As Lucid Group (LCID) launches its new Gravity SUV, the company is hoping to win over disillusioned Tesla owners, many of whom are fleeing the brand due to Elon Musk’s political leanings.

Musk’s increasingly polarizing behavior has already dented Tesla’s brand and business.

Tesla owners are now trading in their vehicles at record levels, while Tesla’s (TSLA) stock has plunged more than 40% year-to-date. Investors are also growing impatient with the collateral damage caused by Musk’s political ambitions.

For now, Tesla’s early lead in the EV market has given it a cushion; it still holds 43.4% of the U.S. EV market, selling 128,100 vehicles in Q1, compared to Hyundai’s 22,995, according to CarEdge.

But that dominance could fade fast, especially as rivals — including startups — seize on the moment.

Lucid’s push: From niche to mainstream awareness

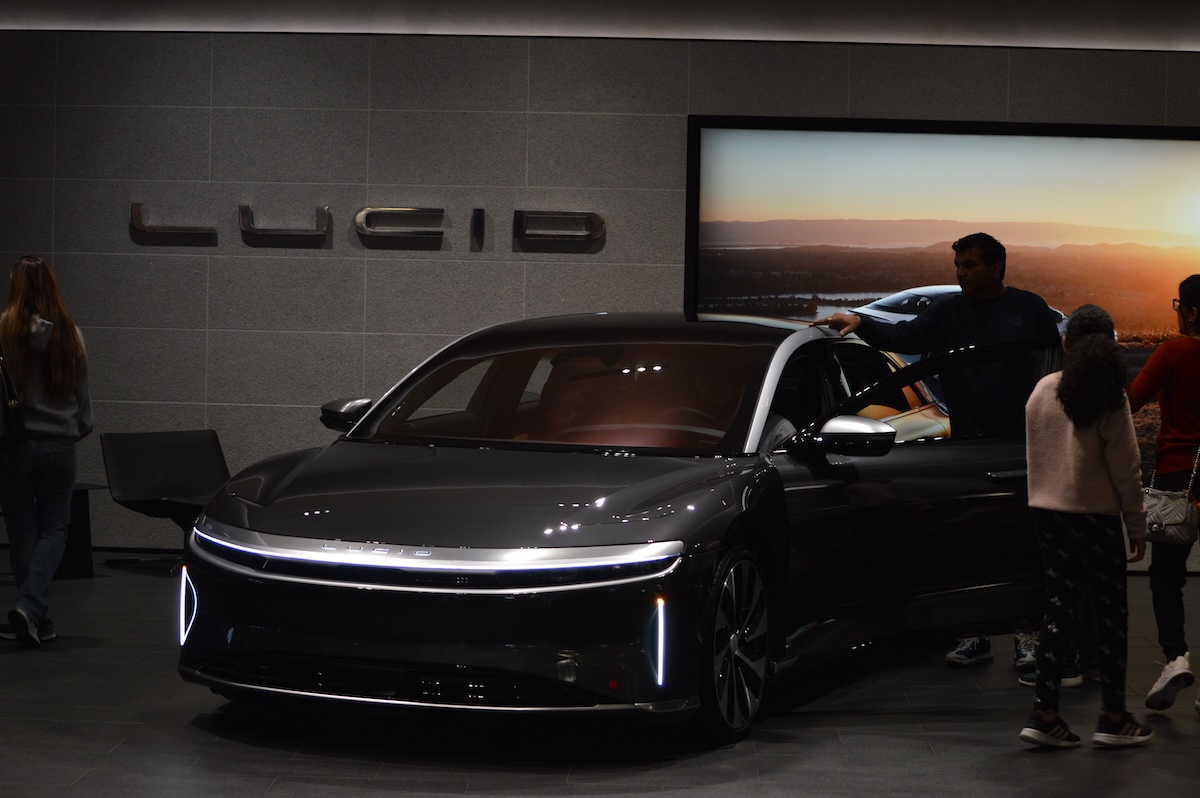

Lucid is positioning itself to be one of those challengers. The company unveiled its 2026 Lucid Gravity Grand Touring SUV last week, and the early reviews have been glowing, across the media landscape.

Priced from $95,000 — with many buyers adding features that push the total past $100,000 — the Gravity is squarely aimed at the high-end market. A more affordable version starting at $79,000 will follow in 2026.

Despite its premium price point, Lucid interim CEO Marc Winterhoff told Fox Business that early demand has exceeded expectations.

“We are very happy with the orders coming in,” Winterhoff said, noting that more than 75% of buyers are new to the Lucid brand — and about 50% are former Tesla owners.

“We have seen a dramatic uptick in the last two months,” he added. “They’re looking for an option to not continue having a Tesla.”

Second act for Lucid stock?

Lucid has struggled to gain investor traction since going public via a SPAC deal in 2021, despite backing from Saudi Arabia’s sovereign wealth fund. Shares rose 3% on Friday, closing just under $2.40.

Winterhoff attributed the sluggish performance to a limited product line. Until now, Lucid only offered the Air sedan — a niche product he said capped growth potential.

“There’s only so many vehicles you can sell,” he said. “So, what [investors] want to see are big sales numbers, but you can’t actually sell them.”

Still, he pointed out that Lucid was the best-selling EV in its segment in the second half of 2024, with four consecutive quarters of record deliveries.

“But nobody really saw that,” Winterhoff said. “My goal is to continue on with this execution — and my second goal is obviously driving up the stock.”

Winterhoff said nearly all components of the Gravity SUV are made in the U.S. at Lucid’s Arizona factory, which should insulate it from Trump’s steep tariffs on foreign parts. Still, he warned that the broader auto industry is not immune.

“It’s going to be a challenge,” he said. “All of the supply chains in the automotive industry are very long and global.”

As Tesla stumbles and political controversy mounts, Lucid appears ready to seize the moment, one luxury SUV at a time.

Your email address will not be published. Required fields are markedmarked