For investors stuck holding the bag on a beaten-down stock, nothing breathes life into a ticker like a billionaire backing it.

Just ask Hertz (HTZ) shareholders. The rental car company — a former meme stock left for dead — suddenly caught fire in April after billionaire Bill Ackman revealed a $46.5 million stake through his Pershing Square fund.

Shares soared 56% on the news, then tacked on another 44% the next day. In just two sessions, Hertz more than doubled from $3.65 to $8.24.

It’s cooled off since but is still up 68.3% year-to-date.

Sweetgreen (SG) hasn’t been so lucky. Despite getting a quiet vote of confidence from not one but two billionaire hedge fund managers, the salad chain is still stuck in the red.

🥗 Billionaire backing and robot kitchens

Last quarter, Israel Englander’s Millennium Management scooped up 2.17 million shares of SG. Ken Griffin’s Citadel added another 1.27 million.

But unlike Ackman, neither Englander nor Griffin has blasted their buys on social media yet. And so far, Sweetgreen has yet to see the kind of rocket-fueled rally that followed Ackman’s tweetstorm.

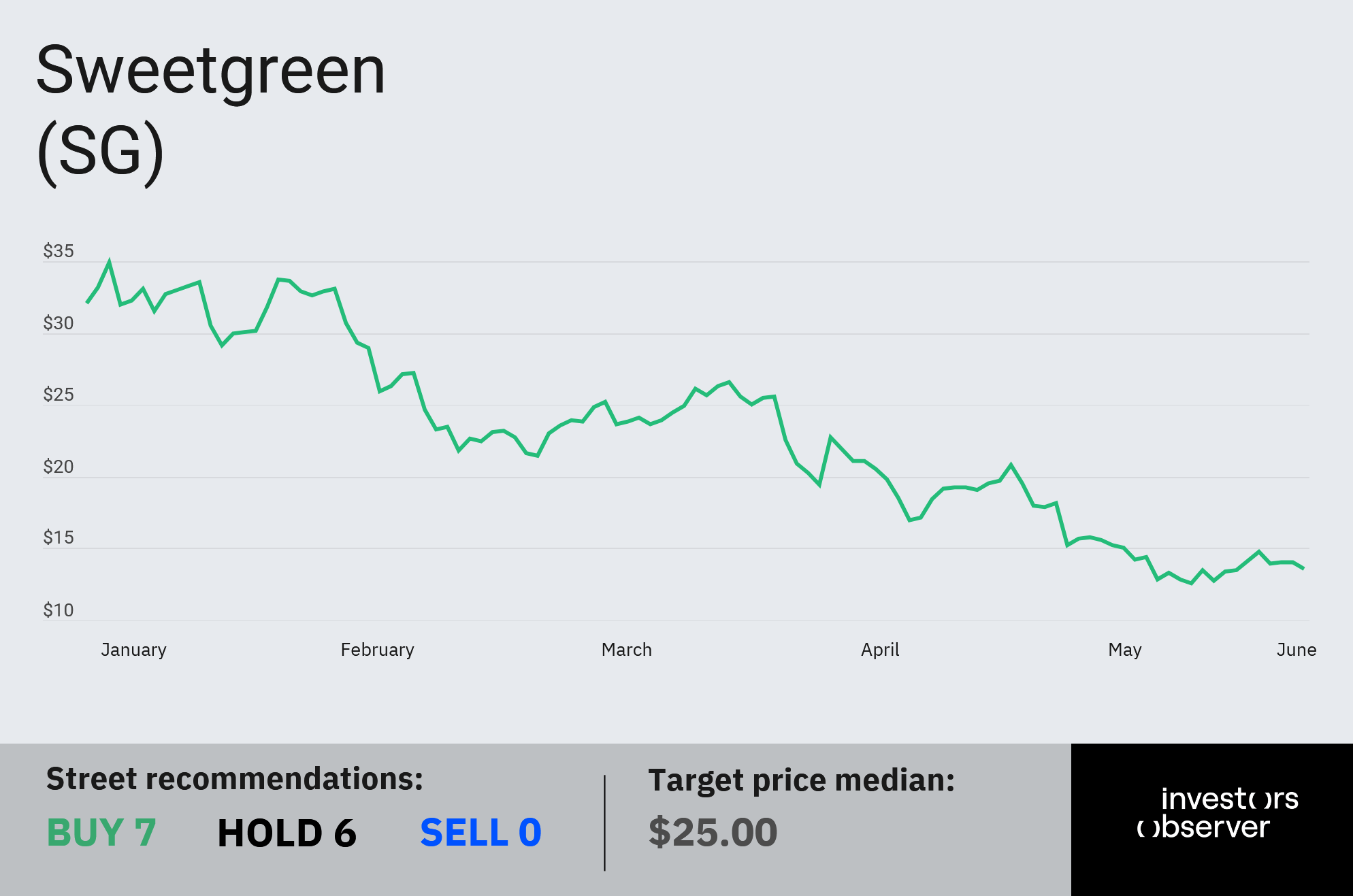

The stock is down 57% in 2025 and 58.4% over the past 12 months.

Part of the reason is that tariffs have upended supply chains and dented consumer confidence across the restaurant sector. Bank of America downgraded the stock in April, citing “macro uncertainty” and slowing demand.

Sweetgreen’s own forecast of flat same-store sales for the year didn’t help either. But the company still has a not-so-secret weapon: tech.

Sweetgreen’s long positioned itself more like a Silicon Valley startup than a salad bar.

At the heart of that strategy is the Infinite Kitchen, a fully automated robotic assembly line that can crank out 500 custom bowls an hour. It opened 12 of them last year and expects to launch 20 more in 2025.

Sweetgreen CEO Jonathan Neman has hinted the technology may eventually be licensed out to others, turning Sweetgreen from fast-casual chain into a platform play.

William Blair analyst Sharon Zackfia called the Infinite Kitchen a differentiator that could “deepen the fast casual’s competitive moat.”

Wall Street may be ignoring Sweetgreen for now, but if another billionaire goes public with a bullish call — or if Infinite Kitchens takes off — SG could still get its Ackman moment.

Your email address will not be published. Required fields are markedmarked