It’s not often that an acquisition starts paying off right away, but that appears to be happening for LightPath Technologies (LPTH), a manufacturer of next-generation optics and imaging technology.

When the Orlando, Florida-based company closed its acquisition of G5 Infrared back in February, LightPath called it a "significant step forward" in its strategy to become "the leading provider of infrared imaging solutions in the $9 billion infrared imaging market."

At the time, LightPath noted that G5 had "a significant pipeline of new business opportunities" expected to begin production over the next two years.

"The acquisition of G5 Infrared is a transformative step in our strategy to become a leading vertically integrated provider of infrared imaging solutions," LightPath President and CEO Sam Rubin said in a statement.

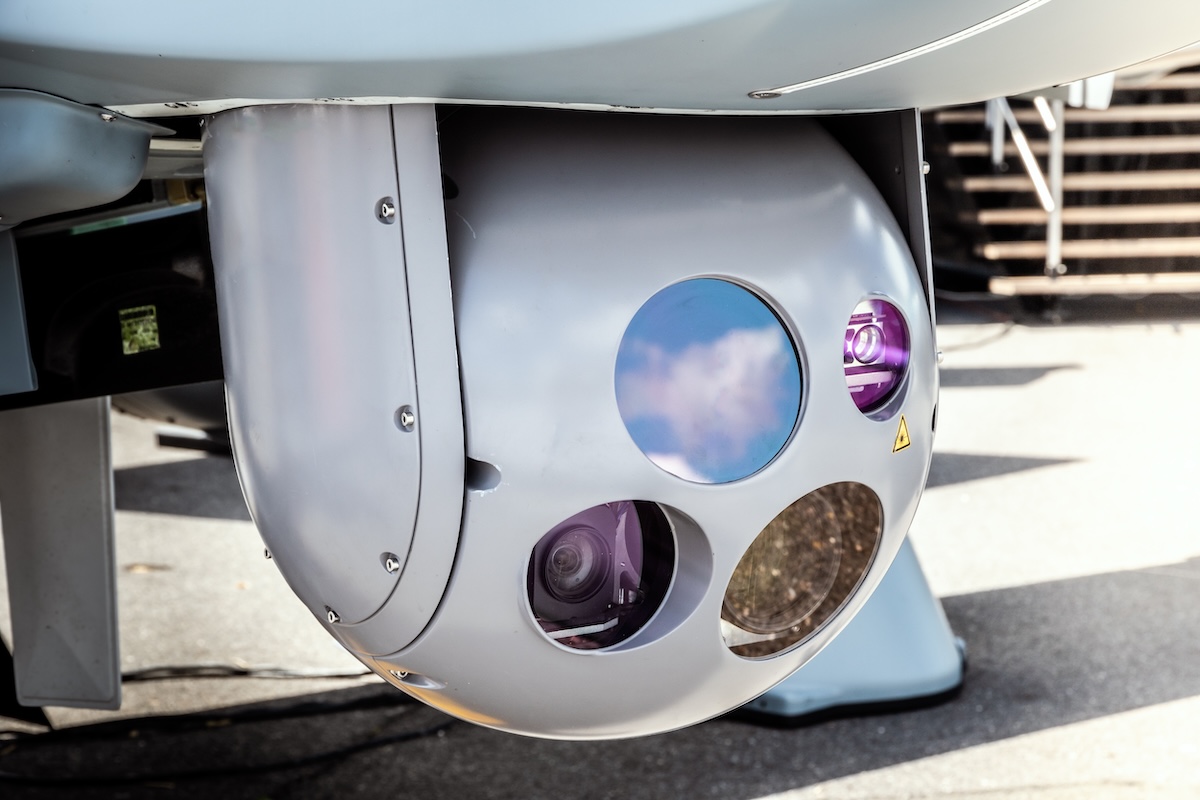

"G5 brings deep expertise in high-end cooled infrared camera systems and is considered the market leader in long-range imaging, which perfectly complements our existing uncooled camera technology."

LightPath acquired G5 for $27 million, consisting of $20.25 million in cash and $6.75 million in common shares.

The deal is expected to drive LightPath’s combined revenue above $55 million over the next 12 months.

LightPath Technologies is already cashing in on its acquisition

Just a few months in, LPTH's acquisition already appears to be yielding results.

In March, just a month after closing the deal, LightPath announced a $4.8 million initial qualification order for G5 infrared cameras from a "new defense industry customer" whose name was not disclosed.

"This initial qualification order further validates our accretive acquisition of G5," Rubin said.

"Delivery of the order will be ongoing, starting in the coming weeks and extending through the end of the year. We believe this could lead to multiple follow-on orders with this customer in the near future."

Rubin added that G5’s revenue is "driven by established multi-year contracts and multiple programs of record," with clients seeking infrared cameras for shipboard long-range surveillance, border security, and counter-unmanned aircraft systems (UAS), or drones.

G5 also maintains recurring federal, naval, and law enforcement programs, according to the company.

Earlier this month, LightPath disclosed that G5 had been awarded an initial $2.2 million engineering development model (EDM) order for infrared cameras by L3Harris Technologies.

The contract supports the U.S. Navy's Shipboard Panoramic Electro-Optic/Infrared (SPEIR) Program, with G5's systems scheduled for delivery to L3Harris later this year.

LightPath shares rose 10.5% on Monday and are up 71.4% over the past year.

In not-so-positive news, the company flagged potential supply chain hold-ups during its Q2 earnings call in February, largely thanks to the ongoing trade war between the U.S. and China.

Specifically, LightPath will need to navigate China’s restrictions on germanium exports, which could impact its revenue.

"Approximately $8 million in revenue comes from China, with $2 million in germanium sales in the U.S. at high risk and $2 million in Europe at moderate risk," LightPath CFO Al Maranda said. "We are actively working to mitigate these risks."

Your email address will not be published. Required fields are markedmarked