Sezzle’s (SEZL) buy now, pay later (BNPL) business model may be one of the beneficiaries of a slowing economy and belt-tightening.

On the company’s earnings call Wednesday, CEO Charlie Youakim acknowledged that Sezzle still makes up less than 10% of the payments market. But he framed it not as a weakness but as an opportunity.

“We believe that our sector will continue to gain share as we gain share within it,” Youakim said.

“It’s a great time to be in the buy now, pay later space. There is a heightened level of uncertainty in the economy. Consumer sentiment is dropping, and many consumers seek out flexibility in their finances in uncertain times.”

BNPL allows consumers to pay for purchases in several installments. This model grew in popularity during Covid when job loss and income insecurity were widespread.

In Q1, Sezzle reported a 123.3% year-over-year revenue jump to a new quarterly record of $104.9 million.

The company credited “higher engagement and the sustained lift” from its partnership with WeBank, which began in August. Under the agreement, WeBank originates and finances Sezzle’s products.

Revenue climbed to 13% of gross merchandise value (GMV), up from a previous high of 11.5% in Q4.

As of March 31, Sezzle reported 658,000 monthly subscribers, down from 707,000 at the end of Q4. The company attributed the dip to post-holiday seasonal trends.

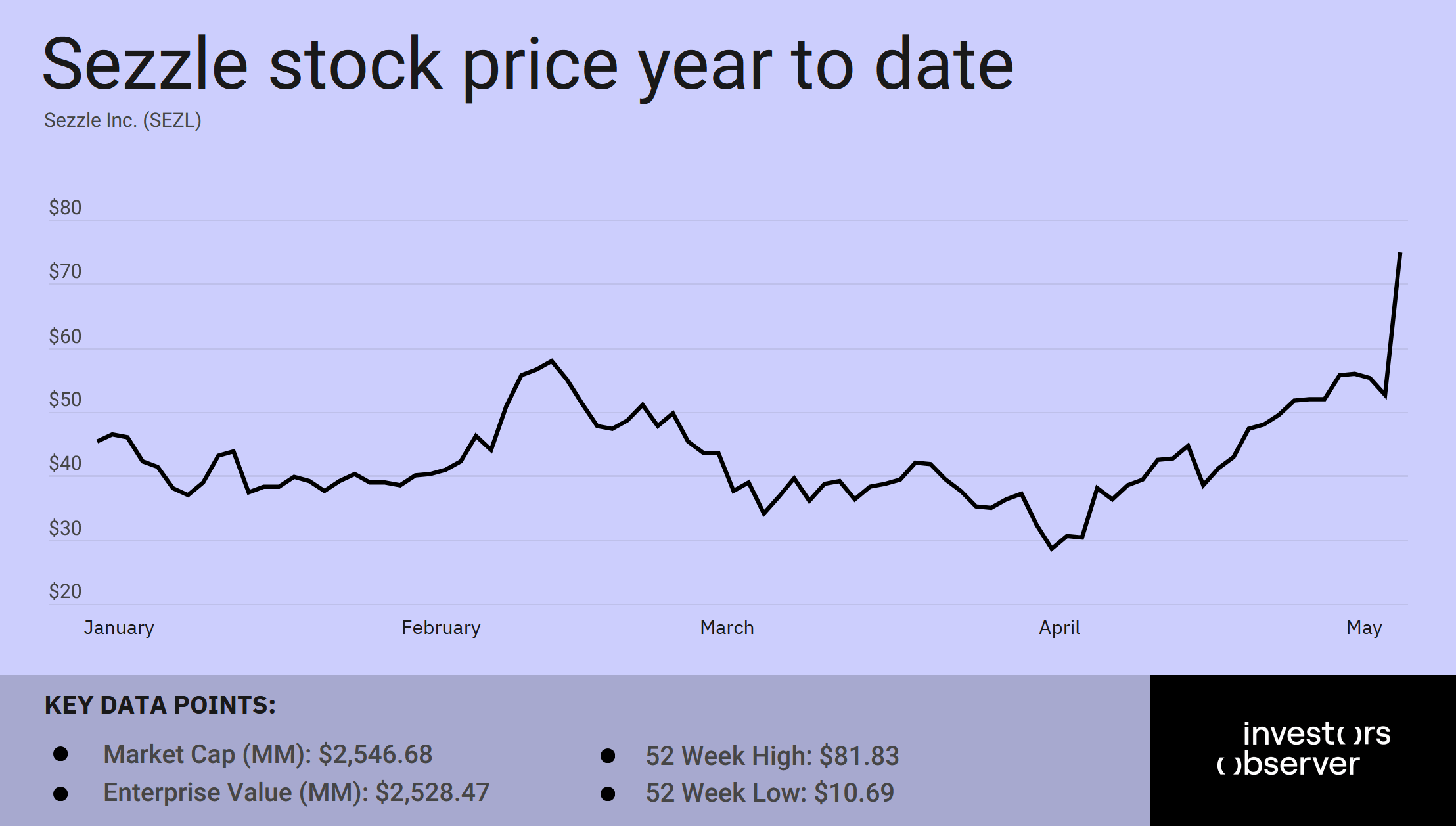

Sezzle raised its full-year revenue guidance to $120 million, up from the $80.4 million it reported in Q4. After the earnings, Sezzle’s stock soared 42.1% on Thursday and is now up 85.6% year to date, closing at $74.

Strong quarter clouded by short seller accusations

Despite a strong Q1 finish, Sezzle’s year began with a short-seller attack.

In January, short-seller Hindenburg Research disclosed a position, accusing Sezzle of risky lending practices and misleading metrics around customers and merchants.

Citing Sezzle’s Q3 earnings, Hindenburg pointed out that while the company claimed 23,000 active merchants — a 51% drop since 2021 — its own search found just 6,776 listed on the company’s website.

It also questioned how Sezzle could report 2.5x growth in subscription products while reporting a 20% decline in customers since 2021.

On lending, Hindenburg highlighted regulatory filings showing Sezzle borrowing at a 12.65% interest rate to lend to “extremely high-risk consumers whose credit is so bad that they are unable to access traditional credit cards.”

Sezzle denied the allegations, calling the report “misleading and out of context,” but investors took notice and the stock plunged 28.6% following the short-seller’s publication.

Addressing concerns on the earnings call, Youakim said Sezzle’s lending model is rooted in financial responsibility.

“BNPL is aligned with responsible repayment,” he said. “Consumers must be current with us or they aren’t allowed to continue to use us as a payment method.”

Following the earnings beat, B. Riley Financial raised its price target on Sezzle from $63 to $101 and reiterated its Buy rating.

The firm called the company’s updated guidance “one of the most sizable upward revisions” it had seen in some time.

Your email address will not be published. Required fields are markedmarked