Major contracts with U.S. defense installations have propelled Oklo (OKLO) to significant gains in recent months, highlighting the advanced nuclear technology company’s growing role in supporting America’s clean energy transition.

In a recent interview with CNBC, Oklo CEO Jacob DeWitte discussed the company’s new partnership with the U.S. Air Force to design, build, and operate a microreactor at Eielson Air Force Base in Alaska. The goal: to enhance energy security on-site.

The project is part of a broader Department of Defense initiative to deploy advanced microreactors across key military bases.

DeWitte emphasized the long-term nature of these efforts, stating, “We’re looking at this as a multi-decade time frame, stretching out 20 to 30 years,” as military installations increasingly seek reliable, clean energy sources.

He also highlighted Oklo’s recent collaboration with the Defense Innovation Unit (DIU), a Department of Defense organization focused on accelerating the adoption and commercialization of advanced technologies, including nuclear energy.

When these efforts are combined with the government’s policy push to utilize defense infrastructure and land to power data centers and AI capabilities on military installations, “it’s a pretty exciting space,” said DeWitte. “The trajectory ahead is compelling.”

These initiatives build on Oklo’s commercial partnership with Amazon to supply advanced microreactors for its data centers — a deal Axios has called “one of the largest for clean energy to date.”

Despite being a pre-revenue company, Oklo stock continues ot surge

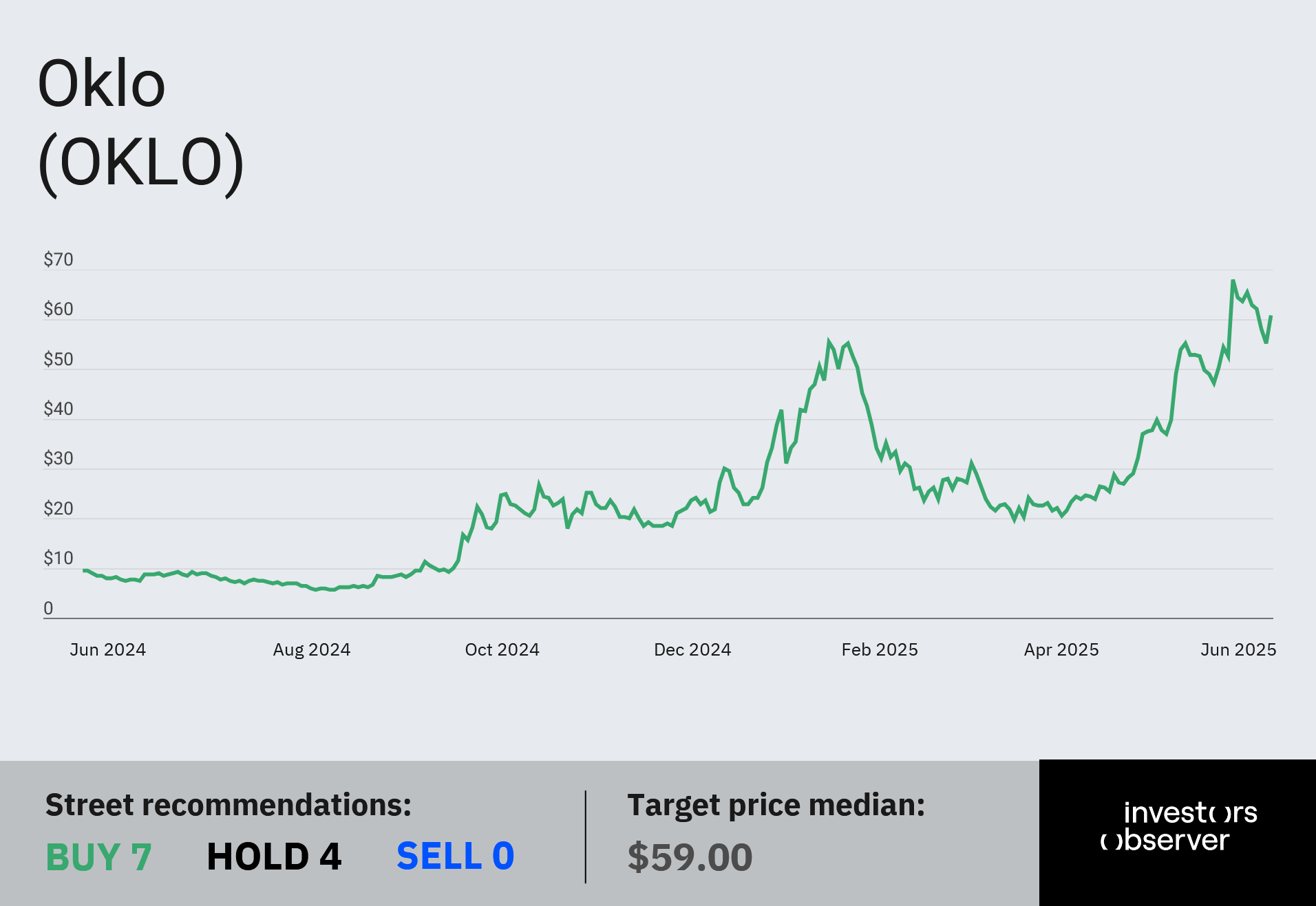

Shares of Oklo have surged more than 57% over the past month, bringing the company’s market capitalization to $8.5 billion.

Year-to-date, the stock has gained 165% and is up an impressive 542% over the past 12 months, making it one of Wall Street’s top performers.

The rally is being driven by a series of strategic contract wins and business moves that position Oklo to benefit from President Trump’s executive order aimed at accelerating nuclear power development in the United States.

The executive order also calls for reforming the Nuclear Regulatory Commission as part of a broader effort to strengthen the nation’s economic security.

While Oklo is not yet profitable, its net loss narrowed significantly in the first quarter of 2025, reaching $9.81 million.

The company remains in the pre-revenue stage, reflecting its ongoing focus on commercialization and development. However, it expects to start generating commercial revenue in early to mid-2026.

Despite this, Oklo continues to strengthen its financial position. At the end of Q1, it held $260.7 million in cash and marketable securities.

Your email address will not be published. Required fields are markedmarked