TeraWulf (WULF) announced on Thursday that it had signed two 10-year high-performance computing (HPC) colocation contracts with AI cloud platform Fluidstack.

Google (GOOG) will backstop $1.8 billion of Fluidstack’s lease obligations to support project-related debt financing.

In return for Google’s funding, it will receive warrants to acquire approximately 41 million shares of TeraWulf common stock, giving the tech giant an 8% stake in the bitcoin mining and data center infrastructure company.

The deal will deliver approximately $3.7 billion in contracted revenue for TeraWulf over the initial 10-year terms, and includes two five-year extension options which would push the total contract revenue to approximately $8.7 billion if they are exercised.

Approximately 40 MW of critical IT load is expected online in the first half of 2026, with the full 200+ MW deployed by the end of 2026.

“This is a defining moment for TeraWulf,” the company’s CEO Paul Prager said in a statement. “We are proud to unite world-class capital and compute partners to deliver the next generation of AI infrastructure, powered by low-cost, predominantly zero-carbon energy.”

The 200+ megawatts of IT load will be provided at TeraWulf’s Lake Mariner data center in Western New York, which is a facility purpose-built for liquid-cooled AI workloads.

“This transaction underscores Lake Mariner’s status as a premier hyperscale-ready campus and further accelerates our strategic expansion into high-performance compute,” Prager added.

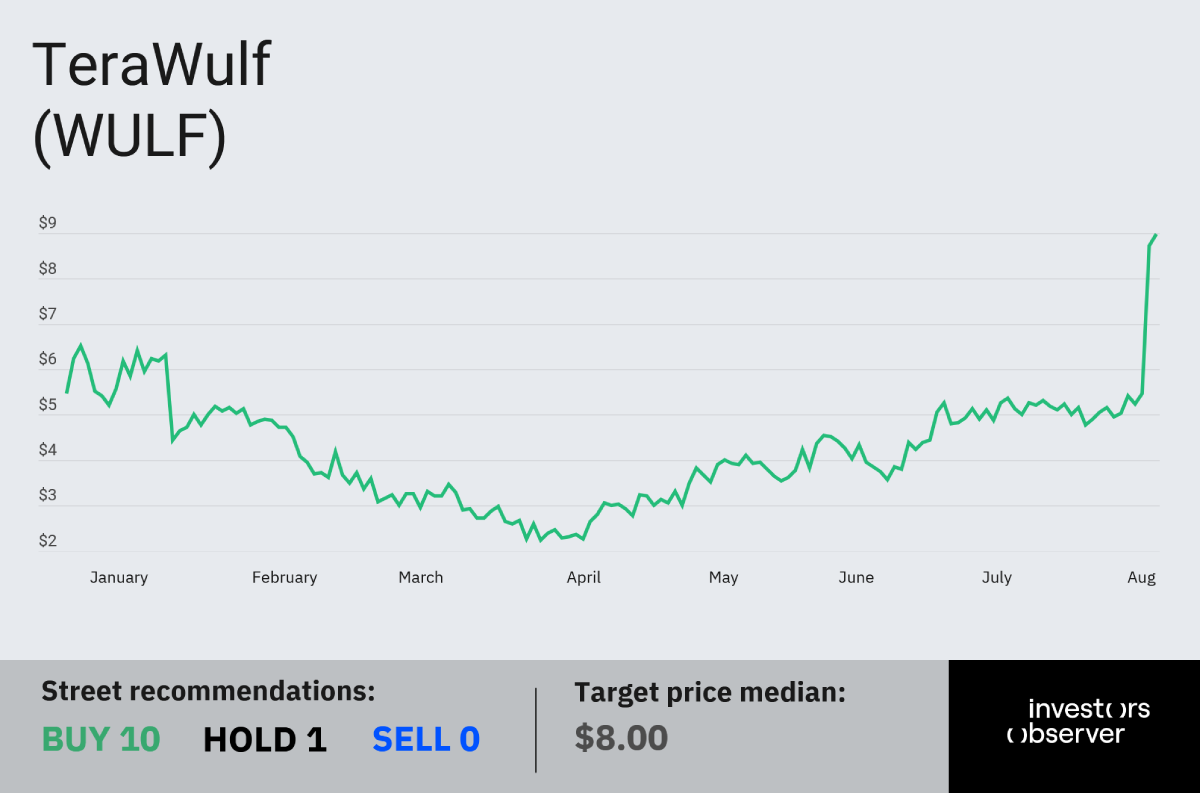

TeraWul shares soared 59.5% on Wednesday following news of the deal.

Mike Alfred, founder and managing partner of Alpine Fox, said in a post on X that even with its stock surging, TeraWulf is “still 40% undervalued when you only consider the asset base.”

And he notes that as more bitcoin miners begin pivoting their businesses toward powering HPC computing and AI services like TeraWulf has done – they should also experience substantial growth.

“A major re-rating is coming for all reformed Bitcoin miners who devote a substantial portion of their asset base to HPC/AI moving forward,” Alfred said. “This is the most important industry on the planet.”

Wall Street calls deal a ‘game-changer’ for TeraWulf

Northland maintained an Outperform rating on TeraWulf, while raising its price target by 20% to $12 from $10.

The analysts called the deal a “game-changer,” with the $1.8 billion backstop from Google “reflecting strong confidence from one of AI’s most influential players.”

“We believe the Google backstop significantly enhances WULF'S credit profile, enabling low-cost, scalable capital solutions aligned with WULF's growth trajectory to deploy 150-200 MW of new capacity annually,” Northland wrote.

Alfred expects that this deal – and especially Google’s involvement in it – signals the beginning of similar investments from other tech giants.

“For the last year, I couldn’t figure out why Microsoft, Amazon, Google, and Meta weren’t tripping over themselves to buy up these companies while they were really cheap,” he said. “The stampede has begun. Hold on to your hats.”

In addition to its deal with Fluidstack and Google, TeraWulf also said on Thursday that it executed on a long-term ground lease for approximately 183 acres at its Cayuga site in Lansing, New York, which it calls “a major step forward in the Company’s expansion of HPC and AI data center hosting.”

The lease is for 80 years and includes reciprocal purchase and sale options exercisable for $100 beginning in the 50th year of the agreement.

TeraWulf’s stock has now surged 53.9% for the year.

Your email address will not be published. Required fields are markedmarked