Analysts at William Blair believe Tesla (TSLA) has a promising future as the electric vehicle giant evolves into an AI-driven mobility platform, but they acknowledge that the path forward will be challenging, especially after a challenging second quarter.

“We fundamentally believe in Tesla’s long-term solution of neural nets and vision only, but acknowledge it opens up attack vectors for the inevitable hiccups to come,” the analysts wrote in a recent note to investors.

The William Blair team contrasted Tesla’s compelling long-term potential — including autonomous vehicles and robotaxis — with near-term challenges such as declining sales in Europe and China, intensifying competition, and the cancellation of the Model 2 hatchback.

Many of these pressures have already surfaced in Tesla’s results, with revenue and earnings growth dropping sharply in the first quarter.

As Investors Observer reported, Tesla’s sales in Europe have been particularly hard hit, partly due to CEO Elon Musk’s ties to the Trump White House.

For instance, France — one of Europe’s largest EV markets — recorded a 67.2% decline in Tesla registrations in May and a 47% drop year-to-date.

The bad news continued in the second quarter, with Tesla’s vehicle deliveries plunging by 14% to 384,000. That was below Wall Street’s consensus forecast of 387,000.

Tesla stock could be worth much more

Tesla shareholders continue to face a trade-off between short-term turbulence and long-term growth potential. According to the William Blair team, investors who maintain a tactical, long-term perspective on Tesla will likely be rewarded.

If Tesla captures a significant share of the robotaxi market — projected to reach $1.4 trillion by 2040 — its robotaxi business alone could be worth nearly $300 per share, the analysts estimate.

With its energy and auto businesses, which could add about $60 more, Tesla’s total valuation would be well above current levels.

Tesla’s robotaxi service launched at the end of June, with nearly a dozen vehicles now picking up passengers in Austin, Texas.

To be truly competitive, however, Tesla will need to scale its robotaxi fleet far faster than Waymo, Google’s self-driving unit, which already operates in Los Angeles, San Francisco, Phoenix, Atlanta, and Austin.

As Investors Observer reported, Waymo provided 700,000 paid rides in California in March alone - a tenfold increase in less than a year.

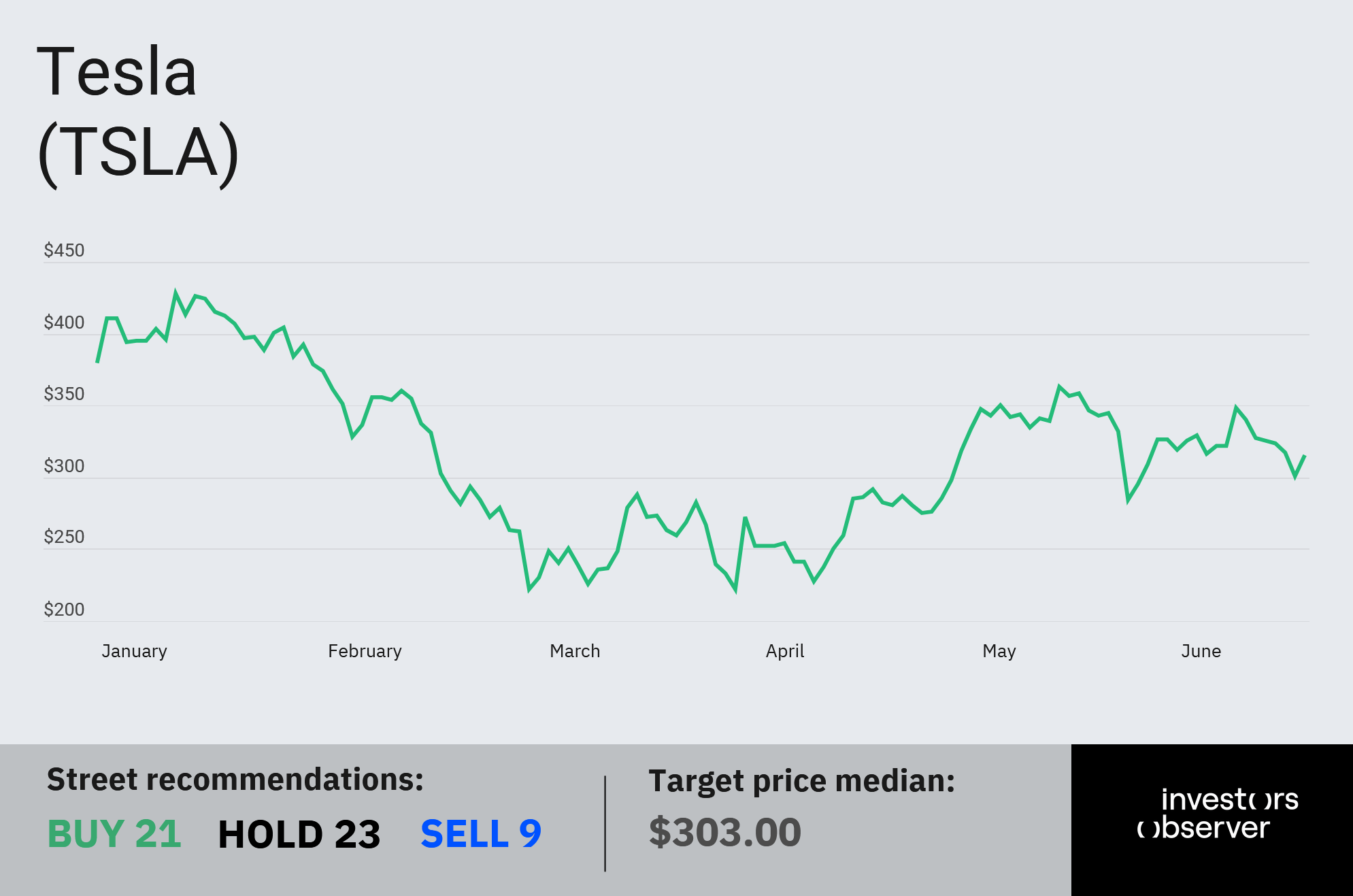

TSLA stock closed at $315.65 on Wednesday, gaining 5% on the day. However, the stock is down more than 16% since the start of the year.

Your email address will not be published. Required fields are markedmarked