Electric vehicle maker Rivian (RIVN) is gaining traction on multiple fronts — from deliveries to brand awareness and production capacity — but one of the clearest signals of momentum may be on social media, where users are increasingly comparing the company directly with Tesla.

On Reddit, Rivian’s community of 129,000 members frequently hosts side-by-side comparisons of the two brands.

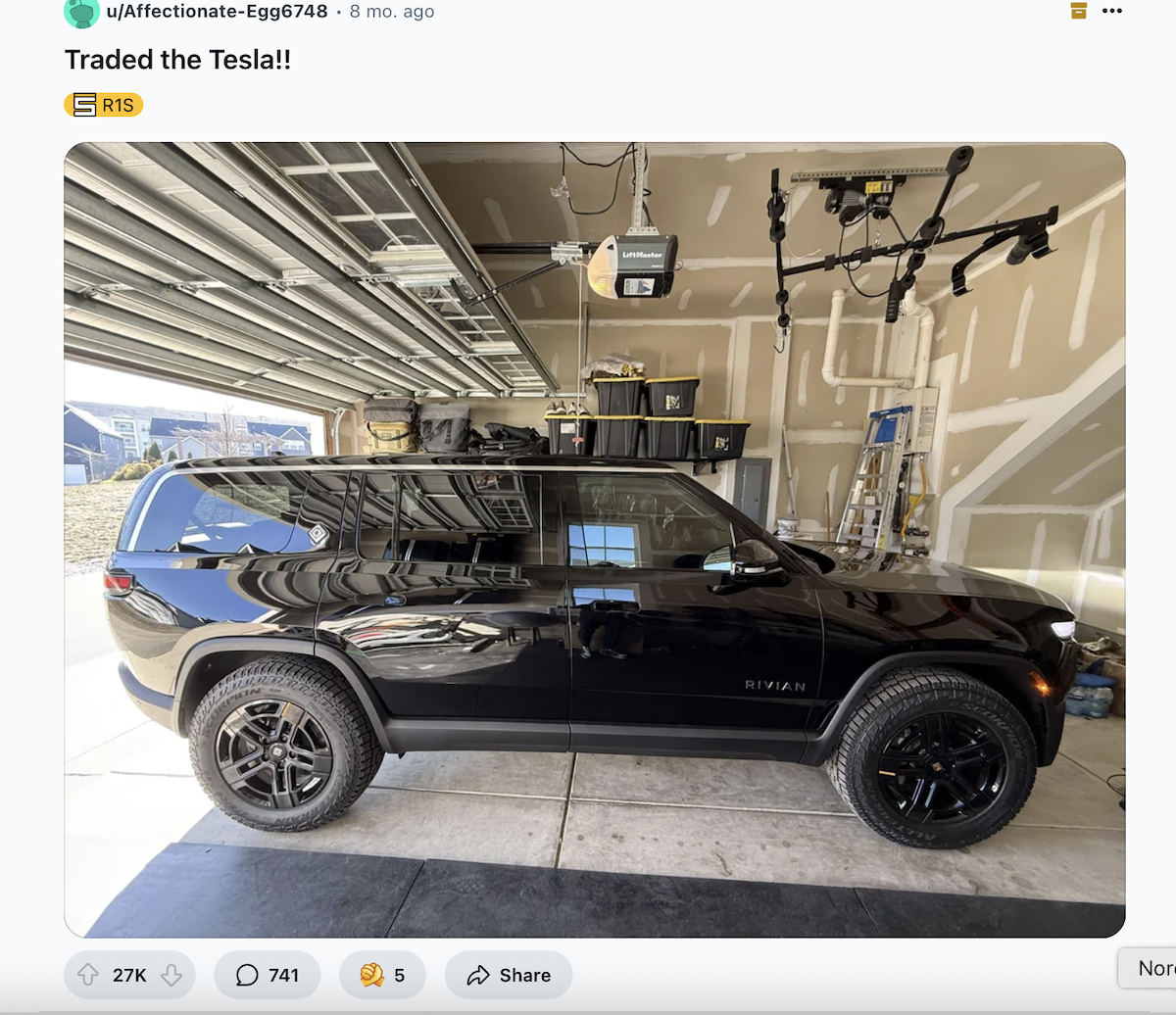

The forum’s most upvoted post from the past year — showing a user trading in a Tesla Model Y for a Rivian R1S — drew more than 27,000 upvotes and 741 comments before being archived. Similar threads highlight a steady stream of Tesla owners making the switch.

The enthusiasm extends beyond Reddit. Rival IQ’s latest industry rankings place Rivian as the top automotive brand for engagement on Facebook and third on TikTok, where its engagement rate is 6.6 times higher than the industry average. Tesla, notably, failed to crack the top three on any platform measured.

Rival IQ attributes Rivian’s strong brand reputation in part to its emphasis on “innovation, adventure, and sustainability.”

Brand recognition has been climbing since at least 2023, when a CivicScience survey found a small but notable share of U.S. adults either planning or considering a Rivian purchase.

That interest has accelerated as Rivian has unveiled more affordable models aimed at broadening its customer base.

Rivian has made progress, but challenges remain

Rivian’s growing brand recognition may bode well for future sales, but the company remains a relatively small EV player. For 2025, Rivian is forecasting between 40,000 and 46,000 deliveries.

In the first quarter, the company sold 8,553 EVs in the U.S. Tesla, by comparison, delivered 128,100 vehicles over the same period.

Despite signs of slowing momentum in global markets, Tesla still commands about 38% of the U.S. EV market. By contrast, CleanTechnica data puts Rivian’s U.S. share at under 3%.

That imbalance underscores Rivian’s uphill battle in a crowded EV landscape — and its shaky stock performance. Shares of RIVN are little changed over the past year, trading around $13, a steep fall from the company’s $78 IPO price in November 2021.

At current values, Rivian has a market cap of roughly $16 billion.

The company’s second-quarter earnings report also disappointed investors. Rivian posted an adjusted loss of 80 cents per share, worse than the 65-cent loss analysts expected. The company also projected core losses of $2 billion to $2.25 billion for the year, higher than earlier forecasts.

The deeper losses are partly linked to reduced U.S. regulatory credits for EV purchases under the Trump administration.

Your email address will not be published. Required fields are markedmarked