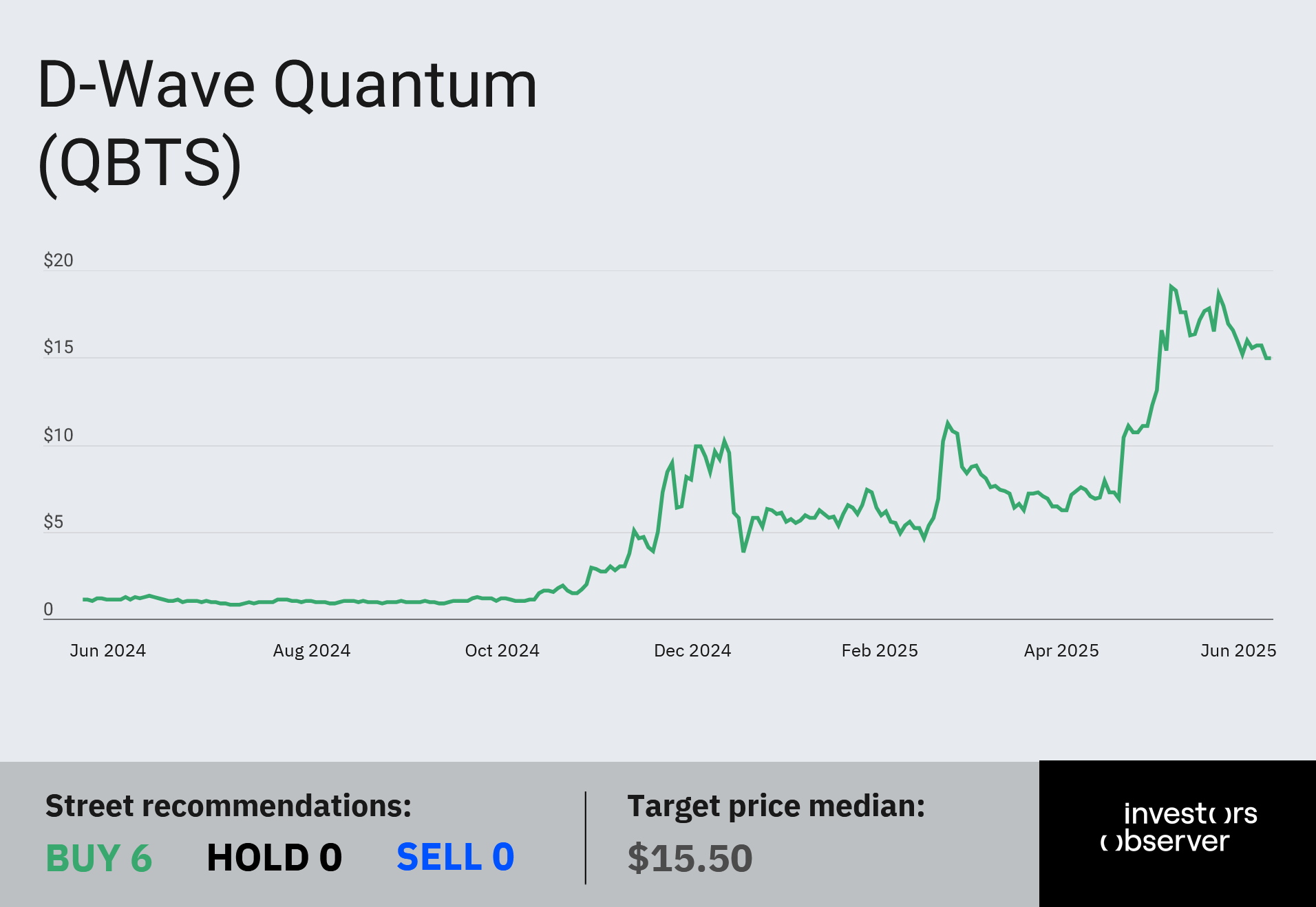

Shares of D-Wave Quantum (QBTS) are showing mixed performance across monthly and yearly timeframes, yet several analysts have reiterated their ‘Buy’ ratings despite a 1,200% annual rally that raises concerns about potential overvaluation.

The new vote of confidence in QBTS stock came from Roth MKM analyst Sujeeva De Silva, who raised his price target by 50% to $18 a share.

Meanwhile, B. Riley Securities analyst Craig Ellis upped his price target for QBTS by 54% to $20 a share.

The analysts are increasingly confident in D-Wave’s position within the quantum computing and AI sectors, with De Silva highlighting the company’s expanding hosted services and hardware sales as key drivers of optimism.

D-Wave positions itself as the world’s first commercial supplier of quantum technology, with applications spanning AI and machine learning.

The company recently announced partnerships with South Korea’s Yonsei University and Incheon Metropolitan City, with analysts speculating that the collaborations involve its Advantage2 system.

Advantage2 is engineered for “production-ready” quantum computing via D-Wave’s Leap quantum cloud platform and on-premise deployments. It’s promoted for delivering a 40% boost in energy scale and a 75% reduction in noise.

While D-Wave still has significant ground to cover to justify its valuation, it operates at the forefront of transformative industries that could reshape the future.

Its stock price, therefore, reflects those ambitions as opposed to underlying business fundamentals.

D-Wave’s stock takes a quantum leap

QBTS stock is down 20% over the past month - a reasonable correction following its 1,200% gain over the past year.

The stock currently trades around $15, giving D-Wave a market capitalization of just under $4.7 billion. Price targets from analysts De Silva and Ellis indicate a potential 33% upside in the near term.

Growth-focused investors remain unfazed by D-Wave’s minimal earnings, instead betting on the company’s strategic positioning in the emerging quantum computing and AI sectors.

D-Wave reported just $15 million in revenue for the first quarter, a 509% increase year-over-year, with per-share earnings of -$0.02.

On a positive note, D-Wave ended the first quarter with a strong cash position of $304.3 million.

Full-year revenue is projected to reach between $22 million and $24 million, though the company isn’t expected to achieve profitability.

D-Wave’s next earnings report is scheduled for early August.

In the meantime, D-Wave continues to operate under a niche business model, maintaining a limited client base while pursuing large-scale deals for its quantum systems, such as its recent partnerships in South Korea.

Your email address will not be published. Required fields are markedmarked