While the Trump administration has thrown its full support behind nuclear energy, nearly every other corner of the renewables sector is struggling to stay afloat.

Hydrogen fuel cell company Plug Power (PLUG) is among the hardest hit, and it’s pulling out all the stops to stop the bleeding.

Earlier this month, the company asked shareholders to approve a reverse stock split and a hike in its authorized share count, warning that without the move, it “may be constrained in our ability to address ongoing needs and pursue opportunities.”

Then, in a show of internal confidence, Plug Power CFO Paul Middleton snapped up 650,000 shares last week at an average price of $1.03. That’s the largest such purchase by a corporate executive in nearly two decades.

Plug Power Insider Trading Alert 🚨

undefined Barchart (@Barchart) June 9, 2025

Chief Financial Officer Paul Middleton just bought $672,000 worth of $PLUG shares, the largest insider buy in almost 2 decades 👀 pic.twitter.com/x8iaWaowNy

It’s also the second time in under a month that Middleton bought in. In May, he picked up 350,000 shares at roughly $0.72 apiece, investing a total of around $250,000.

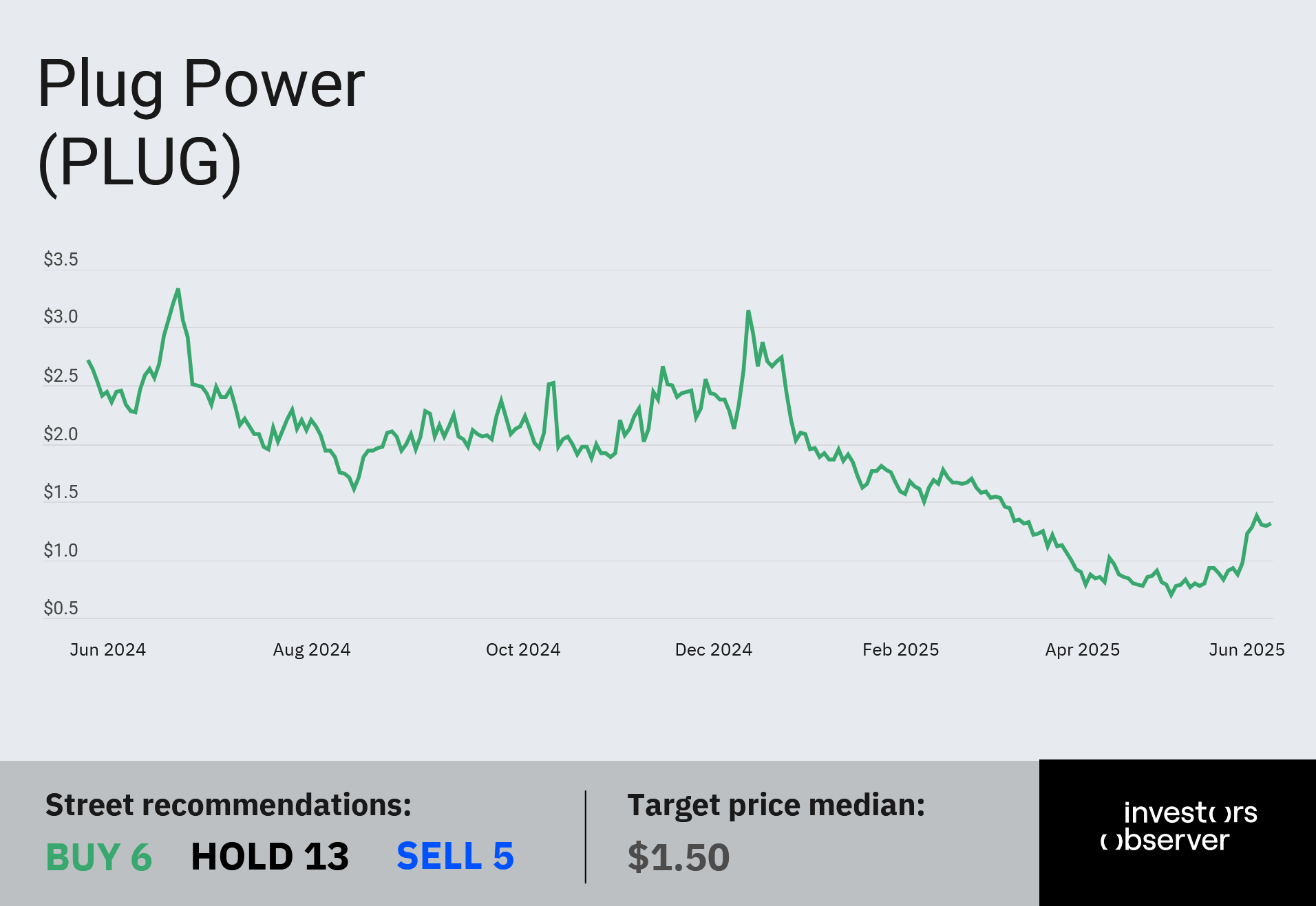

Those bets have helped fuel a modest rally. Plug shares are up 72.8% in the past month but still deep in the red over a longer timeline.

“This additional investment reflects my strong conviction in Plug’s strategy and long-term value creation,” Middleton said in a statement.

“As we execute and gain market traction, I continue to see meaningful upside and believe Plug remains one of the most compelling growth opportunities in the energy sector.”

But so far, that “compelling growth” story hasn’t shown up in the stock performance.

Plug stock collapsed 56% in 2022, 63% in 2023, and 53% in 2024. It’s down another 38.5% year-to-date as of Monday’s close.

Plug’s plan: Reverse split, insider buys, and shareholder push

Earlier this year, the company introduced a new executive compensation program aimed at aligning leadership with shareholders. CEO Andy Marsh is now taking 50% of his 2025 compensation in Plug stock.

Plug is also urging retail investors to play defense.

In a blog post last week, the company warned that about 50% of Plug shares on loan to short sellers come from individual brokerage accounts.

It even posted instructions on how to disable share lending, reminding investors that if their shares are loaned out, they lose voting rights, something that could matter in a big way.

At Plug’s annual meeting on July 3, shareholders will vote on whether to approve the reverse stock split.

The company hopes this move will help it regain compliance with stock exchange listing requirements and attract more institutional investors.

The Political Wild Card

While Plug’s fate now partially rests in shareholder hands, there’s another potential lever in play: federal funding.

U.S. Energy Secretary Chris Wright is currently reviewing up to $2.2 billion in hydrogen hub funding commitments that were announced during the Biden administration.

Wright pushed back on claims of political bias, saying the Department of Energy is “looking at these like any business would look at an investment.”

A decision on whether to continue with the funding is expected by the end of the summer. That call could determine whether Plug Power — and the broader hydrogen sector — still has runway left.

Your email address will not be published. Required fields are markedmarked