Palantir Technologies’ (PLTR) sudden flash crash on Friday caught many investors off guard, fueling fears that the data analytics company was facing steep valuation risks. But one analyst says the drop was “much ado about nothing.”

The sharp sell-off occurred because Palantir is the largest holding in the Russell 1000 MidCap Index, accounting for about 9% of the benchmark, according to stock analyst and YouTuber Amitinvesting.

“Because the index was rebalancing, funds were forced to sell shares,” he wrote. “When PLTR got into the S&P and Nasdaq, funds were forced to buy. This was the opposite scenario.”

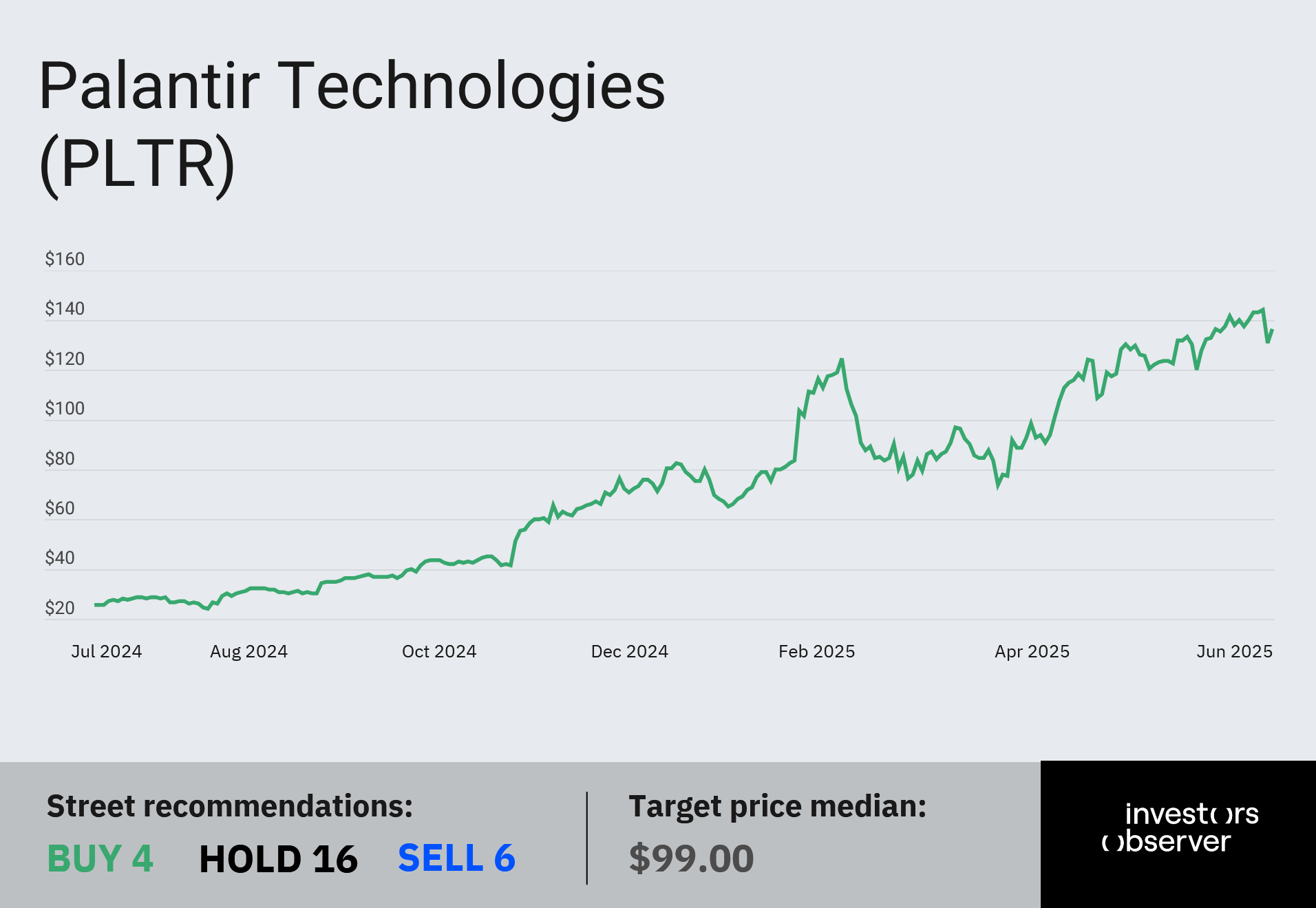

Palantir stock fell 10.6% on Friday, closing at $130.74. Despite the drop, the stock is only 13% below its 52-week high and boasts a market cap of $308 billion.

The sell-off came even as the S&P 500 and Nasdaq Composite closed at record highs - a sign, Amitinvesting noted, that the decline was more about index mechanics than company-specific news.

Despite the technical dip, Palantir remains one of Wall Street’s top-performing tech names, up 73% year-to-date and more than 400% over the past 12 months.

Even more impressive, PLTR has nearly doubled since its April 4 low, when the stock tumbled alongside the broader market after President Trump’s “Liberation Day” tariff announcement.

Rising government demand comes with risks

Palantir’s remarkable success is largely rooted in its deep ties with the U.S. government and allied nations. The company is also expected to benefit from President Trump’s proposed “Golden Dome” missile defense system and a larger national security budget.

As Investors Observer reported, Palantir’s reliance on government contracts has given it a recession-proof formula, so long as the federal bucks keep flowing.

However, beyond government contracts, Palantir faces significant criticism for its alleged involvement in mass surveillance.

This issue was at the center of a recent WikiLeaks statement calling Palantir a “spyware company” that enables widespread data collection for government agencies.

WikiLeaks also cited a recent executive order from the Trump administration directing federal agencies to increase information sharing - a move that has already steered millions of dollars in new contracts to Palantir.

Despite the controversy and its rich valuation — currently trading at 73 times revenue — Morningstar analysts say Palantir is likely fairly valued at these levels.

“Our analysis concludes that we are in the early innings of an AI revolution. In our base case, we expect Palantir to have a growth profile similar to that of innovative software companies like Salesforce in the late 2010s,” wrote Morningstar’s Mark Giarelli.

Your email address will not be published. Required fields are markedmarked