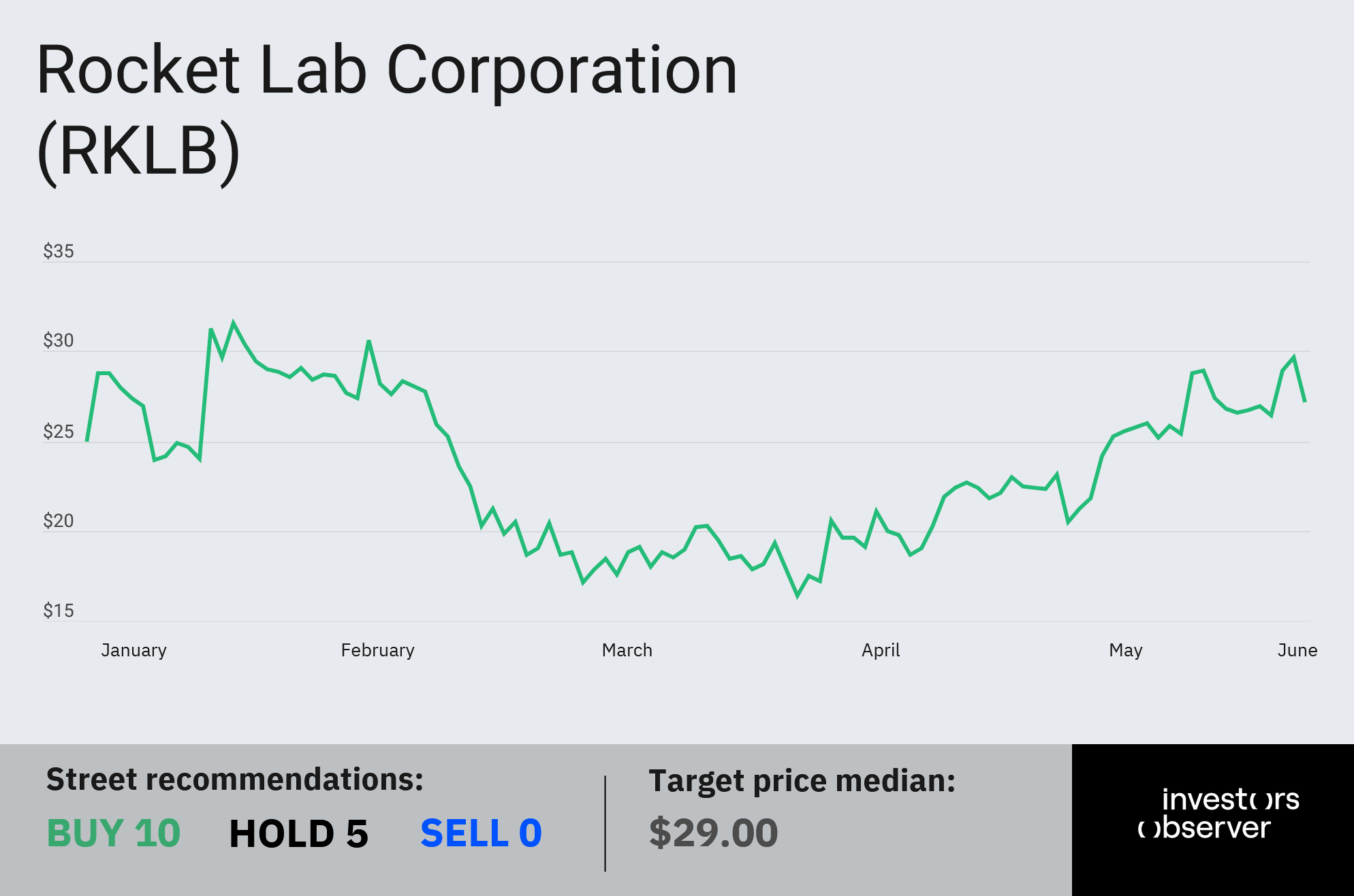

That expansion is already showing up in the numbers. In the first quarter, the company posted a 32% jump in revenue to $123 million, and forecasts $130–140 million for Q2.

RKLB stock is up more than 48% in the past month, and nearly 22% year-to-date, bringing its total market cap to around $14 billion. If Boloor’s prediction plays out, that number may just be getting off the launch pad.

Your email address will not be published. Required fields are markedmarked