Oklo (OKLO), the nuclear startup backed by OpenAI co-founder Sam Altman, may have a prominent chairman, but its most powerful ally might be someone who used to sit on its board.

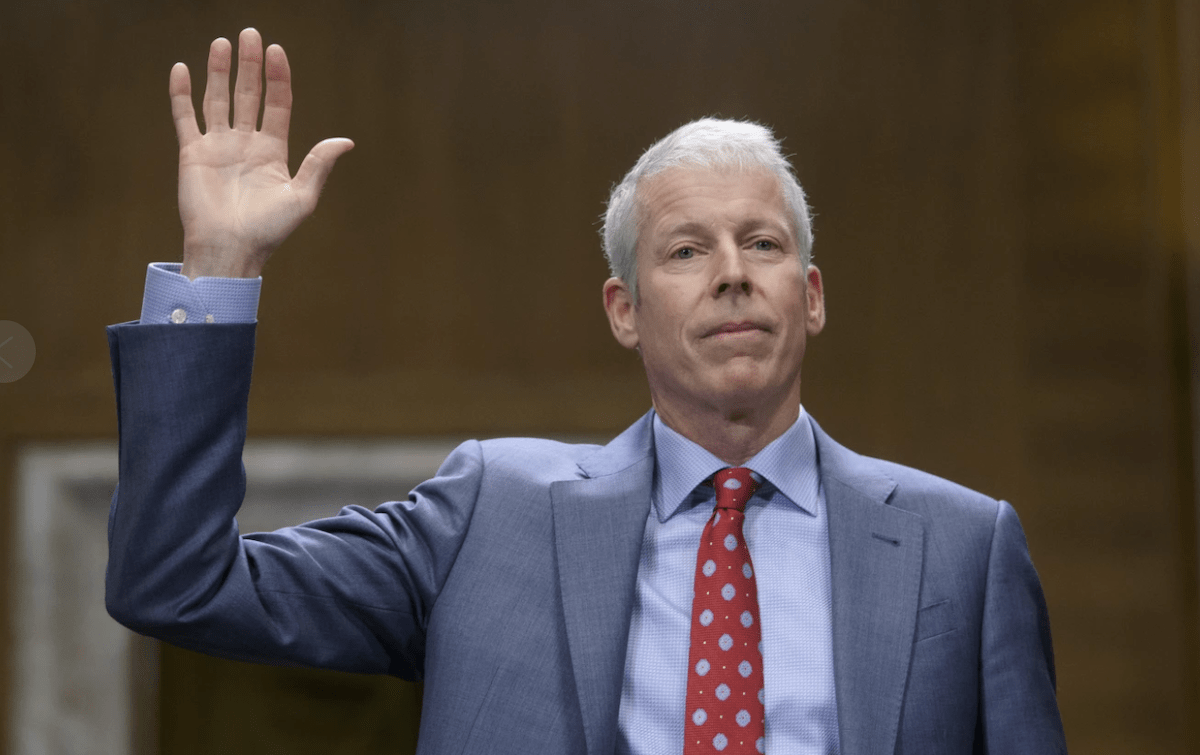

That would be Chris Wright, who stepped down from Oklo’s board in February to become U.S. Secretary of Energy in the Trump administration.

Wright, like President Trump, views AI dominance as a national imperative and energy as the bottleneck.

He’s described the AI race as “the next Manhattan Project,” underscoring just how much firepower — and electricity — it will take to stay ahead.

Earlier this month, the Department of Energy identified 16 federal sites “uniquely positioned for rapid data center construction,” with existing energy infrastructure and the ability to fast-track new nuclear generation.

The DOE said it would prioritize public-private partnerships, meaning companies like Oklo are suddenly in a prime position to power the next wave of AI infrastructure.

“With today’s action, the Department of Energy is taking important steps to leverage our domestic resources to power the AI revolution,” Wright said in a statement, spinningthe initiative as a dual push for innovation and energy security.

Investors seem to be paying attention: Oklo is up 7.5% year-to-date, and 82.6% since its public debut last May.

But can nuclear scale fast enough?

According to Bloomberg Intelligence, AI could drive U.S. data center power demand up by 20–40% next year alone, with “strong double-digit growth” through 2030.

Big Tech is already in on the action.

Microsoft just inked a 20-year deal with Constellation Energy to restart Three Mile Island, the site of the worst nuclear accident in U.S. history. Amazon has invested in SMR developer X-Energy, and Google signed a power agreement with Kairos Energy.

Nuclear offers one big advantage: zero-carbon, always-on electricity. But it’s far from a guaranteed bet.

A report from consulting firm ICF last month questioned whether nuclear is economically viable or scalable enough to meet AI’s demands.

Despite renewed interest and several aging plants coming back online, ICF’s Dino Vivanco remains skeptical.

“Should these new investments in nuclear energy come to pass, they could make a dent in the growing electricity demand,” Vivanco wrote. “But a nuclear renaissance isn’t written in stone.”

The challenges? Cost, long construction timelines and the simple fact that no small modular reactor (SMR) has ever gone live in the U.S.

NuScale scrapped what would’ve been the first operational SMR last year after it failed to attract enough subscribers. Meanwhile, Oklo just pushed back the launch of its first reactor from late 2027 to early 2028.

That delay leaves investors with more questions than answers. No one knows what it will cost to operate an SMR — or if it’s even scalable.

And time may be the most critical variable.

“The timing of the next nuclear plant also matters because buyers are looking for solutions today,” Vivanco said. “The lack of readily available nuclear options will lead them to seek out alternatives.”

Your email address will not be published. Required fields are markedmarked