While Roku (ROKU) stock has rallied this year, its struggle to break past $100 underscores the balancing act of a onetime pandemic highflyer now trying to rebrand as a value play.

Not long after its IPO, Roku skyrocketed to nearly $475 a share. Then came the double top in 2020 and 2021, followed by a brutal 91% collapse to around $40 in 2022.

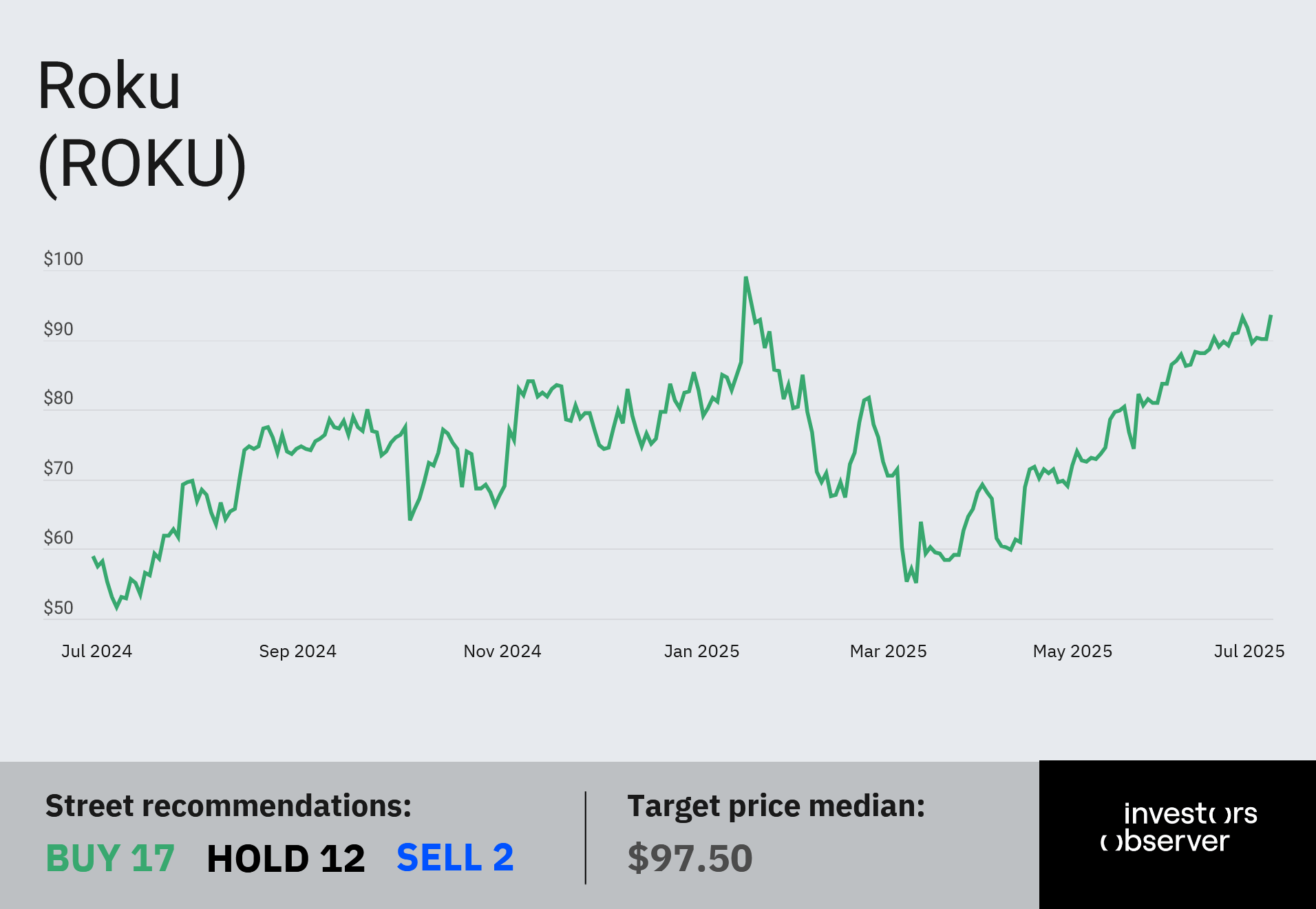

The stock has rebounded since up 20% year to date and 56% over the past 12 months, fueled by strong revenue growth and dominance in its core platform business. But it’s still a long way from those euphoric highs.

While Roku built its name on streaming devices, the real driver now is its platform segment. Advertising, subscription revenues, and operating system licensing made up 86% of total revenue last year.

Even with record engagement, profits remain out of reach.

Roku posted a $129.4 million net loss in fiscal 2024. Management says profitability is possible by 2026, but that long runway helps explain why the stock hasn’t consistently cleared $100 since 2023.

Competition isn’t making things easier. Amazon, Google, Apple, and even Samsung’s smart TVs are all fighting for living room dominance.

The Roku Channel is the wild card

Despite that, Roku has managed to defend its turf and investors are starting to notice.

2024 was a record year. Users streamed 127.7 billion hours of content, which is 21 billion more than the year before. Active accounts climbed 12% to nearly 90 million, with average daily viewing hitting 4 hours and 13 minutes by year-end.

The Roku Channel, its free, ad-supported service, is also gaining steam. A Business Insider study found households are increasingly pushing back on rising subscription fees from Netflix, Disney, and other premium streamers, boosting free options like Roku’s platform.

By June, The Roku Channel grabbed 2.5% of U.S. connected TV viewership, more than doubling from 1.1% a year earlier and outpacing rival Tubi’s growth.

Roku reports Q2 earnings on July 31 when it will reveal its latest streaming metrics and outlook. Investors will be watching closely to see if the platform’s ad-supported momentum can finally push shares beyond that stubborn $100 ceiling.

Your email address will not be published. Required fields are markedmarked