Wall Street had hoped President Trump’s tax cuts and deregulation push would revive the “animal spirits” that drove stocks after his 2016 election win.

And while Trump’s “One Big Beautiful Bill” may come with the tax cuts he promised, his sweeping tariffs are still keeping investors on edge.

The result is a hesitant retail investor base that is still wary of macro shocks.

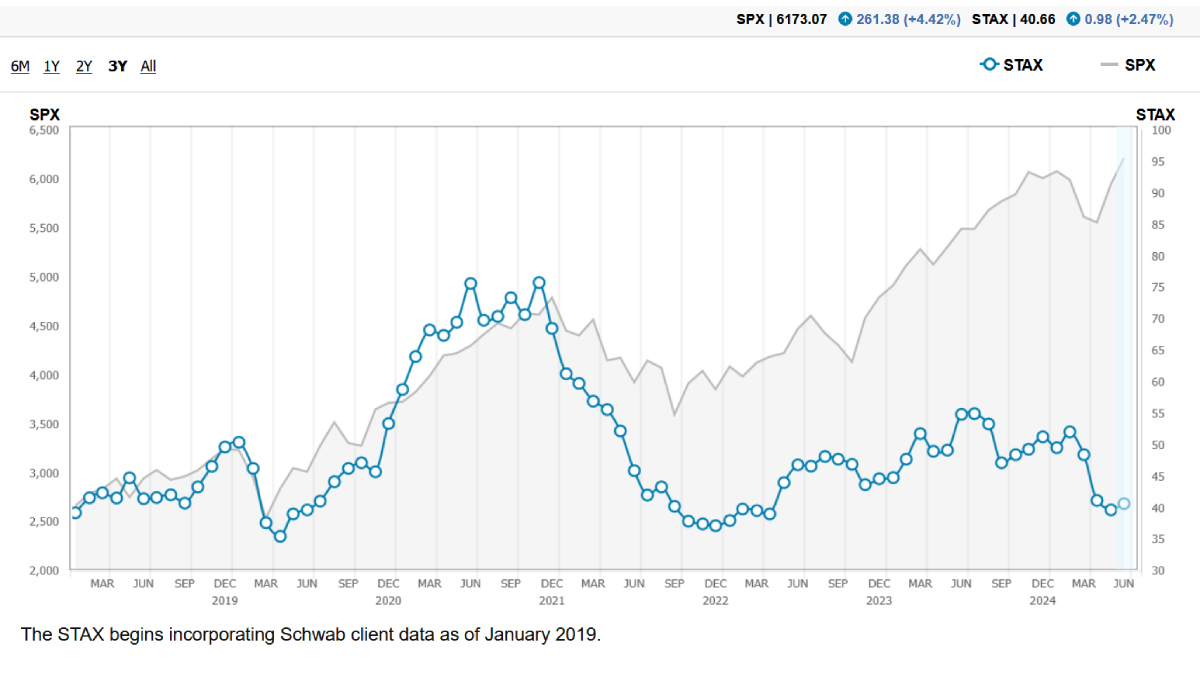

The Schwab Trading Activity Index (STAX), which tracks the behavior of Schwab’s self-directed clients, fell for three consecutive months before edging up in June.

The latest reading rose 2.47% to 40.66, which is still far below the February peak of 51.94 and only slightly above May’s two-year low.

“Clients gingerly dipped their toes in the water but stayed cautious,” Schwab noted.

Schwab pointed to easing market volatility and a slight improvement in geopolitical sentiment as drivers of the modest bounce.

Investors appeared less concerned that Trump’s tariffs would spiral into a worst-case trade war scenario.

Meanwhile, tensions between Israel and Iran, though still present, did little to rattle markets.

AI stocks fall out of favor

One of the most notable shifts in June was a flight out of Nvidia (NVDA), even as the AI leader hit new highs.

Information technology was the most net-sold sector on a dollar basis for the fifth straight month, followed by financials and communication services.

It marked the sixth consecutive month of broad net selling across tech stocks.

Instead, investors rotated into consumer discretionary, health care, and industrials, with the latter likely benefiting from falling Treasury yields, which can help debt-heavy companies.

“It is possible clients were looking for some non-tech, lower-beta movers,” said Joe Mazzola, Schwab’s head trading and derivatives strategist.

“The drop in Treasury yields during June might have made the industrial sector look more attractive because those companies tend to have a good deal of debt on their balance sheets.”

Tesla (TSLA) was the top individual buy, likely driven by investor enthusiasm around the company’s robotaxi reveal. It was followed by Palantir (PLTR) and Amazon (AMZN).

Shares of Circle Internet Group (CRCL), which went public last month, also saw strong interest from Schwab clients, despite a sharp pullback after its meteoric rise.

“Clients bought into the momentum trade,” Mazzola said. “They added heavily to Circle as it rose five-fold, but those who didn’t pare back saw the stock retreat from around $300 to $180 a share.”

“There’s a good lesson to be learned in how massive price moves and volatility can swing both ways.”

Your email address will not be published. Required fields are markedmarked