Rocket Lab (RKLB) is setting the stage for liftoff in the second half of the year, thanks to a major acquisition in the defense sector and the long-awaited launch of its next-generation rocket.

On Tuesday, Rocket Lab announced it had acquired Geost, an Arizona-based company that builds sensor systems used in missile tracking and surveillance.

Valued at $275 million, the deal brings Rocket Lab deeper into the world of national security and military contracts.

Geost’s technology is used in critical defense systems, including space-based cameras and sensors that help detect threats in real time.

By bringing Geost in-house, Rocket Lab expands its ability to offer full-service satellite and payload solutions, which could give it an edge when competing for Pentagon missions.

The timing of the deal is key.

Rocket Lab is preparing to launch its long-awaited Neutron rocket later this year, a next-generation vehicle designed to carry large batches of satellites into low-Earth orbit.

The rocket has been in the works since 2021 and is positioned to help power future satellite networks like Amazon’s Project Kuiper or SpaceX’s Starlink.

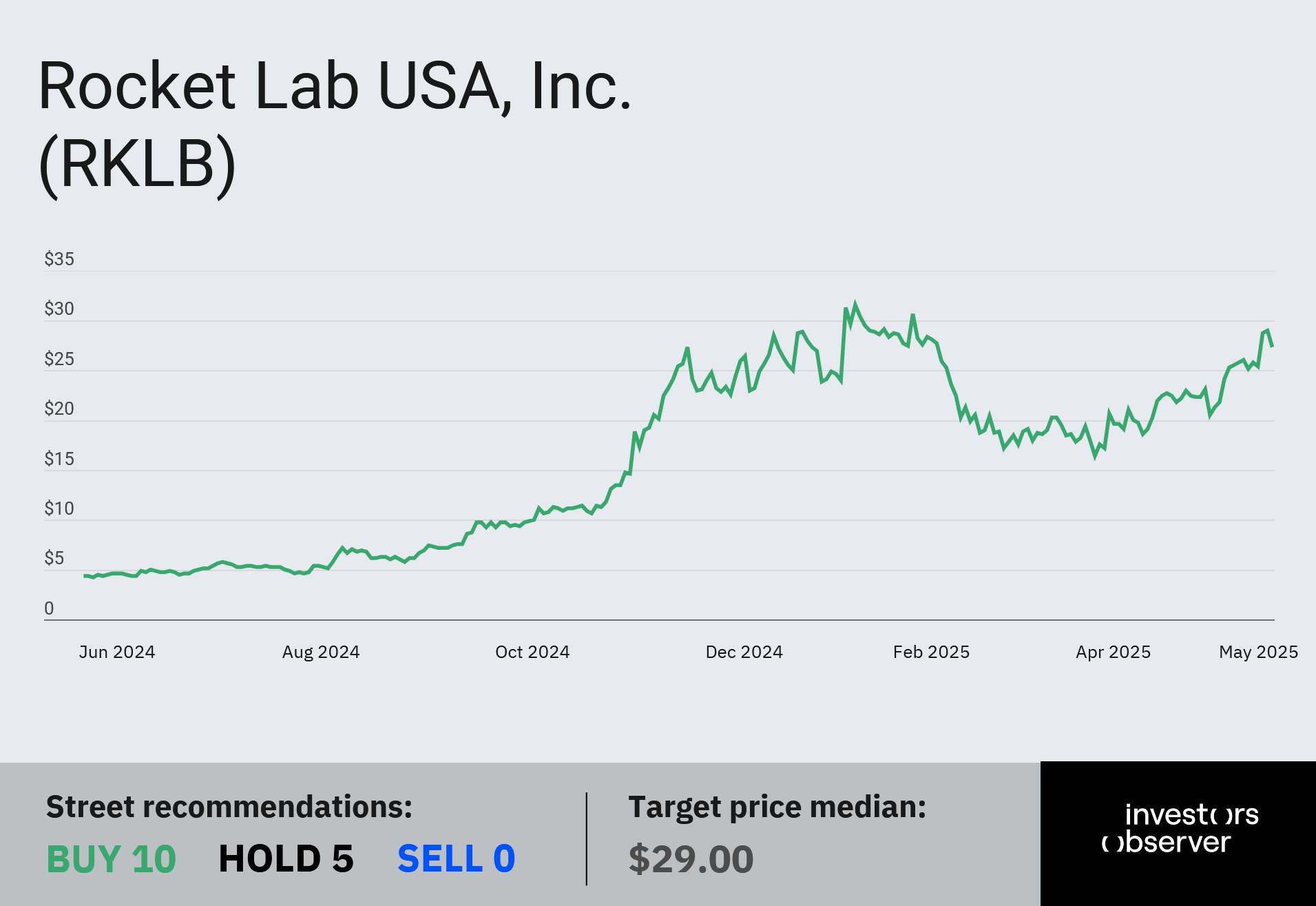

RKLB stock has already caught the attention of individual investors who are betting on space stocks. Now, Wall Street is starting to take notice, too.

Following the Geost acquisition, Stifel analyst Erik Rasmussen raised his price target on RKLB to $34, suggesting more upside even after the stock’s 500% rally over the past year. He also reiterated his “buy” rating.

As of Thursday morning, Rocket Lab is trading just under $30 per share.

Not just another space frenzy

Rocket Lab’s rally isn’t based on sheer hype. Its business is growing fast, with the company reporting $123 million in revenue for the first quarter, up 32% from a year ago.

It also notched a major milestone by getting its Neutron rocket accepted into the U.S. Department of Defense’s National Security Space Launch program, essentially the shortlist for Pentagon-approved launch providers.

Most of that revenue came from its space systems business ($87 million), with the rest from launch services ($35.6 million). The company also reported a growing backlog of $1.067 billion.

For the current quarter, Rocket Lab expects to bring in between $130 million and $140 million.

Despite the growth, Rocket Lab isn’t profitable yet.

Management projects a loss of $28 million to $30 million this quarter, and analysts don’t expect the company to turn a profit until at least next year.

But for now, investors seem more focused on what’s coming — from defense contracts to mega-constellation launches — and Rocket Lab is positioning itself as a serious contender in both.

Your email address will not be published. Required fields are markedmarked