Medical technology firm Tempus AI (TEM) announced that it has acquired Paige, an AI technology company specializing in digital pathology, for $81.25 million.

The transaction is being paid predominantly in Tempus common stock, as well as Tempus’ assumption of Paige’s remaining commitment under its existing Microsoft Azure cloud services agreement.

Tempus said that the acquisition of Paige allows it “to grow its dataset, expand its experienced technical team, and establish a strong footprint in digital pathology with an industry leading technology portfolio.”

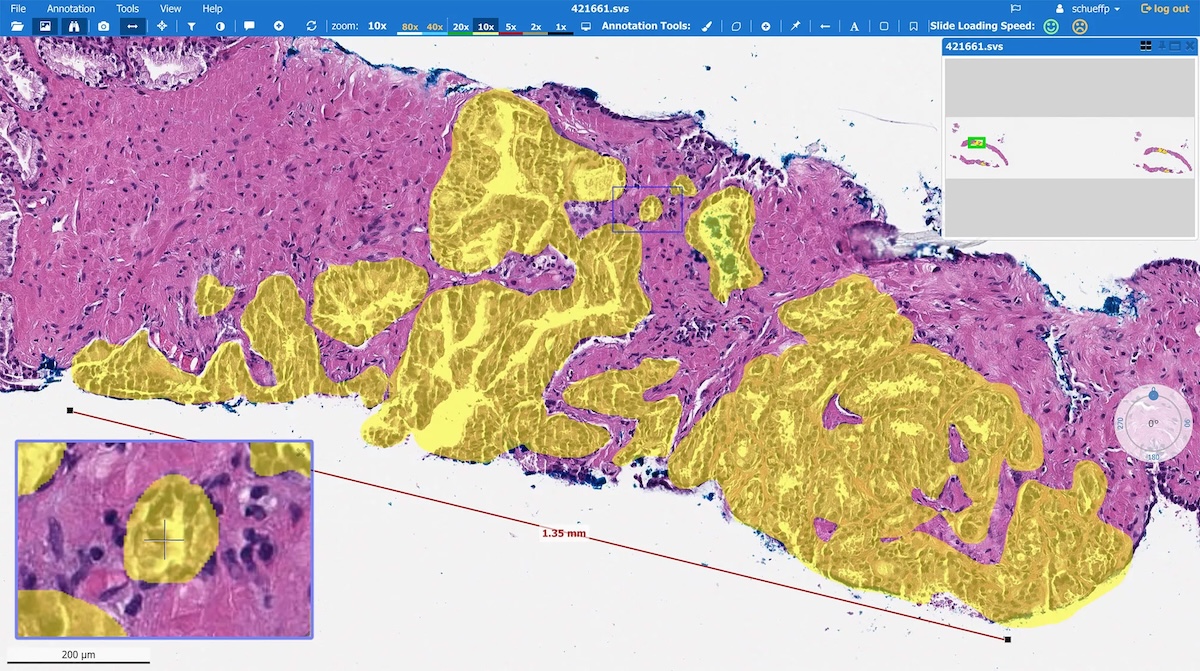

Paige was founded in 2017 and deployed the first FDA-approved AI application in pathology, which allows researchers and pathologists to better detect cancer.

The company has a dataset that includes almost seven million digitized pathology slide images and associated clinical and molecular data.

Tempus has claimed to already operate the world’s largest clinical and molecular database, with its tools now used by cardiologists, oncologists, pharmaceutical companies, and academic researchers.

The Chicago-based company announced earlier this year that it was expanding its AI-powered clinical platform, Tempus Next, into breast cancer care.

The system, already in use for lung cancer treatments, helps physicians close biomarker testing gaps by using real-time data from patient records and clinical guidelines to improve treatment decisions.

“As we embark upon building the largest foundation model that’s ever been built in oncology, the acquisition of Paige substantially accelerates our efforts,” said Eric Lefkofsky, Founder and CEO of Tempus.

Lefkofsky noted that Paige “has amassed one of the most comprehensive digital pathology datasets in the world through its relationship with Memorial Sloan Kettering Cancer Center,” which is one of the leading cancer hospitals in the world.

Shares of Tempus have surged 116.9% this year.

A great deal for Tempus. Was it a good deal for Paige?

TEM stock has been largely driven by the support of Cathie Wood’s Ark Invest. Wood now holds about $416.4 million worth of TEM in her flagship Ark Innovation ETF (ARKK).

She told CNBC in February that she thinks the “most underappreciated application of AI is healthcare.” “Data is the name of the game,” she said.

And while the acquisition appears to be a great deal for Tempus, allowing it to further expand its sizable dataset and boost its digital pathology footprint, one industry expert questioned whether the deal was actually favorable to Paige.

Dr. Tanishq Mathew Abraham, CEO of Sophant and founder and ex-CEO of MedARC AI, called Paige “trailblazers in the field” of pathology AI in a post on X.

“However, they only got acquired for $81M, despite raising a total of $241M,” he said. “And the acquisition was clearly a pure data play (dataset of millions of pathology slides from Memorial Sloan Kettering Cancer Center).”

Abraham wonders whether Paige was perhaps a victim of its own pioneering status in the field, developing its AI-powered solution before large sums of money began pouring into artificial intelligence.

“I think it's clear AI will have a huge impact in pathology but it seems like companies like Paige may have been too early to directly capture the value?” he said.

Although it should be noted that Tempus itself celebrated its 10th anniversary this week, making it a pioneer in the field as well.

Your email address will not be published. Required fields are markedmarked