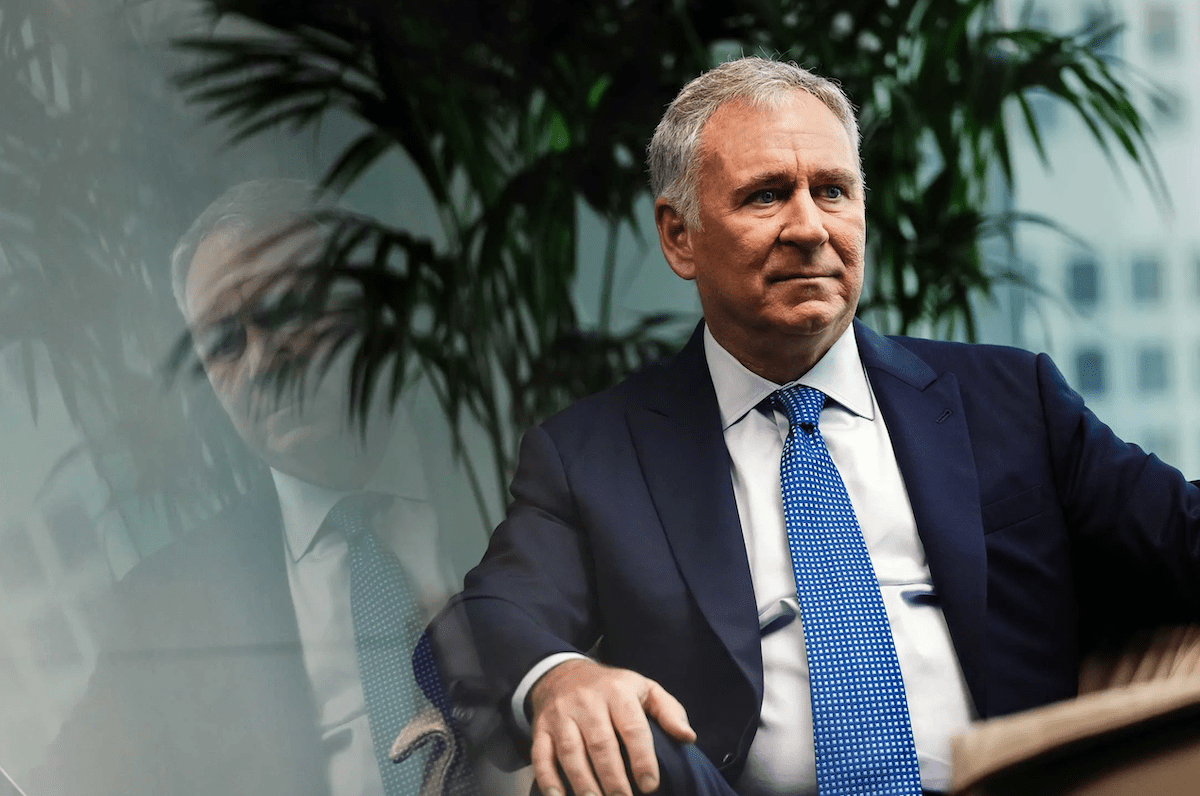

Citadel CEO Ken Griffin has warned that the accelerating global move away from the U.S. dollar indicates that investors are de-risking their portfolios from U.S. sovereign risk.

“We’re seeing substantial asset inflation away from the dollar as people are looking for ways to effectively de-dollarize, or de-risk their portfolios vis-a-vis U.S. sovereign risk,” Griffin told Bloomberg in a recent interview.

For Spencer Hakimian, founder of Tolou Capital Management, that shift is a stark signal. He argues it’s akin to telling Americans: “You now live in a third-world country.”

Hakimian’s comment may be hyperbolic, but it underscores a deeper concern.

Sovereign risk, the fear that a government may fail to meet its financial obligations, is typically a problem for emerging markets, politically unstable regimes, or nations with high debt and weak currencies.

It’s rarely associated with the issuer of the world’s de facto reserve currency. Yet, several warning signs are emerging in the U.S. itself.

The national debt has climbed past $37 trillion and continues to rise, fueling concerns among bond investors about growing pressure on demand for Treasurys.

Meanwhile, Washington remains mired in fiscal and political gridlock, with recurring debt ceiling standoffs and a recent government shutdown that triggered a temporary blackout of key economic data.

Adding to concerns, the Federal Reserve has begun cutting interest rates even as inflation remains elevated — a combination that some economists warn could pave the way for stagflation, a toxic mix of stagnant growth and rising prices.

For investors, Griffin’s warning suggests a deeper unease that the U.S., long considered the world’s safest bet, may be drifting toward the risks it once stood apart from.

America’s fiscal nightmare deepens

Economists have long sounded the alarm over Washington’s ballooning national debt, warning that unchecked borrowing poses serious risks to economic stability, interest rates, and future growth.

Analysts at the Peter G. Peterson Foundation, among others, argue that persistent deficits drive up borrowing costs, crowd out private investment, and leave the government less able to respond to crises.

Now, a new paper by Paul Winfree, PhD, president of the Economic Policy Innovation Center, suggests that the Fed’s bond-buying programs, commonly known as quantitative easing (QE), have worsened fiscal irresponsibility in Washington.

“When a macroeconomic shock occurs and the Fed is actively buying Treasuries, active fiscal policy becomes expansionary over the medium-term,” Winfree wrote, arguing that large-scale asset purchases distort economic signals and make policymakers more complacent about mounting debt.

In essence, Winfree contends that by printing money to finance government debt, the Fed has blurred the line between monetary and fiscal policy, reducing the political pressure on lawmakers to rein in spending.

The result, he suggests, is a dangerous feedback loop: as the Fed buys more debt, Washington borrows more, further weakening the nation’s fiscal discipline and deepening long-term vulnerabilities.

Your email address will not be published. Required fields are markedmarked