Leveraged bets on U.S. semiconductor stocks have surged since the “Liberation Day” market sell-off in April, prompting retail investors to lock in gains at one of the fastest paces since the pandemic.

The Direxion Daily Semiconductor Bull 3X Shares (SOXL) — an exchange-traded fund that offers triple-leveraged exposure to a semiconductor index spanning the NYSE and Nasdaq — has soared 120% over the past six months and 31% in September alone. Now, investors are cashing out.

SOXL has recorded $2.4 billion in outflows month-to-date, the second-largest in four years, according to Bloomberg data cited by The Kobeissi Letter, a market commentator. September marks the fifth straight month of outflows for the fund.

The withdrawals reflect a broader trend across leveraged ETFs, which have seen $7 billion in outflows this month, the most since 2019.

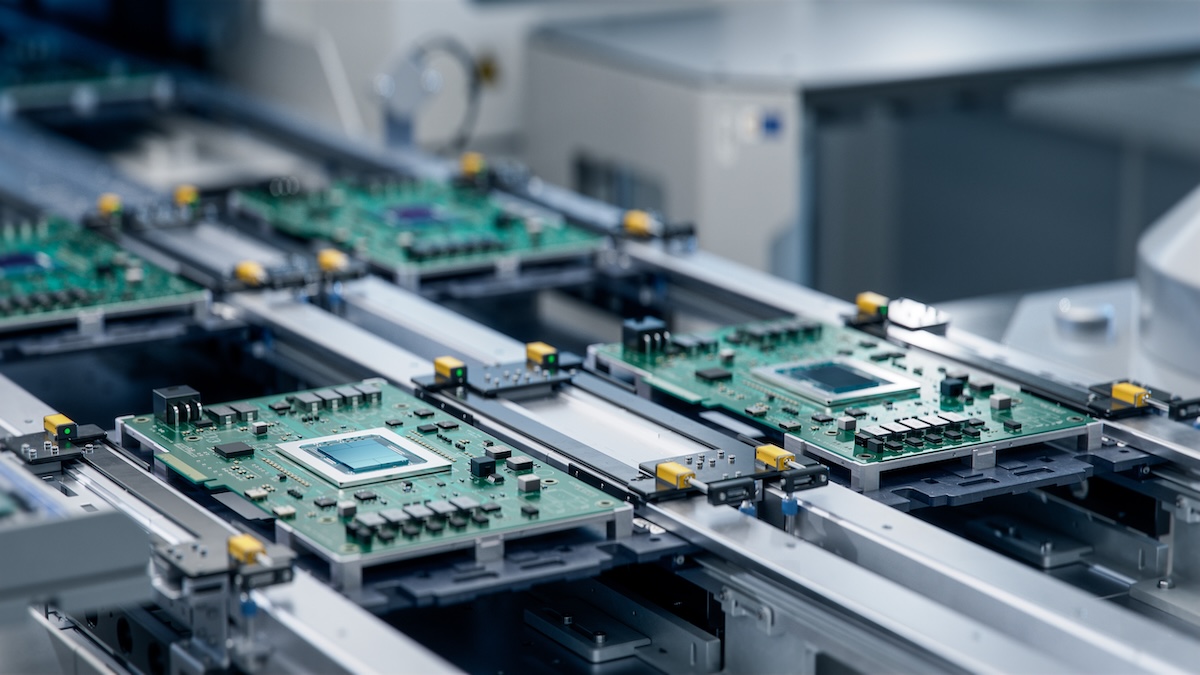

Once a focal point of the U.S.-China trade war, semi stocks have staged a rebound this year, fueled by optimism around trade negotiations, strong earnings from industry leaders, and the explosive growth of artificial intelligence.

Massive AI-related capital spending from major tech firms has further amplified the rally.

However, the latest wave of redemptions suggests investors are turning cautious, taking profits amid concerns that the sector’s bull run may be overextended and vulnerable to a pullback.

Valuation pressures and Fed uncertainty raise pullback risks for U.S. stocks

Despite steady inflows of global capital, the U.S. stock market may be nearing a correction as valuations stretch to historically high levels, according to Gene Goldman, chief investment officer at Cetera Financial Group.

Goldman told Yahoo Finance he expects a pullback driven by rising volatility and elevated forward price-to-earnings (P/E) ratios, which are approaching levels last seen during the tech bubble.

“Volatility is going to pick up and that’s where we see the pullback coming to play,” Goldman told Yahoo Finance in an interview.

He added that uncertainty surrounding the Federal Reserve’s next moves could amplify market swings. Policymakers remain divided over how quickly to adjust interest rates as they balance inflation control with economic growth.

Adding to the caution, Morgan Stanley strategist Mike Wilson warns that a more resilient U.S. economy could trigger a correction if it reduces the need for aggressive rate cuts that investors have already priced in after the September FOMC meeting.

Wilson described a “tension between the Fed’s reaction function and the market’s ‘need for speed’ in terms of rate cuts,” calling it a key near-term risk for stocks.

Your email address will not be published. Required fields are markedmarked