Oracle (ORCL) CEO Safra Catz delivered a very optimistic outlook during the company’s latest earnings report, saying "revenue growth rates will be dramatically higher" for 2025.

It turns out she was not kidding.

The company’s stock surged to an all-time high on Monday after Catz disclosed in an 8-K filing with the SEC that she was planning to tell employees about multiple cloud deals the company has landed - including one really big one.

“Oracle is off to a strong start in FY26,” she noted in the filing. “Our MultiCloud database revenue continues to grow at over 100%, and we signed multiple large cloud services agreements including one that is expected to contribute more than $30 billion in annual revenue starting in FY28.”

Shares of Oracle gained 5% in intraday trading to a record high of $228.22.

It closed up 3.99% at 218.63.

Oracle did not disclose the name of the customer that inked a $30 billion deal with the company, creating a bit of a guessing game for the tech industry.

Bloomberg’s Brody Ford noted that “the list of companies that could spend $30 billion a year on cloud infra is tiny.”

He added that “this is probably the largest single cloud deal ever.”

Ford pointed to the possibility that this deal might be related to Stargate, the $500 billion AI infrastructure project announced by President Trump in January.

The Stargate initiative will have Oracle, OpenAI and SoftBank joining forces to build data centers across the United States.

“The giant white whale if you’re an Oracle investor is when do they actually start seeing revenue from that OpenAI/Stargate deal,” Ford said.

If this $30 billion revenue is in fact from Stargate, it leads to the possibility that it's more specifically from OpenAI, one of the few companies that could afford that expenditure.

Ford called it a deal that’s “an unprecedented scale and an unprecedented win for Oracle.”

Wall Street grows bullish on Oracle

Eight Wall Street firms had already raised their price targets on Oracle back in June, with analysts turning bullish on the company’s role in building and operating cloud infrastructure data centers.

On Monday, another firm raised its price target.

Stifel analyst Brad Reback upgraded Oracle shares to “buy” from “hold,” citing an expectation that the company will achieve accelerated earnings per share (EPS) growth as its cloud mix expands, and as its “cost discipline holds.”

“While the higher capital spending will lead to additional near-term gross-margin compression, there is no question this management team is extremely adept at managing expenses,” Reback wrote. “This, coupled with a greater emphasis on physical infrastructure rather than people to generate new business, should enable revenue to grow meaningfully faster than OPEX in coming years.”

Reback raised his price target on Oracle to $250 from $180, representing a 38.9% increase.

Oracle said in its latest earnings report that it expects overall cloud growth will jump from 24% in FY25 to more than 40% in FY26.

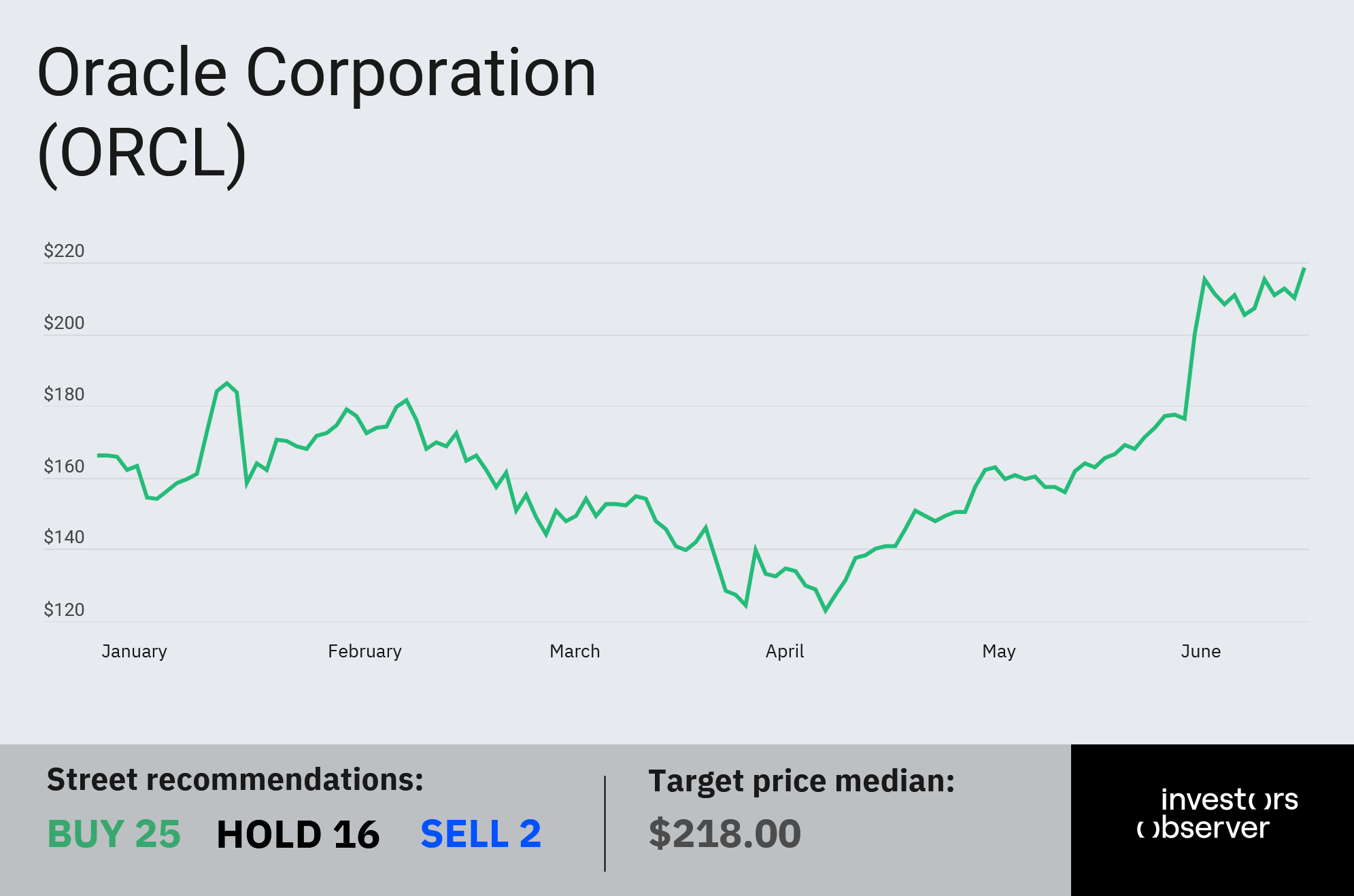

Oracle’s shares are up 31.2% this year.

Your email address will not be published. Required fields are markedmarked