EV maker Lucid Group (LCID) is doubling down on its U.S.-based supply chain as a way to insulate its business from President Trump’s trade policy.

While Trump recently paused most of his reciprocal tariffs for 90 days, his broader “America First” agenda has already forced many companies to reassess their global sourcing strategies.

For Lucid, that means securing long-term access to critical battery materials at home.

This week, the company announced a multi-year deal with Graphite One to source natural graphite from the Graphite Creek deposit near Nome, Alaska. Production is expected to begin in 2028.

“A supply chain of critical materials within the United States drives our nation's economy, increases our independence against outside factors or market dynamics, and supports our efforts to reduce the carbon footprint of our vehicles,” said Marc Winterhoff, interim CEO at Lucid.

“These partnerships are another example of our commitment to powering American innovation and manufacturing with localized supply chains.”

Lucid already has a history with Graphite One.

Last year, it inked a separate deal for synthetic graphite to be sourced from the company’s proposed active anode material (AAM) facility in Warren, Ohio, also set to begin operations in 2028.

“We made history then, and we're continuing to make history now as we build momentum for our efforts to develop a fully domestic graphite supply chain, to meet market demands and strengthen U.S. industry and national defense,” said Graphite One CEO Anthony Huston.

Lucid is also tapping other domestic sources.

In February, it signed a three-year agreement with Syrah Resources to purchase 7,000 tons of natural graphite AAM from Syrah’s Vidalia facility in Louisiana, with deliveries set to begin in early 2026.

📉 Still niche EV maker

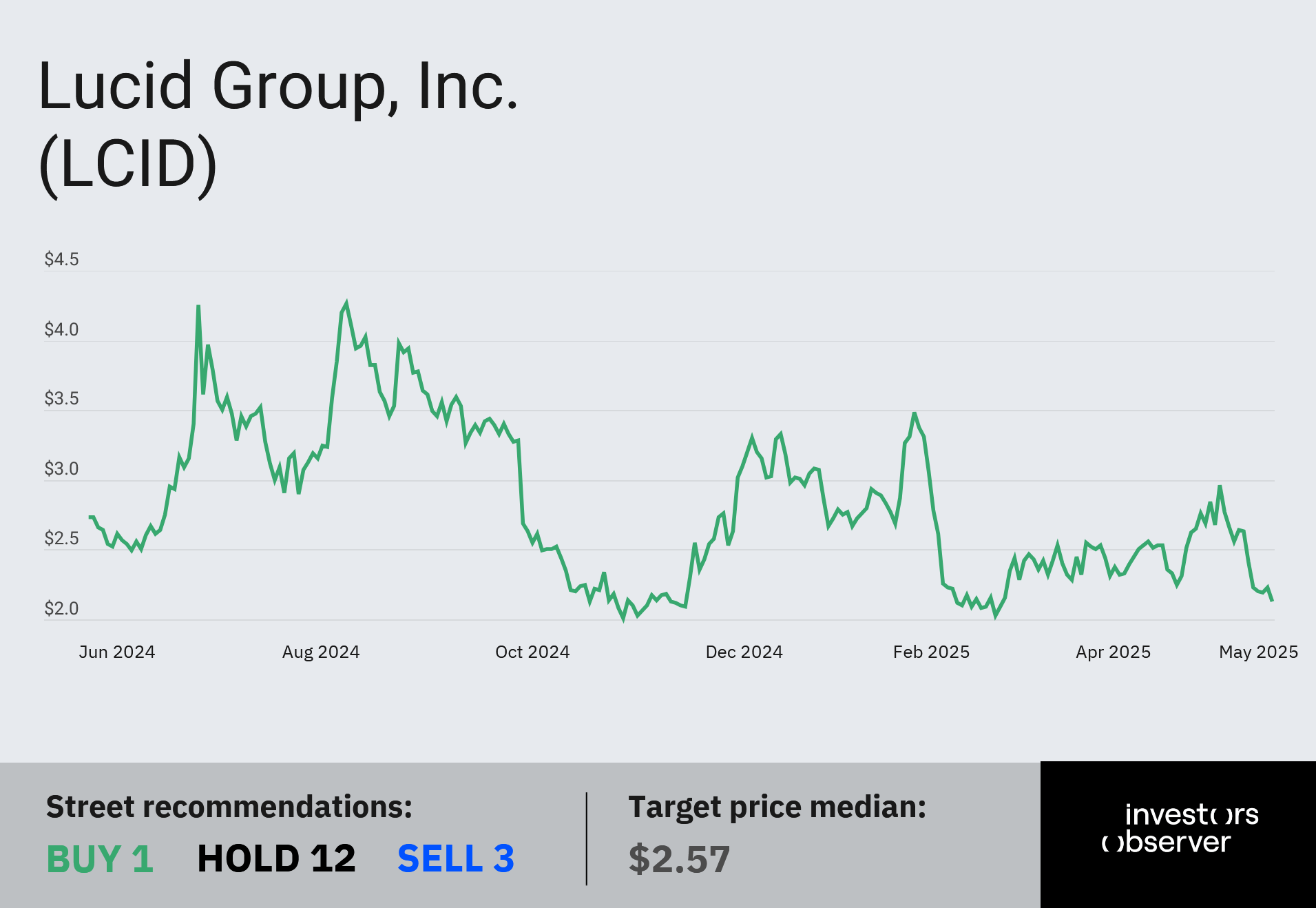

Despite these moves, Lucid has struggled to gain traction in the increasingly crowded EV market. The company’s stock is down 29.5% year-to-date and 23.7% over the past year.

Lucid went public in 2021 via a SPAC deal backed by Saudi Arabia’s sovereign wealth fund, and has since grappled with limited product offerings.

Until recently, it only sold a high-end sedan, which is a too niche segment that caps growth potential, according to Winterhoff.

In April, the company debuted its Lucid Gravity Grand Touring SUV, which it hopes will expand its addressable market. Winterhoff told Fox Business that interest is already rising, particularly among former Tesla (TSLA) owners disenchanted with Elon Musk’s political alignment with Trump.

Although Tesla still dominates EV sales, the brand fallout from Musk’s political entanglements may be creating a window for rivals like Lucid. The timing may be especially fortuitous now that Musk and Trump’s relationship appears to have soured.

On Thursday, Tesla stock plunged 14.3%, wiping out $152.4 million in market cap, the company’s largest single-day drop on record.

Whether that signals an opening for Lucid or simply more volatility across the sector remains to be seen. But one thing is clear, Lucid is betting big that a homegrown supply chain will give it an edge in a politically unstable world.

Your email address will not be published. Required fields are markedmarked