After months of setbacks — including an SEC probe, an auditor exit, and a near-delisting from Nasdaq — Super Micro Computer (SMCI) just got a much-needed vote of confidence from Wall Street.

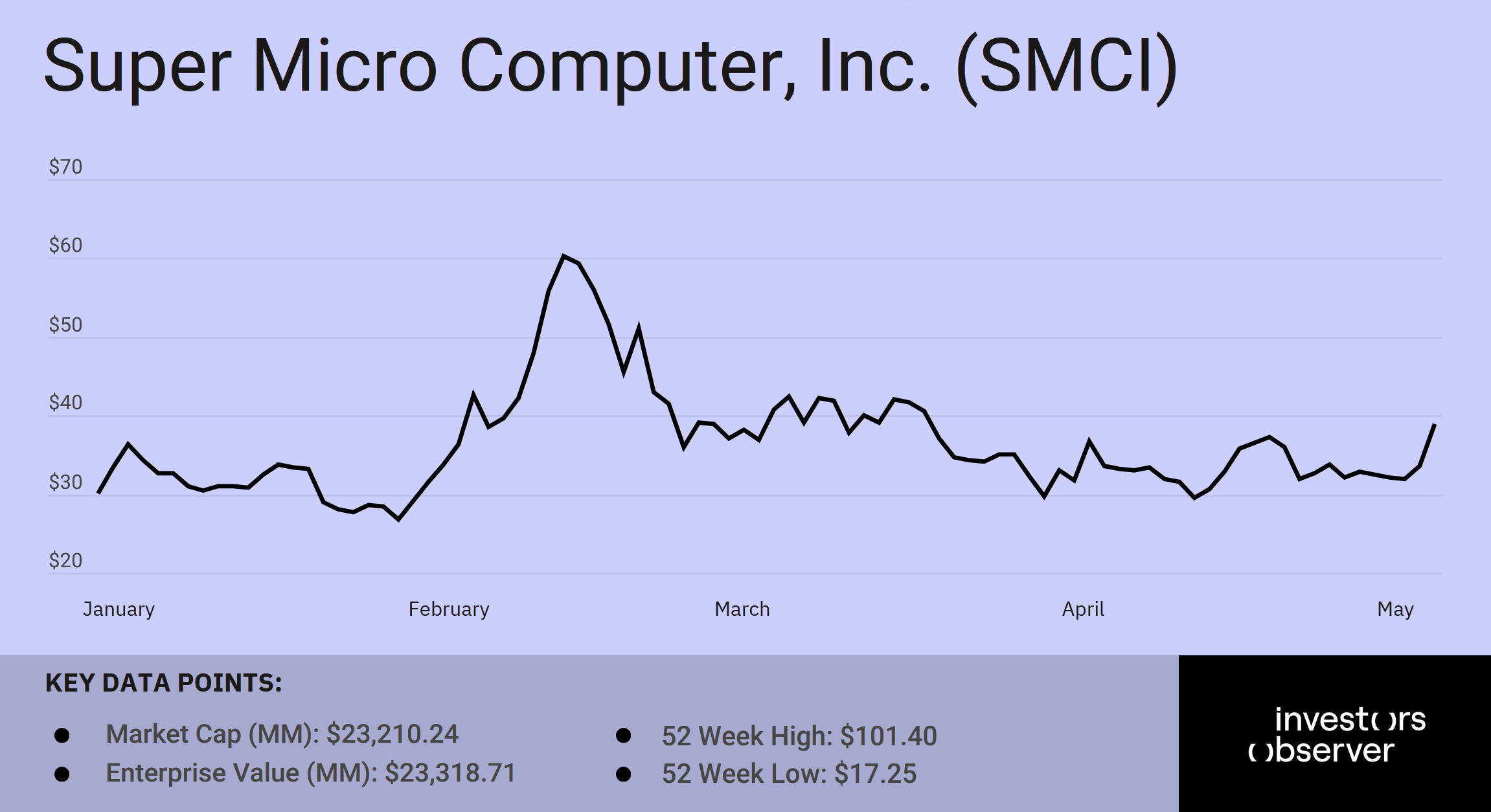

On Tuesday, analysts at Raymond James initiated coverage on the data center firm with an “outperform” rating and a $41 price target, calling the company a “near pure AI play.” Supermicro’s stock jumped 15.5% on the day and closed at $38.89, up 25.5% year-to-date.

The bullish call came as a surprise after a string of recent hits to the company’s reputation and earnings.

But analysts led by Simon Leopold said Supermicro has “emerged as a market leader in AI-optimized infrastructure” and that “AI projects represent a long-term secular driver” for its business.

AI-related platforms now make up about 70% of the company’s revenue, and Raymond James believes Supermicro is well-positioned to grow — if it can prove it can win over more enterprise customers.

From delisting risk to AI darling?

Yesterday marked a sharp turnaround from earlier this year. In February, Supermicro barely avoided getting kicked off Nasdaq after missing its annual filing deadline.

The delay came in the wake of serious scrutiny from both regulators and investors.

In August, short-seller Hindenburg Research accused the company of “glaring accounting red flags.” By October, its longtime auditor, Ernst & Young, resigned, citing concerns over accounting practices, governance, and the board’s independence from CEO Charles Liang.

That reputational risk still hangs over the company, Raymond James noted.

Mixed earnings, lowered Outlook

Supermicro's stock also took a hit last week after reporting adjusted earnings of 31 cents per share on $4.6 billion in revenue for the March quarter. That was down from 67 cents per share a year earlier, despite a rise in sales from $3.85 billion.

The company also lowered its earnings outlook to 30 cents per share on $4.55 billion in sales at the midpoint, well below its earlier guidance of $5 billion to $6 billion.

Supermicro blamed the revision on delayed platform decisions that pushed expected Q3 sales into Q4. But Wall Street had been looking for 53 cents per share on $5.38 billion in revenue.

In March, Goldman Sachs downgraded the stock to “sell,” citing concerns over competition, margins, and valuation.

Raymond James, however, pointed to the company’s “very competitive pricing” as a key edge, especially as demand for AI infrastructure continues to grow.

While Supermicro still has questions to answer, analysts now say it may be in a better position than investors thought, especially if it can win back trust and keep riding the AI boom.

Your email address will not be published. Required fields are markedmarked