It might seem odd to call Oracle (ORCL) a “slept-on” stock when it has a $564 billion market cap and Larry Ellison as its co-founder. But if any mega-cap can sneak up on Wall Street, Oracle just made its case.

According to Synovus senior portfolio manager Dan Morgan, Oracle had missed earnings in seven of its last 10 quarters. That’s not a track record for a company trying to convince investors it has a shot in the AI race.

That narrative, however, shifted this week.

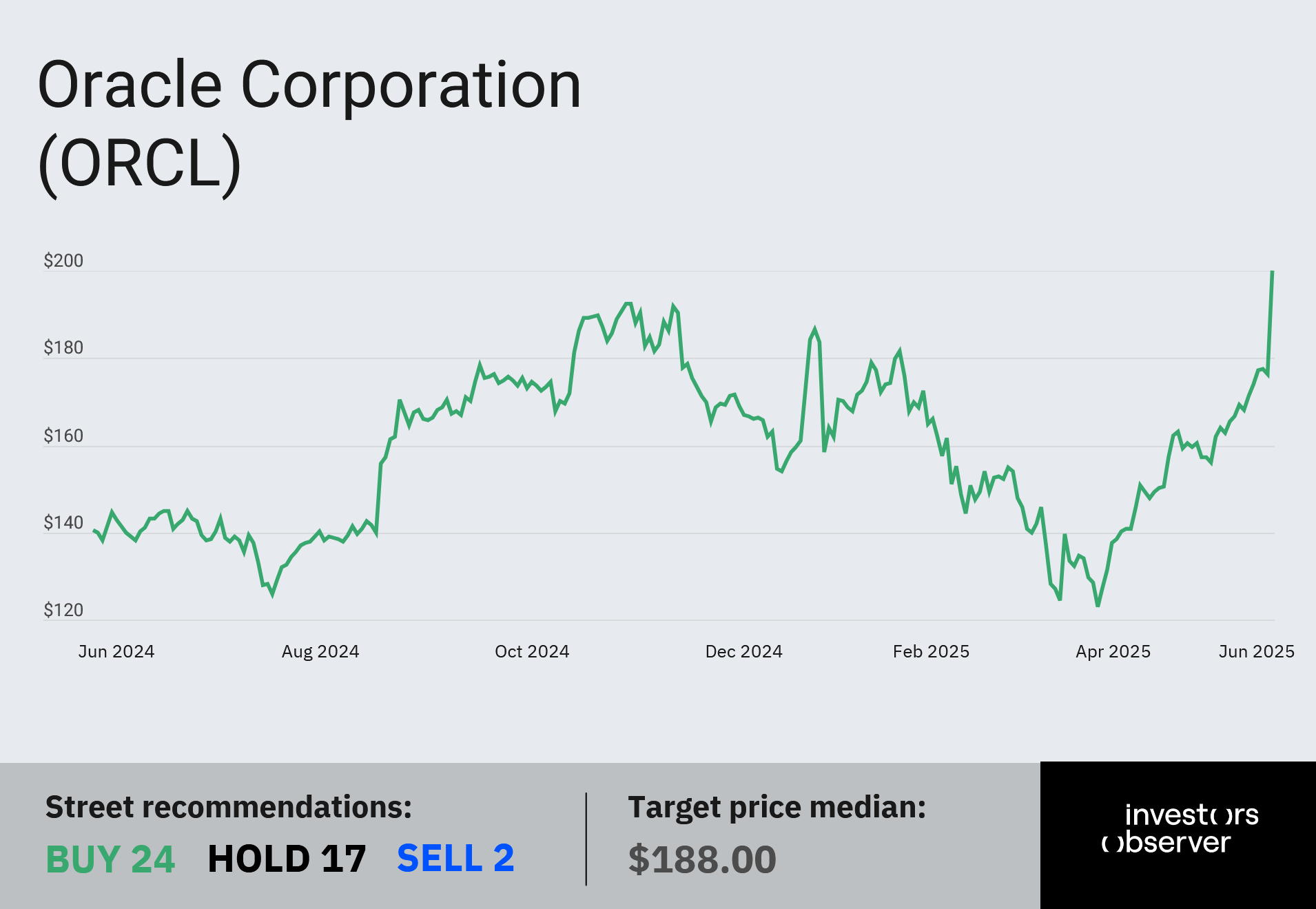

Oracle beat expectations for last quarter and fiscal full-year earnings, catching some shorts off guard and sending ORCL stock up 14% to an all-time high of $202.

But the real kicker was Oracle’s management outlook.

Oracle CEO Safra Catz said Oracle expects "revenue growth rates will be dramatically higher" this year, driven by explosive demand for cloud.

The company now projects overall cloud growth will jump from 24% in FY25 to more than 40% in FY26.

That’s where Oracle is starting to look like a serious AI winner and why some analysts are playing catch-up.

“Funny how Oracle has all the analysts jumping on it after it moved up 100% and all the good news is priced in... albeit it will continue the run for a bit with all this momentum,” AIX Capital Group CEO Suhail Ahmad posted on X.

“You could easily anticipate that Oracle and even SAP would benefit from AI adoption. It’s been in our tech portfolios since last year.”

Invest where the puck is going, not where it is!

undefined Suhail Ahmad (@SuhailAhmad) June 12, 2025

Funny how Oracle $ORCL has all the analysts jumping on it after its moved up 100% and all the good news is priced in... albeit it will continue the run for a bit with all this momentum.

You could easily anticipate that Oracle… pic.twitter.com/AiP9mJN7va

The database giant has long been a critical part of enterprise infrastructure but had been losing share to upstarts in recent years.

As Morningstar analyst Luke Yang noted, Oracle “still plays a dominant role in handling some of the world’s most mission-critical data workflows,” but its broader influence had been fading… until now.

🔧 Hybrid cloud is Oracle’s secret weapon

Oracle’s Ellison is calling a generational opportunity in AI.

“Oracle will be the #1 cloud applications company, and Oracle will be the #1 builder and operator of cloud infrastructure data centers,” he declared on the earnings call.

“We will build and operate more cloud infrastructure data centers than all of our cloud infrastructure competitors combined.”

Eight Wall Street firms raised their price targets after the report. UBS bumped its target to $225 from $200, citing Oracle’s exploding backlog.

“The new guide for 100% backlog growth to $275B+ in FY26 is extraordinary and implies more backlog growth than Microsoft is likely to post,” UBS analysts wrote.

Steven Dickens, founder of HyperFRAME Research, told Schwab Network that Oracle is now “arguably the fourth hyperscaler” right behind AWS, Microsoft, and Google.

“What that success has been driven by... has really just been their hybrid cloud approach,” Dickens said.

Unlike some of its rivals, Oracle allows clients to run workloads either on-premise or in the cloud, which is proving especially attractive to large enterprises.

Morningstar’s Yang added that “Oracle’s current product lineup is in the best shape it has been in for some years,” and that the company is well-positioned to retain long-time on-premise customers as they make the leap to cloud services.

“In our view, the cloud transition for Oracle customers is still in the early stage,” Yang wrote. “And we think it will serve as a tailwind to Oracle’s revenue growth in the coming years.”

Your email address will not be published. Required fields are markedmarked