Netflix (NFLX) just got a major vote of confidence from Wall Street.

UBS upgraded the stock to “Buy” and lifted its 12-month price target to $1,450, a 26% jump from its previous estimate and 19% over yesterday’s close price.

The call reflects growing confidence in Netflix’s growing margins and revenue, thanks to changing TV habits and international expansion.

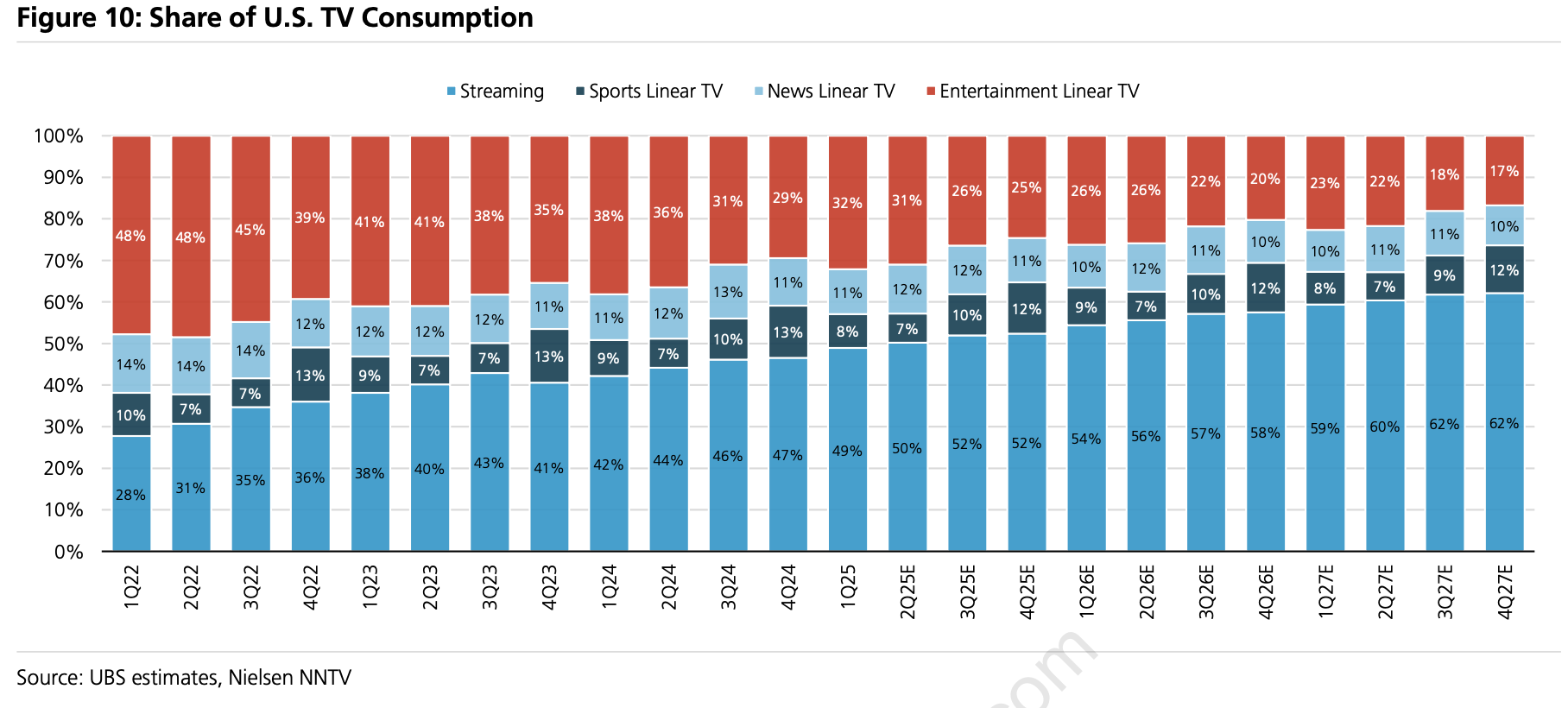

As linear TV (programming delivered on a fixed schedule) continues to shrink, UBS argues Netflix is best positioned to scoop up displaced viewers and content share.

“While consumption of general entertainment on linear is fading, it still accounts for 30% of all TV consumption in the U.S. across both streaming and linear, suggesting several more years of viewership substitution in Netflix's largest and most mature market,” wrote UBS analyst John C. Hodulik.

In fact, legacy broadcasters announced just 10 new scripted series across FOX, CBS, ABC, and NBC for the 2025–2026 season. Netflix, by contrast, is planning over 30 original series over the same time.

That content growth is translating well into new subscribers. Netflix ended 2024 with around 301 million subscribers, which is projected to reach 340 million by the end of 2025, according to Omdia.

Meanwhile, the ad-supported tier is on a tear.

Netflix now reports 94 million monthly active users globally — nearly 5x the number from last November — unlocking what UBS sees as a powerful new monetization channel.

On top of that, Netflix's is successfully expanding internationally. Global viewership on the platform’s Top 10 list is up 10% year-over-year, driven by international hits from Korea, Argentina, and Spain.

📈 A standout Q1

In April, Netflix posted a blowout quarter, with earnings and revenue handily beating expectations. First-quarter revenue rose 13% year-over-year to $10.54 billion, slightly above the $10.52 billion consensus from LSEG.

Netflix pricing power remains itanct, with revenue rising despite price hikes across its standard, ad-supported, and premium tiers. UBS says that’s a sign Netflix has successfully locked in subscibers.

On the bottom line, net income surged to $2.89 billion, or $6.61 per share, topping Wall Street estimates of $5.71.

It was also the first quarter the company chose not to disclose subscriber numbers.

Netflix Co-CEO Greg Peters, however, downplayed any major surprises. “There wasn’t anything significant to report,” Peters said, referring to the broader economic backdrop of rising prices and trade headwinds.

But he added, “We also take some comfort that entertainment historically has been pretty resilient in tougher economic times.”

In other words, Netflix is proving it can thrive, even when the economy doesn’t.

Your email address will not be published. Required fields are markedmarked