Moody’s recent downgrade of U.S. debt sent Wall Street into a tailspin, but individual investors wasted no time buying the dip, according to new data from JPMorgan.

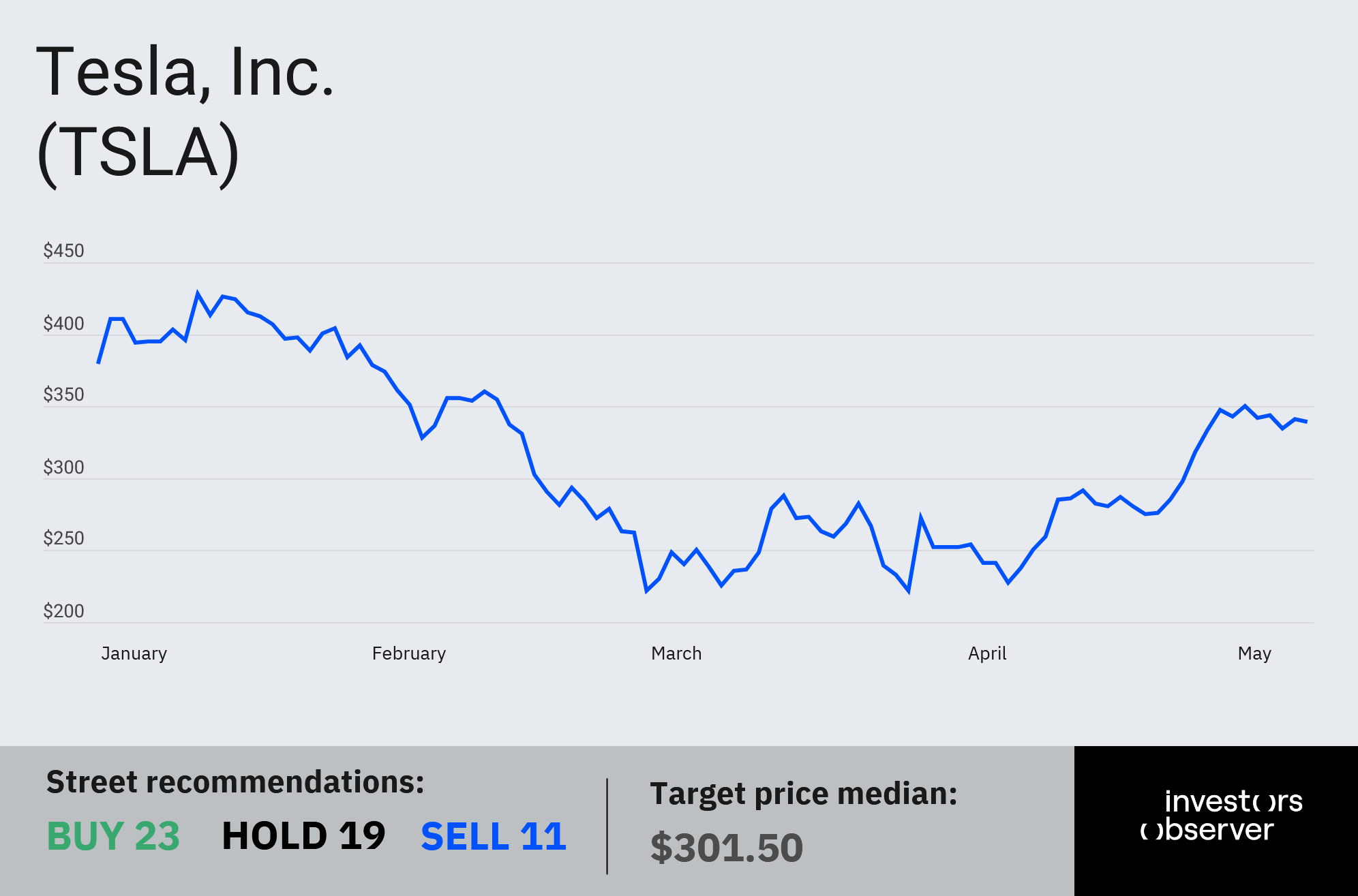

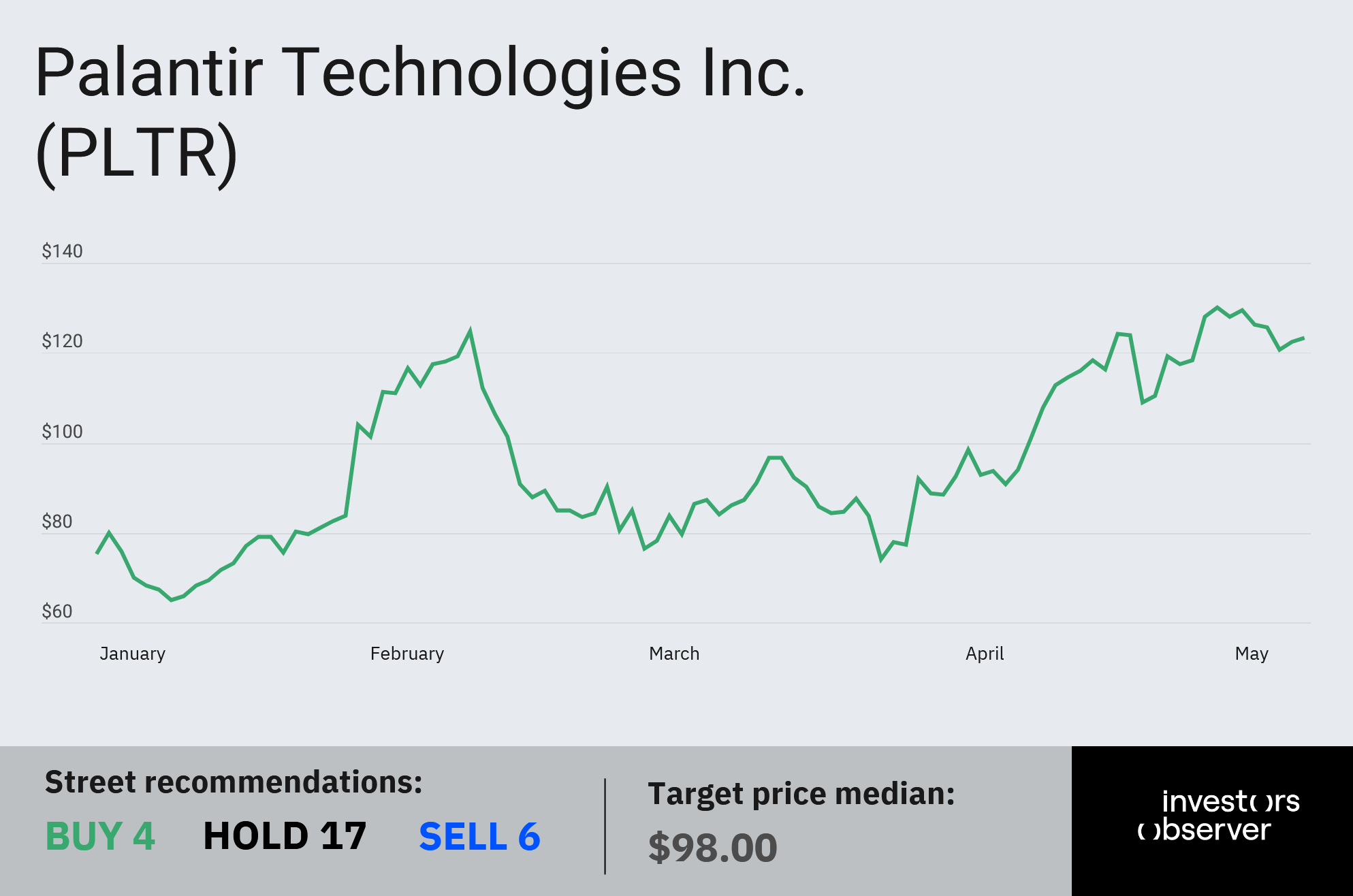

Within hours of the downgrade, retail traders snapped up $4.1 billion worth of stocks and ETFs, including $675 million in Tesla (TSLA) shares and $439 million in Palantir (PLTR).

The aggressive dip-buying highlights maturity among everyday investors who increasingly recognize pullbacks as opportunities.

Since bottoming on May 21, Tesla shares have climbed 2.4% for the week, while Palantir bounced 2.5% from recent lows.

Tesla, which was down as much as 46% at one point this year amid tariff headwinds, has now recouped the bulk of its losses and is down just 10% year-to-date.

Meanwhile, Palantir, continues to defy market jitters, gaining more than 64% in 2025 as it rides a surge in federal spending.

And it’s not just tech darlings that are popular among retail.

Since early April — when President Trump’s “Liberation Day” tariffs erased $4.6 trillion in market value — retail investors have poured roughly $50 billion into stocks, JPMorgan says.

"The bull market probably isn’t finished"

Stocks stumbled again Friday after Trump started swinging new tariff threats aimed at smartphone makers. But analysts remain confident that the broader rebound still has legs.

“The bull market probably isn’t finished, and the S&P 500 may yet end the year with single-digit gains,” wrote Andrew Slimmon, head of Morgan Stanley’s applied equity advisors team.

If history is any indication, when the S&P 500 drops 15%, it returns, on average, 14% one year later.

Strategic Wealth Partners CEO Mark Tepper seconded JPMorgan’s optimism on Fox Business, saying U.S. stocks have already entered a new bull market.

He highlighted strength in industrials and tech, with more than 90% of stocks in those sectors trading above their 50-day moving average (a key technical signal of momentum).

Tepper also noted that unlike bear markets driven by fundamentals, this one was triggered by politics, and policy-driven corrections, he said, tend to reverse fast.

“When there’s a policy-influenced bear market, something that is self-inflicted, man-made [...] those hemorrhage quickly and snap back super quick,” he said.

Your email address will not be published. Required fields are markedmarked